Long-term weather forecasts can hold invaluable guidance for energy traders and analysts, particularly as the hot summer days turn cooler in the fall. Or rather, when they are supposed to turn cooler.

This time of year in regions throughout the Northern Hemisphere, it’s not unusual to experience temperatures that are warmer than in August. If you can pair advance weather forecasts with patterns drawn from relevant historical data, you can predict when and where above average temperatures may create trading opportunities—and not just by the day, but also by the hour.

That’s the power that Enverus Trading & Risk’s PRT solution, the market’s most accurate forecast tool, places in your hands no matter where you are in the world.

PRT is part of Enverus Trading & Risk’s MarketView Fundamentals product suite delivered in the MarketView Desktop platform to provide users worldwide with access to a comprehensive collection of global energy and commodity market data.

Twice each weekday, PRT delivers power analytic reports which discuss power market conditions throughout North America. These reports also include regional load, wind, solar, and wholesale power price forecasts to traders, utilities, marketers, and other power market participants. This frequent cadence of updates is invaluable to power and natural gas traders.

To see how PRT can play a vital role in the success of your load forecasting efforts, follow the link to the replay of a webinar Rob Allerman, Senior Director of Power Analytics at Enverus Trading & Risk, led in late August titled, “California September 2019 Power Market Outlook.”

On August 28, Rob used PRT to create a September 2019 California Independent System Operator (CAISO) Market Analysis that presented bullish signals due hot weather forecasts. It also provided details on the decreased renewable power in September, and why that would compel the need to use Natural Gas Peakers if hot conditions occurred.

California is one of the largest states in the U.S., and the weather varies significantly as you move up and down the Pacific coastline. Rob paired the U.S. government’s National Oceanic and Atmospheric Administration (NOAA) weather forecasts with information drawn from the volumes of historical data in the Enverus Trading & Risk Marketview database to show what market conditions were possible with hotter than average temperatures.

The executive summary: an expected hotter-than-average September signaled a bullish month. With the benefit of 20/20 hindsight, we can see those forecasts were accurate, and that created opportunities for traders to make money.

Upsetting the Renewables Supply-Demand Balance

As California moves from August into September, the sun rises later and sets earlier, and sunlight shines on the northern hemisphere at a lower angle. These factors (along with lower Hydro and Wind Generation) combine to lower temperatures and reduce the amount of solar energy generated in September compared to August.

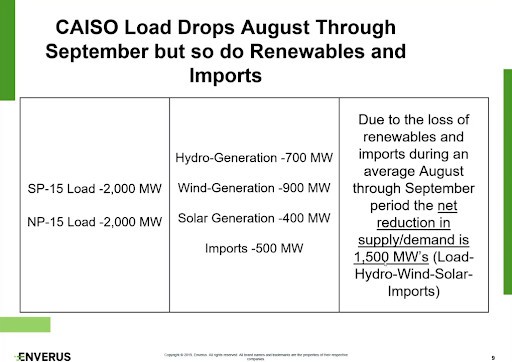

As this slide from the webinar shows, typically load in California moves lower from August to September, and so too do renewables and imports.

However, California power markets can get bullish in September if temperatures rise higher than average. Remember, there’s no way to increase renewable generation because there’s no way to keep the sun in the sky longer, create more water, or make the wind blow harder.

