[contextly_auto_sidebar]

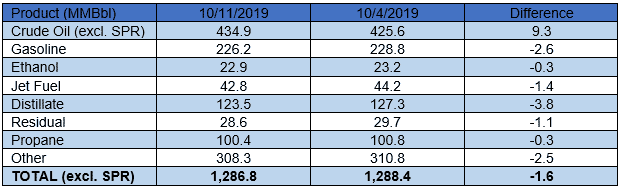

US crude oil stocks increased by 9.3 MMBbl. Gasoline and distillate inventories decreased 2.6 MMBbl and 3.8 MMBbl, respectively. Yesterday afternoon, API reported a crude oil build of 10.5 MMBbl alongside a gasoline draw of 0.93 MMBbl and a distillate draw of 2.9 MMBbl. Analysts were expecting a crude oil build of 4.0 MMBbl. Total petroleum inventories posted a decrease of 1.6 MMBbl.

US crude oil production remained unchanged last week, per the EIA’s estimates. Crude oil imports were up 70 MBbl/d last week, to an average of 6.3 MMBbl/d. Refinery inputs averaged 15.4 MMBbl/d (0.22 MMBbl/d less than last week’s average), leading to a utilization rate of 83.1%. Prices are pressured by large crude oil build and stocks in Cushing posting a 28.6 MMBbl increase. Prompt-month WTI was trading down $0.38/Bbl, at $52.98/Bbl, at the time of writing.

West Texas Intermediate for November delivery settled higher on Wednesday at $53.36/Bbl, up $0.55 from the prior day. Regardless, the US benchmark remains down $1.54/Bbl from Monday’s open. Markets have taken a step back from the enthusiasm of last week as traders look for details on the “Phase 1” trade agreement with China touted by the White House. With the agreement so far appearing to be more sizzle than steak, WTI has drifted lower on the back of weak global economic growth prospects put forward by the IMF on Tuesday and the EIA’s Drilling Productivity Report showing stronger US tight oil production in November. Growing US crude inventories due to planned refinery maintenance and difficult export arbs caused by steep freight rates continue to weigh on nearby contracts, with the front spread settling $0.10 in contango yesterday. The contango in the Nov-Jan spread also continued to widen, settling at $0.11. Furthermore, challenging export economics have led Midland Sweet to drop close to parity with WTI Cushing after trading at premiums as high as $1.10/Bbl last week.