Risk Analysts Take Note—High Oil Market Volatility is Here to Stay

2020 has been quite a roller coaster ride—and it’s not even halfway over yet. To be sure, in recent weeks WTI crude reached a little bit of oil price stability compared to what we have been experiencing. But by no means is market volatility in the rearview mirror. In fact, the kind of volatility WTI […]

How COVID-19 Will Impact Power Loads During Summer Peaks

U.S. power markets have endured a transformative two and a half months as school, business, and some manufacturing closures have swept across the nation due to COVID-19. A little more than two months ago, the PRT team was analyzing the first results of our COVID-19 power load demand destruction models. (I wrote about the challenges […]

MarketView Anywhere Links Remote Energy Traders to Markets

2020 brought on brand new challenges for everybody in the energy industry. Working from home set-ups were particularly challenging for traders and analysts who normally work in close proximity in trade floors. Our director of product management for MarketView, Sven Schoerner, sat down with ComTech Advisory to talk about the benefits MarketView as a data […]

Oil Markets in Crisis: Production Outlook and Outline for Recovery

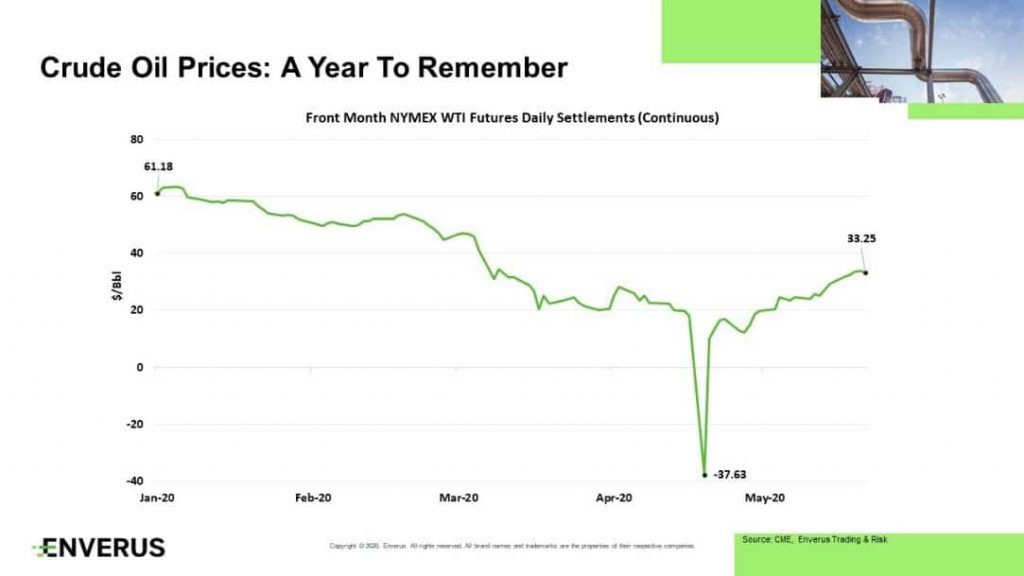

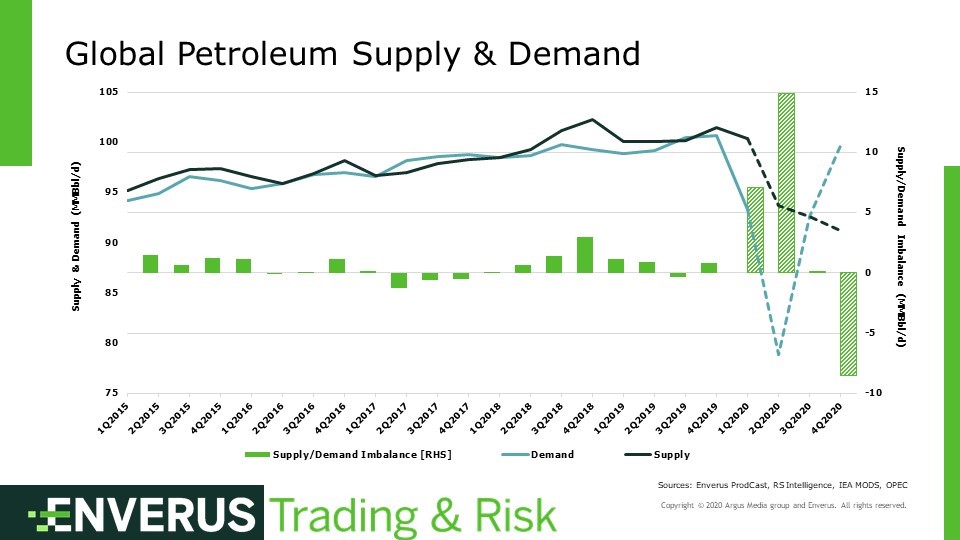

By now, everyone reading this blog should be aware of the crisis in oil markets. If not, this week’s spectacular collapse of the May WTI contract almost certainly caught your attention. I’m not the first to say this, but it’s worth repeating: the WTI settlement of -$37.63 a barrel was the result of traders’ difficulty […]

Coronavirus Power Demand Destruction Forecasting 101

When the coronavirus power load demand destruction began appearing in Enverus Trading & Risk’s daily ISO load forecasts, our team had to quickly tackle a new set of realities. Just like businesses all over the world, we were faced with never-before-seen scenarios as a result of the nationwide shutdowns. Our machine learning-based forecasting tools have […]

Why Automated Forward Curves Matter to Energy Traders

Forward curves are an integral part of the trading & risk business across the energy industry. In a typical trading & risk organization, you’ll see a few different segments focused on forward curve management. Risk managers watch curves to manage their value at risk Traders evaluate curves to value their profits and losses on a […]

Deep Learning Brings Texas-Sized Accuracy to Power Forecast

Machine learning has powered the forecasts of PRT, the Enverus power analytics platform, for more than 25 years. PRT analysts were trailblazers, using machine learning to build more accurate power forecasts in the 1990s. We have now cracked a new code in lowering MAPE (mean absolute percentage error) with deep learning, a powerful new counterpart […]

Data Management is Everything for Energy Traders & Risk Professionals

Our customers have an enormous amount of data to manage, digest, and analyze in a quick, timely manner. How can customers have a single source of the truth to gather that data and mitigate risk? We asked Wendi Orlando, VP of Enverus Trading & Risk Product Management, and Ben Golden, Director of North American Professional […]

As the World Watches the Permian, Enverus Brings the Rockies & Bakken In Focus

Austin, TX (February 19, 2020) – Enverus, the leading oil & gas SaaS and data analytics company, has released its latest FundamentalEdge report focused on oil, gas and natural gas liquids production, pipelines, and prices in the Rockies and the Bakken. This report, Rockies & Bakken in Focus, reviews upstream and midstream activity in these […]

How Utilities Can Mitigate Price Risk With Enverus Forecasts

Third-party power forecasts are key when ISOs provide inaccurate load projections. Power market participants in the PJM, a regional transmission organization covering a large swath of the northeastern U.S., may remember Oct. 1, 2019 for the rest of their careers. PJM power traders that relied on their local ISO for load forecasting began the […]