As I began to reflect the market trends of 2020, as well as what to expect in the New Year, I couldn’t help but laugh at my naivete in my call for more market volatility as renewables gain market share in power markets, which I published at this time last year.

To be sure, we were all naïve about the tsunami of market impacts that would come with the coronavirus, which was all but unknown to us 365 days ago. And I’ll give credit where credit’s due – the call for volatility in the CAISO market was pretty dead on! But overall, the fascinating forces that moved power markets in 2020 were in many cases impossible to predict.

My team and I tackled slews of new trends that impact power trading this year. We did this by leveraging the capability of artificial intelligence and machine learning to quickly adapt our abilities to measure power loads. Here’s a quick round-up of the top three power market trends that literally stunned us as they emerged.

3. Battling California Blackouts with Accurate Renewable Power Forecasting

As I mentioned above, I wrote about the increasing need for accurate power load forecasting technology as renewables gain market share and boost market volatility last year.

The possibility of power outages in California were a prospect to us based on our longer-term outlooks, but we didn’t expect the dangerous and tragic extended blackouts. I blogged about what unfolded in August:

The latest scare in California was manageable for utilities thanks to efforts of cooperation, hydro-generation and a stroke of luck with the weather. B.C. Hydro was able to send additional hydro-generation to CAISO and water supplies to Bonneville Power Administration, which increased its hydro-generation and sent more power to CAISO, too.

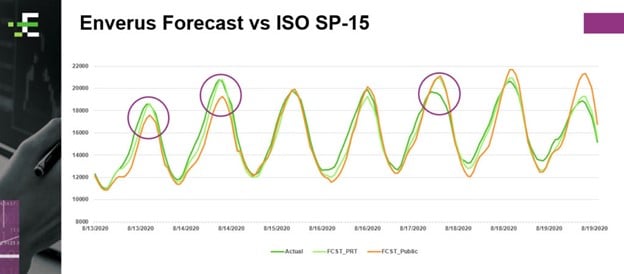

Figure 1: Observe the peak on the chart from Monday, Aug. 17. California was able to shed enormous amounts of power before cooler weather came Tuesday and Wednesday. The public ISO forecast (orange line) is coming in much higher than the actuals, as the ISO continues to hold on to higher load forecasts to ensure the grid has the resources available in case of another spike.

This strategy is utilized across other ISOs, too, which makes sense from a strategic perspective. For utilities to get a more accurate view of power load forecasts, the AI-based methodology we utilize is lending more precision. We are hitting it right on.

2. Social Unrest Showed up in New York Power Loads This Summer

Social unrest and protests erupted around the country after the death of George Floyd. The impacts to power markets were striking in New York.

Once the epicenter of the COVID-19 outbreak in the U.S., New York maintained strict closures and travel restrictions throughout April and May. Its shutdowns were swift compared with the rest of the country. As early as March 24, my team uncovered the first hints of COVID-19-related power load demand destruction between 10-15% in NYISO compared with what our machine-learning models predicted using historical weather and demand data.

Here’s what I wrote in June:

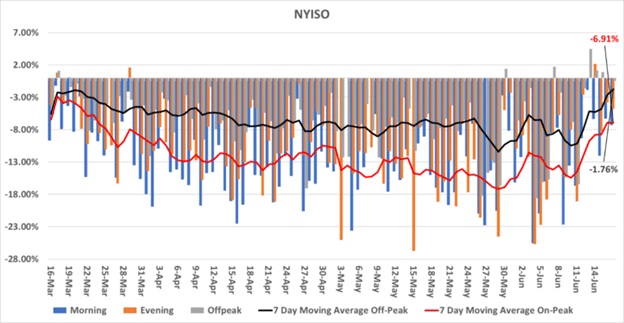

At the end of May, demand rebounded in NYISO, as shown in Figure 2 in the black and red lines. The recovery was short-lived, however, as protests and civil unrest spread in New York City and across the U.S. Just as soon as demand started to recover, it dropped. As protest activity subsided slightly in June and more businesses reopened around the state, demand destruction once again eroded. As of June 10, the seven-day moving average on-peak demand destruction stood at 15%. However, as protests have subsided and as New York continues to reopen, we have measured the demand destruction recovery growing.

1. Coronavirus-Related Shutdowns Spark Power Demand Destruction All Across the U.S.

Just like businesses all over the world, we were faced with never-before-seen scenarios as a result of the nationwide shutdowns in March. Our machine learning-based forecasting tools have never learned the demand dynamics at play—nor had our team. Here’s a snippet from my blog entry in March:

Our old model was suddenly forced to predict demand in a scenario where it had no historical data to compute, and we had customers reach out and ask us how they can track the demand destruction underway.

We launched a new model that was capable of measuring power load demand destruction – basically charting out the new post-COVID demand trends versus the trend data that we have monitored historically, measuring temperatures, load growth, and other market factors.

The exciting new analysis was groundbreaking in measuring a completely unique and unprecedented change to consumer behavior.

We were proud to offer free trials of our ISO forecasts throughout 2020, which helped utilities and power traders hedge against the uncertainty in load impacts.

As we enter into the new unknown of 2021, we’d like to extend one last offer for a free trial of our twice-daily ISO reports that measure the COVID-19 demand destruction. Sign up here today, and have a safe, healthy and prosperous New Year!