CALGARY, Alberta (Aug. 14, 2024) — Enverus Intelligence Research (EIR), a subsidiary of Enverus, the most trusted energy-dedicated SaaS company that leverages generative AI across its solutions, has released a report that analyzes the operator-level impact of the U.S. Environmental Protection Agency’s (EPA) finalized Subpart W reporting rule change under multiple scenarios and examines the risk that super-emitter events could add going forward. This latest report is one of many that EIR has released discussing source categories and calculations, and assessing their potential to significantly alter the current emissions landscape among upstream and gathering entities in the U.S.

“The EPA’s finalized revision to Subpart W will nearly double reported methane if operators fail to act, sending methane fee estimates skyrocketing,” said John Gutentag, a product owner with EIR.

“These new baselines will impact operator targets and have substantial implications for the waste emissions charge, or methane fee, especially when operators consider the additive risk of the Super-Emitter Response Program.”

Key takeaways:

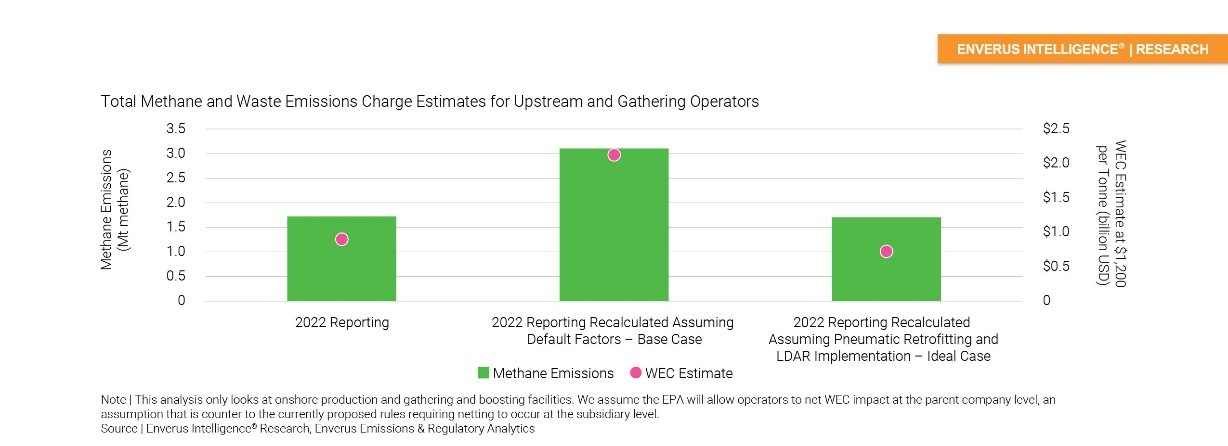

- In EIR’s base case analysis, which excludes super-emitters, total methane would jump 80% under the EPA’s new Subpart W rules, leading to an aggregate waste emissions charge (WEC) that could surpass $2 billion once implemented in 2025. This increase is driven by equipment leaks, methane slip, low-bleed pneumatic controllers, flaring and reciprocating compressor rod packings.

- Industry can and will partially limit the impact of the fees by retrofitting equipment and enhancing operational practices, as shown in EIR’s ideal scenario which decreases reported methane by 45% and the WEC by 66% relative to its base case.

- Large public operators typically show limited WEC exposure due to significantly higher productivity per well and a longer history of voluntary emissions reduction initiatives due to ESG pressures. The Super-Emitter Response Program, however, is a universal risk that could impact any producer.

- EIR finds that Permian Basin sites have between 1.8x and 22.6x higher probability of super-emitter notifications when compared to the Fort Worth, Appalachia, Uinta, DJ and San Joaquin basins.

- Enverus Emission and Regulatory Analytics clients can access our customizable emission model for all 343 operators that report to the EPA’s onshore production and gathering and boosting sectors.

Additional Resources:

- Progress continues in US oil and gas emissions reduction efforts (March 2024)

- EPA’s Quad O regulations expected to trigger tsunami of plugged wells (Feb 2024)

- EPA’s emission revision: More rules, double the methane, triple the tax (Sept 2023)

- Starting the Descent to Net Zero (Jan. 17, 2023)

- Say Goodbye to Flaring Uncertainty (Dec. 30, 2022)

EIR’s analysis pulls from a variety of Enverus products including Enverus Intelligence® Research and Enverus Emissions & Regulatory Analytics.

You must be an Enverus Intelligence® subscriber to access this report.

About Enverus Intelligence Research

Enverus Intelligence ® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations and macro-economic forecasts; and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. Enverus is the most trusted, energy-dedicated SaaS company, with a platform built to create value from generative AI, offering real-time access to analytics, insights and benchmark cost and revenue data sourced from our partnerships to 95% of U.S. energy producers, and more than 40,000 suppliers. Learn more at Enverus.com.

Media Contact: Jon Haubert | 303.396.5996

View all press releases at Envers.com/newsroom.