As a professional power market forecaster, you better believe that I hate to see instances of rolling power blackouts. Americans from California to New York are experiencing power interruptions this summer, which brings on loads of new market risks to individual consumers and businesses alike.

Thankfully, the latest scare in California was manageable for utilities thanks to efforts of cooperation, hydro-generation and a stroke of luck with the weather. B.C. Hydro was able to send additional hydro-generation to CAISO and water supplies to Bonneville Power Administration, which increased its hydro-generation and sent more power to CAISO, too.

Cooler weather arrived by chance — and we won’t always be able to rely on the luck of good weather when managing power interruptions. Back-up supplies may become increasingly important as wildfires flare up, which could disrupt transmission coming from outside of California.

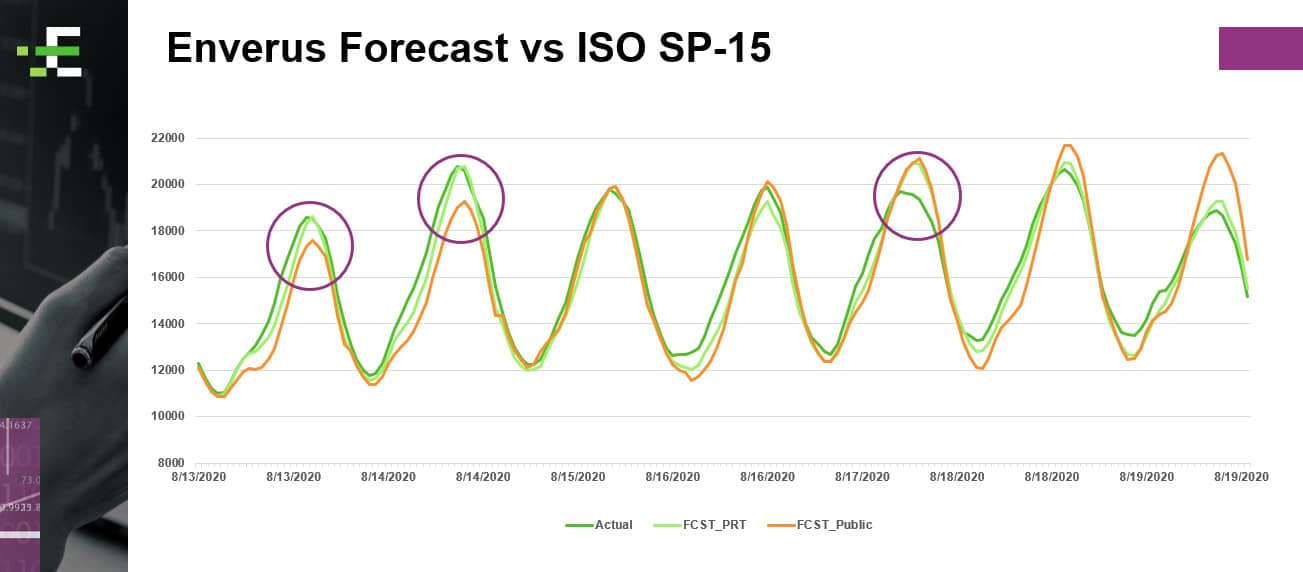

The chart above tells a couple of interesting stories and demonstrates the reliability of Enverus Power Intelligence load forecasting during rolling blackouts.

The first two peaks in the chart — Thursday, Aug. 13 and Friday, Aug. 14 — show that Enverus forecasts (lime green line) accurately predicted the spike in power consumption, closely aligning with the actuals (darker green line).

While Enverus forecasts portrayed the pending heat wave and correlated demand for power, the public power forecast from the California ISO was not prepared for the demands that would pull on the power grid.

This is why accuracy matters. Utilities and power traders rely on accurate data to make important split-second decisions.

Now let us move to the peak on the chart from Monday, Aug. 17. California was able to shed enormous amounts of power before cooler weather came Tuesday and Wednesday. The public ISO forecast (orange line) is coming in much higher than the actuals, as the ISO continues to hold on to higher load forecasts to ensure the grid has the resources available in case of another spike.

This strategy is utilized across other ISOs, too, which makes sense from a strategic perspective. For utilities to get a more accurate view of power load forecasts, the AI-based methodology we utilize is lending more precision. We are hitting it right on.

This one week shows how having accurate renewables forecasts enables utilities to better manage their resources, allowing them to mitigate blackouts and procure the right amount of resources to avoid these situations.

Enverus, formerly PRT, has more than 25 years of experience using machine learning to forecast renewables, hydro, wind and solar power. We know these markets and we know how to manage load forecasting for these markets.

In December 2019, I wrote about the increasing need for accurate power load forecasting technology as renewables gain market share and boost market volatility. Well, never in my wildest dreams would I have thought things would get this wildly volatile in 2020. COVID-19 was definitely not a part of the plan for any of us.

We are proud to continue to help utilities and power traders get through these tough spells of blackouts. And we continue to look to the future and how we will use our technology to support the management of volatility as renewables’ influence grows.

Renewables aren’t always easy to manage, but having a reliable forecast will always be the key to managing volatility. Sign up today for complimentary access to our daily power market reports to keep ahead of the markets.

Click below to register for our upcoming webinar!