[contextly_auto_sidebar]

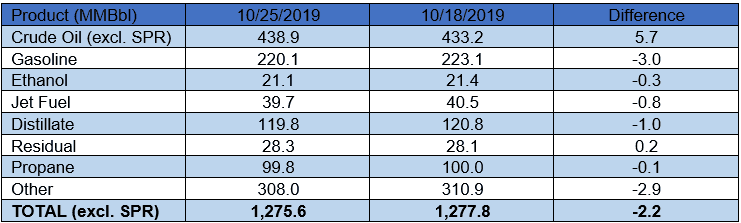

US crude oil stocks increased by 5.7 MMBbl. Gasoline and distillate inventories decreased 3.0 MMBbl and 1.0 MMBbl, respectively. Yesterday afternoon, API reported a crude oil build of 0.6 MMBbl alongside gasoline and distillate builds of 1.6 MMBbl and 1.9 MMBbl, respectively. Analysts were expecting a crude oil build of 0.7 MMBbl. Total petroleum inventories posted a decrease of 2.2 MMBbl.

US crude oil production remained unchanged last week, per the EIA’s estimates. Crude oil imports were up 0.84 MMBbl/d last week to an average of 6.7 MMBbl/d. Refinery inputs averaged 16.0 MMBbl/d (0.13 MMBbl/d more than last week’s average), leading to a utilization rate of 87.7%. Prices are pressured by crude oil build and stocks in Cushing posting a 31.9 MMBbl build. Prompt-month WTI was trading down $0.29/Bbl, at $55.25/Bbl; at the time of writing.

Crude prices have been retracting since last week after nearly reaching their one-month-high levels. The boost in prices last week was due to reports that OPEC+, led by Saudi Arabia, could reach an agreement in December to potentially cut more supply from the market, as well as positive sentiment around China increasing its oil import quota and optimism surrounding the US – China trade deal. Although prices gave up some of their gains from last week, they are still near their monthly highs because of support from the optimism surrounding a deal materializing between the world’s two largest economies, the upcoming OPEC+ meeting in December, and possible tensions in the Middle East. While the bullish sentiment in the market may have increased amid the factors mentioned, conflicting reports from Russia that the country may not be interested in participating in another round of supply cuts as well as the lingering threat of slowing economic growth and demand growth for oil products are continuing to pressure prices, and these factors will keep a lid on prices. The market will pay close attention to any news regarding the US – China trade deal negotiations and any developments on the upcoming OPEC+ meeting in December. Prices are expected to trade in the narrow range of $53/Bbl-$57/Bbl for the near term as any positive news around these developments may cause prices to challenge the 200-day average just above last week’s close at $57.02/Bbl, while any negative news could pressure prices to $53/Bbl levels, where it will likely find selling.