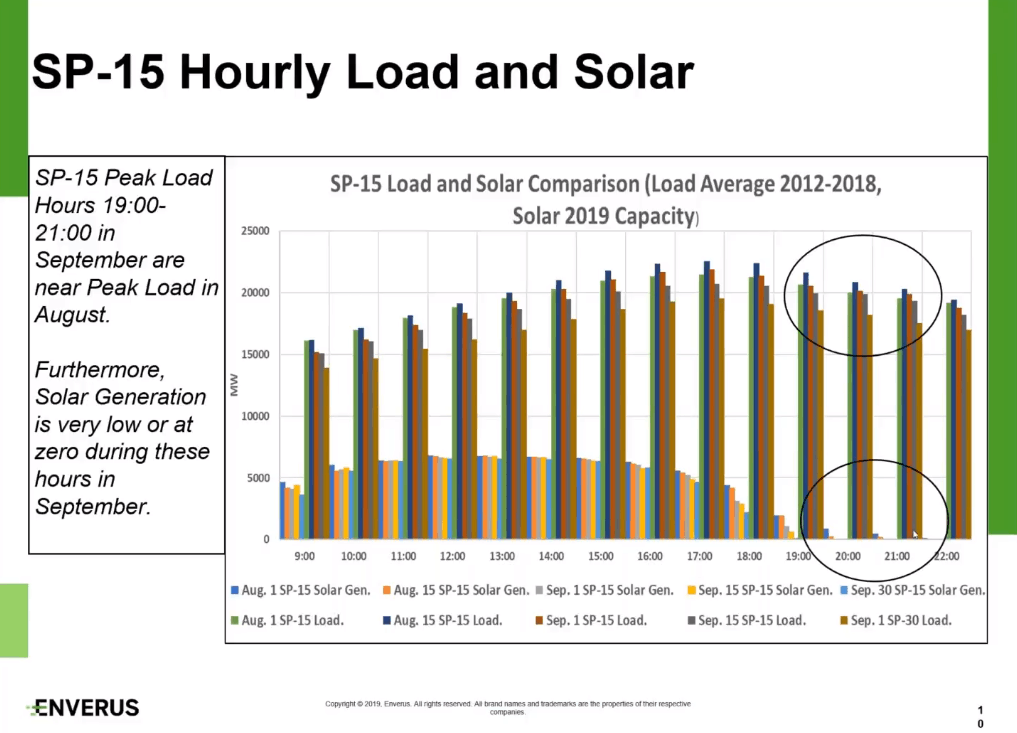

The below slide shows average load and demand data in August and September for each year between 2012 and 2018. When the sun goes down (hours 19-21) throughout August, strong loads were balanced by adequate supplies. Compare that to the averages for the days in September that are circled: load remained strong and there was virtually no solar generation. Natural Gas Peakers are required to turn on to match this load. Natural Gas Peakers are expensive to run and therefore cause wholesale electricity prices to be expensive—a clear bullish signal.

Running of the Bulls in September

The northern region of California experienced several September days when temperatures peaked as much as 15 degrees above average. During the week of September 12, the Greater Los Angeles area was under heat advisories as temperatures reached as high as 106 degrees (the daily average is between 81°F – 84°F).

Now that we’ve moved into October, we asked Rob to analyze whether people who hypothetically bought 50 MWs of On-Peak Power on the day of his webinar (August 28) and carried this position through the month of September would have made money.

The short answer: “Yes, lots of money.”

Doing the Math

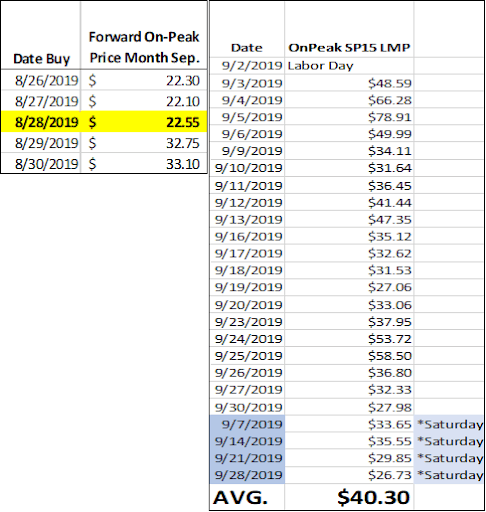

On August 28, September On-Peak Forwards were trading $22.55 and September On-Peak Power ended up being $40.30:

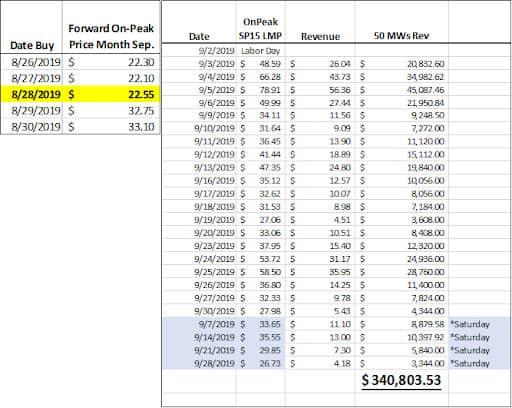

If you had bought 50 MWs on August 28 at $22.50, and held the trade through the month, you would have made approximately $350,000:

Don’t Miss the Next Seasonal Opportunities

The key takeaway is that flipping the calendar from one month to the next may not preserve the balance between renewable energy supply and demand. As we move into winter and look ahead to spring, remember that October won’t necessarily be cooler than September, and March does not always come in as a lion and leave as a lamb.

PRT provides you with the data and insight you need to identify opportunities the change of seasons create, giving you a competitive advantage.

Follow this link to learn more about Enverus Trading & Risk’s PRT solutions and request a demonstration.

We are also offering a free trial of e-LoadForecast®, a 24/7 online forecast service powered by sophisticated machine-learning technologies and multiple weather sources. Use this link to start your free trial today.

To view the replay of the webinar, “California September 2019 Power Market Outlook,” click this link.