CALGARY, Alberta (Sept. 19, 2023) — Enverus Intelligence Research (EIR), a subsidiary of Enverus, the most trusted energy-dedicated SaaS platform, has released a report that analyzes the U.S. Environmental Protection Agency’s (EPA) latest proposed changes to Subpart W of the Greenhouse Gas Reporting Program (GHGRP), quantifying the impacts on total reported methane, CO2e emissions levels and IRA methane fee liabilities across U.S. sectors and basins. EIR has pinpointed the most material new source categories and calculations and assess their potential to significantly alter the current emissions landscape among upstream and gathering entities in the U.S.

“The EPA’s latest proposal would drastically change reported methane from the oil and gas industry in the U.S.,” said John Gutentag, product owner with EIR.

“We model that the new regulations would more than double 2021 reported methane if implemented and increase overall CO2e emissions by 41%. This has huge implications for exposure to the IRA’s methane fee that kicks in next year, a year before this proposal is projected to take effect and will cause PR headaches as companies will inevitably reset emission reduction targets and baselines.”

Key takeaways:

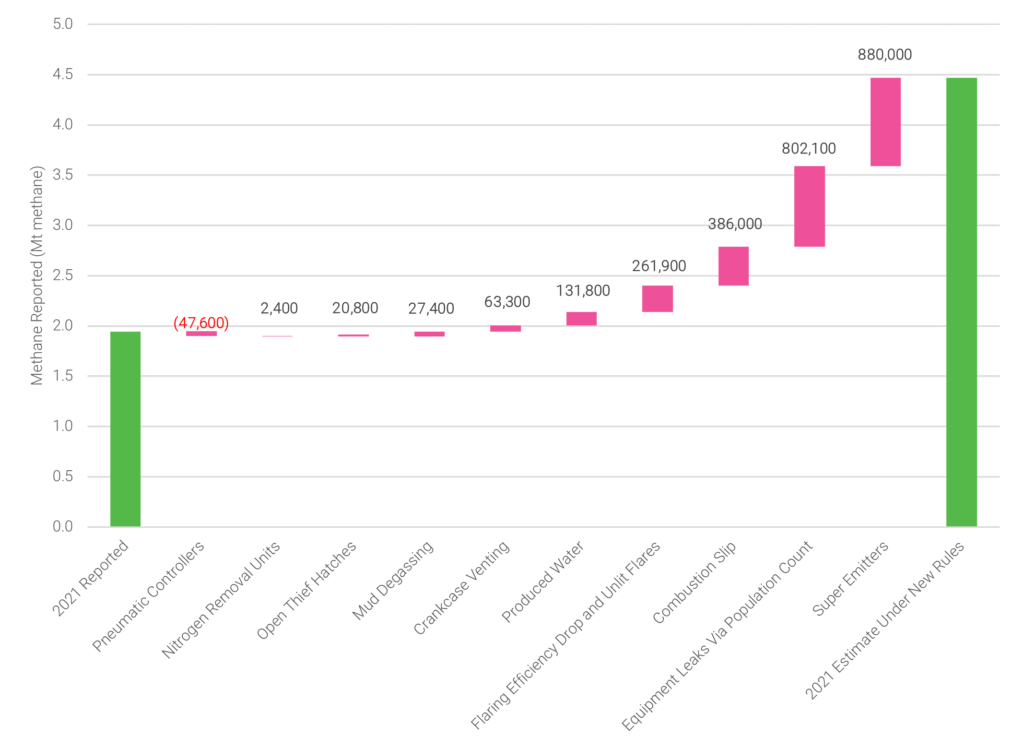

- EIR calculates that the EPA’s revisions lead to an estimated 130% increase in 2021 reported methane emissions and a 41% increase in overall CO2e emissions from the upstream and gathering sectors.

- EIR sees four categories driving the increase in reported methane: super-emitter events, higher emission factors for equipment leaks, updates to combustion slip from engines and lowered flaring efficiencies, contributing an additional 2.3 million metric tonnes (Mt). Total reported methane emissions in 2021 amounted to 1.9 Mt.

- The proposal could expose more than half of upstream assets and all gathering assets to the IRA’s future methane tax, disproportionately impacting lower-producing, higher-emitting assets that may be forced to shut in production when faced with higher taxes and monitoring costs.

Additional resources:

- Starting the Descent to Net Zero (Jan. 17, 2023)

- Say Goodbye to Flaring Uncertainty (Dec. 30, 2022)

Members of the media should contact Jon Haubert to schedule an interview with one of Enverus’ expert analysts.

EIR’s analysis pulls from a variety of Enverus products including Enverus Intelligence® Research, and Enverus ESG® Analytics.

Did someone forward this email to you? Sign up for Enverus’ press list or update your email preferences.

View all Enverus news releases at Envers.com/newsroom.

About Enverus

Enverus is the most trusted, energy-dedicated SaaS platform, offering real-time access to analytics, insights and benchmark cost and revenue data sourced from our partnerships to 98% of U.S. energy producers, and more than 35,000 suppliers. Our platform, with intelligent connections, drives more efficient production and distribution, capital allocation, renewable energy development, investment and sourcing; and our experienced industry experts support our customers through thought leadership, consulting and technology innovations. We provide intelligence across the energy ecosystem: renewables, oil and gas, financial institutions, and power and utilities, with more than 6,000 customers in 50 countries. Learn more at Enverus.com.

About Enverus Intelligence Research

Enverus Intelligence ® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies, and capital providers worldwide.

Media Contact: Jon Haubert | 303.396.5996