CALGARY, Alberta (Sept. 9, 2025) Enverus Intelligence® Research (EIR), a subsidiary of Enverus, the most trusted energy-dedicated SaaS company that leverages generative AI across its solutions, is releasing CCUS Fundamentals, its annual report series that examines changes across the CCUS landscape over the past year, highlighting shifts in momentum, evolving policy frameworks and emerging opportunities. The report analyzes deployment challenges from permitting delays and public pushback, as well as the rise of credit stacking, low-carbon power and next-generation capture and sequestration technologies. Key players, cost trends and technology readiness are explored to identify where value and competitive advantages are emerging.

“The CCUS industry is facing a major reality check right now. There’s a growing chasm between ambition and execution, and our data makes that gap startlingly clear,” said Graham Bain, principal analyst at EIR.

“Despite more than 600 million tonnes of globally announced capacity, only 29% of projects slated for a 2024 in-service date are actually operational. Looking ahead to 2025, that number plummets to just 2%. This isn’t a single issue, it’s a combination of slow permitting, public opposition and tricky project economics forcing developers to rethink megaprojects in favor of smaller, more manageable builds,” Bain said.

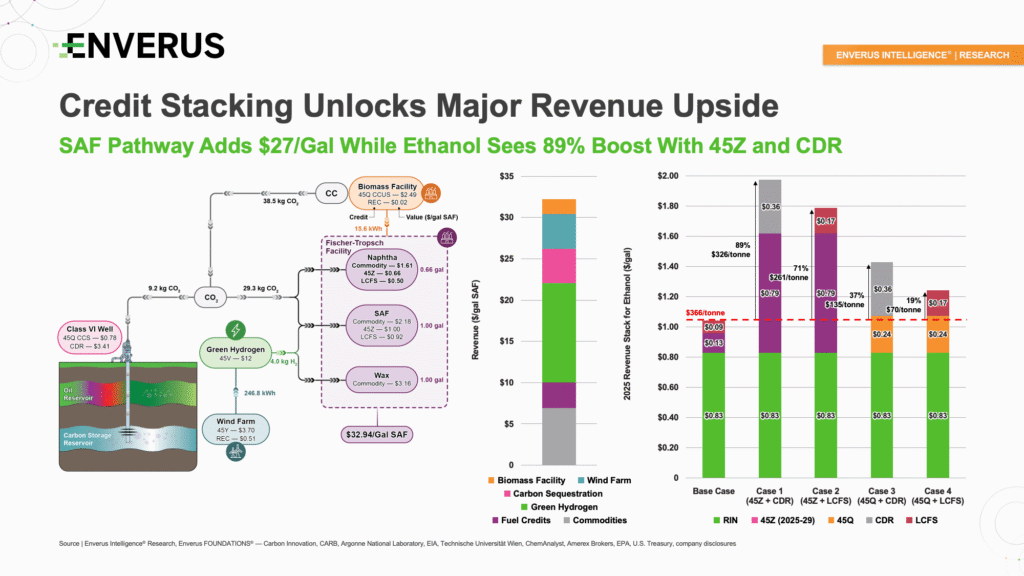

“While large-scale deployment is hitting roadblocks, the economics for certain pathways are becoming incredibly compelling, driven almost entirely by stacking tax credits and incentives,” Bain added. “Our analysis shows this can boost revenues for sustainable aviation fuel by up to 15 times and provide a $138 per tonne uplift for ethanol projects. That revenue stream is strong enough to make transporting CO₂ by rail economic today, completely bypassing the years-long wait for new pipelines. It’s a game-changer for getting projects off the ground now.”

“The big sleeper story is in enhanced oil recovery, where new tax credit parity has completely reset the competitive landscape,” said Bain. “Our research found that the incentive changes have slashed project breakevens by 40%, dropping them to just $16 per barrel. To put that in perspective, that makes a barrel of oil produced with CO₂-EOR more profitable than one from some of the best remaining shale wells in the Permian.”

Key Takeaways:

- Only 29% of projects with 2024 in-service dates are operational and just 8% are under construction. The outlook worsens in 2025 with only 2% online, revealing a widening gap between industry announcements and execution.

- A revenue increase of up to 15x is possible for sustainable aviation fuel by stacking credits like 45Q and 45Z. This strategy is crucial for project viability, enabling even higher-cost options, such as CO₂ transport by rail, to become economically viable.

- A $16 per barrel breakeven for CO₂-EOR now outcompetes top-tier Permian shale. This 40% cost reduction, driven by tax credit parity, presents a compelling and potentially overlooked opportunity for producers with existing infrastructure.

- CDR credit purchases nearly tripled in the past year, with Microsoft accounting for 92% of the total offtake. This growth conceals a significant concentration risk for the market if the tech giant’s purchasing approach shifts.

On Sept. 10, 2025, Graham Bain will moderate a panel at the RE+ conference in Las Vegas entitled, “Tapping the Core: The Role of Nuclear, Geothermal and Hydrogen in a Clean and Resilient U.S. Energy Mix.” (View details here.)

Fundamentals is an EIR research series that dives into a key geographical basin or energy transition technology. A collective series, with each play or technology updated annually, it includes technical research and interactive maps, investment opportunities, benchmarking, macro trends, basin and technology analytics, empowering readers to make intelligent connections and, overall, more informed investment, operating and strategic decisions. It is considered the most in-depth research EIR offers and among the most-read analysis series in the energy industry.

EIR’s analysis pulls from a variety of products including Enverus PRISM® Infrastructure, Enverus PRISM® Emissions & Regulatory Analytics, Enverus FOUNDATIONS® – Carbon Innovation, Enverus FOUNDATIONS® – Power and Renewables.

You must be an Enverus Intelligence® subscriber to access this report.

About Enverus Intelligence® Research

Enverus Intelligence ® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations and macro-economic forecasts; and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. Enverus is the most trusted, energy-dedicated SaaS company, with a platform built to create value from generative AI, offering real-time access to analytics, insights and benchmark cost and revenue data sourced from our partnerships to 95% of U.S. energy producers, and more than 40,000 suppliers. Learn more at Enverus.com.