Machine learning has powered the forecasts of PRT, the Enverus power analytics platform, for more than 25 years. PRT analysts were trailblazers, using machine learning to build more accurate power forecasts in the 1990s. We have now cracked a new code in lowering MAPE (mean absolute percentage error) with deep learning, a powerful new counterpart to machine learning.

What is deep learning? Colleagues and customers ask me this question multiple times a day. I think of it as the more advanced cousin of machine learning, with stronger computing power and more granular datasets.

In February, we upgraded our power load forecast models for ERCOT, the Electric Reliability Council of Texas. After upgrading our models and computing servers to handle the advancements we put into place, the Enverus power analytics team had the opportunity to hunker down and put our forecasts to work. The results have blown us away.

Many power market participants are happy to rely on ERCOT price and load forecasts, provided by the ISO (independent system operator) of the Texas power market. ISOs across the country offer their forecasts free of charge and are typically accurate enough for participants balancing their power supply and demand balances.

For most traders, however, “accurate enough” isn’t accurate enough. We’re proud to reveal our February MAPE for ERCOT, which provides a refreshing alternative to the ISO with less bias and less risk than we’ve ever had the privilege of offering.

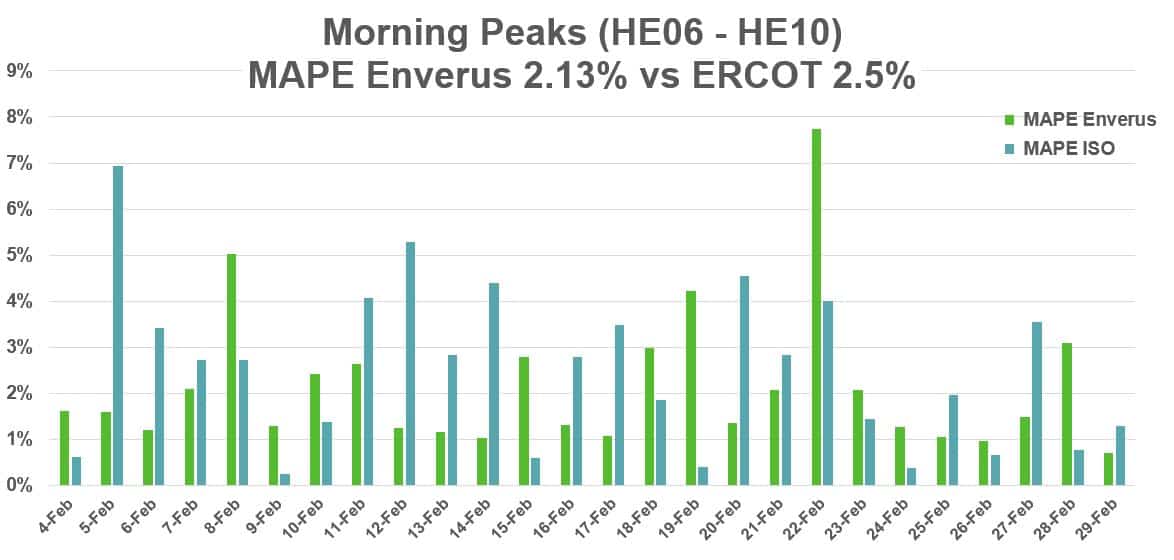

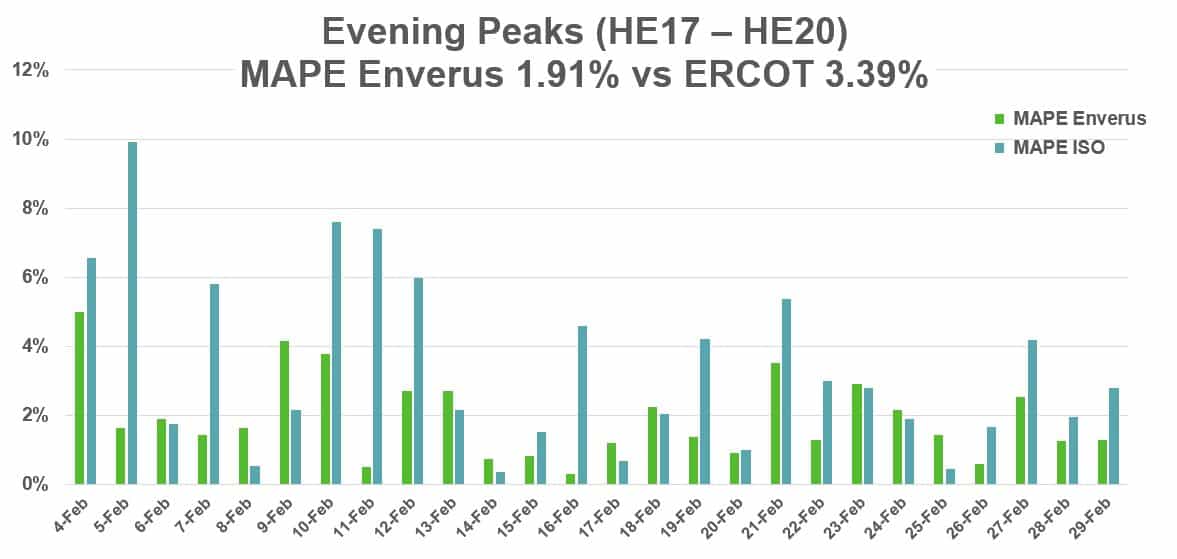

Enverus ERCOT Power Load Forecasts Outperform the ISO Morning and Evening Peak MAPEs in February

Every dollar counts for utilities and power traders trying to grow their businesses through cost savings. For the morning peak loads throughout ERCOT in February, Enverus averaged a 2.13% MAPE, versus the ISO’s 2.5%. Here’s a closer look at the two entities’ performances.

While those morning results were extremely positive for the power analytics team, the evening results were even more exciting. The ISO’s MAPEs for the evenings tended to be much more biased than those in the mornings. For the month of February, Enverus ended with a MAPE of 1.91% for evening peaks, versus the 3.39% MAPE clocked by the ISO.

These numbers don’t just speak for themselves. We think they scream for themselves that utilities and power market participants are missing out on hundreds of millions of dollars of savings by relying on the ISO forecasts.

We want to prove to the world that our power forecasts carry less bias and less risk than ever before. We invite you to sign up for a free trial of our Enverus ISO load and power forecasts to see the difference for yourself.