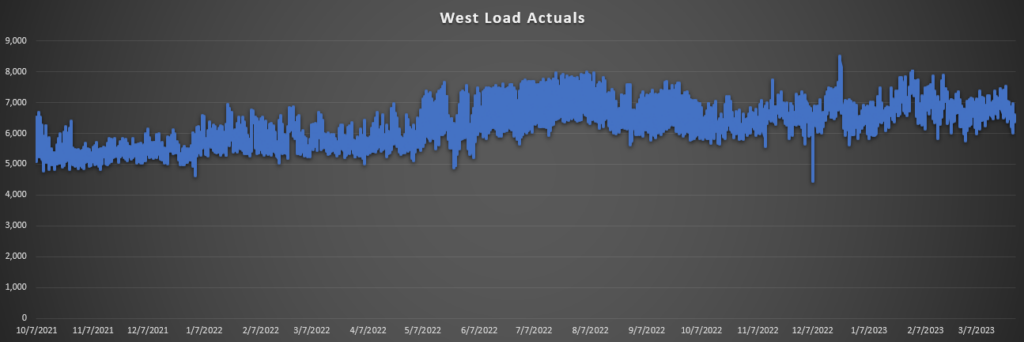

In the past, the energy market experienced significantly low prices during extreme lows of net load in West Texas. However, recent observations indicate these ultra-low prices are becoming rarer. The increasing presence of price sensitive datacenters in West Texas is believed to be a major driver behind this change.

Let’s explore the effects of these developments on power flows and energy pricing in the region.

A shift in power flows

The growing number of cryptocurrency mining operations and datacenters in West Texas has led to an increase in native load growth with 2.4 gigawatts having received approval so far, and 8-20 gigawatts under study through 2027. As a result, power flows out of West Texas along the typical binding paths have remained below last year’s levels.

Our Panorama power flow simulator for FTR/term-traders reveals decreased flows out of the region versus the prior year, which supports this hypothesis.

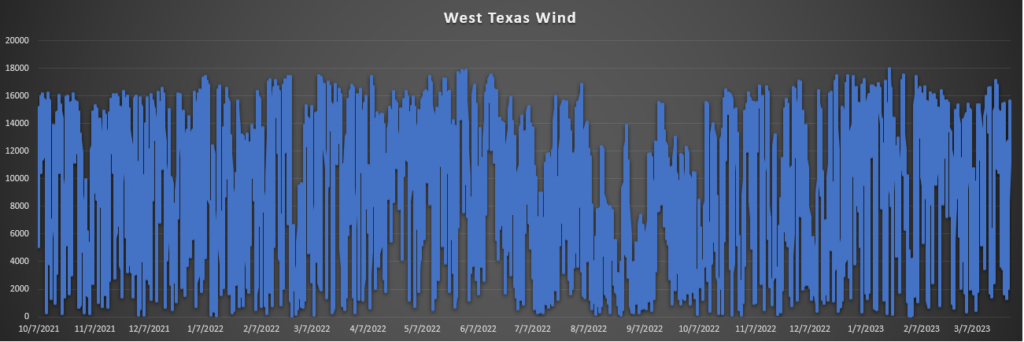

The impact of weather patterns

As we’ve reported in our biweekly 90-Day Forecast Flash publication for ERCOT, our April forecasts predict average to high wind conditions due to the transition from La Niña to a more neutral El Niño-Southern Oscillation. On average or under-performing days, there is a risk of the HB_WEST hub taking the premium due to insufficient thermal generation and solar power locally to meet the increased demand from these new loads.

Bringing it all together for real-time optimization and trading, we can monitor these paths live in our Mosaic congestion decomposition tools, which provide an accurate lookback and a continuous forward-look for these paths and prices for the next week.

Outages and risk premiums

The current high number of thermal outages compared to historical levels may also contribute to an increased risk premium for energy contracts into April 2023 if they persist.

An evolving energy market

The emergence of cryptocurrency mining and datacenters in West Texas has reshaped the energy landscape, contributing to lower power flows out of the region and reduced instances of extremely low net load prices. As the industry continues to evolve, it is crucial to monitor these trends and adapt to the changing dynamics of energy pricing and availability. Stay tuned for further updates on this topic, as we keep a close eye on developments in the Texas energy market.

Enverus Power & Renewables supports power market leaders to reduce the complexities of market volatility. We help traders and asset managers hedge risk, accelerate trade opportunities and make data-driven decisions.

To talk to one of our power market experts today about navigating power market volatility, fill out the form below.