CALGARY, Alberta (March 25, 2025) — Enverus Intelligence® Research (EIR), a subsidiary of Enverus, the most trusted energy-dedicated SaaS company that leverages generative AI across its solutions, is releasing a report on the hidden economics within biomass energy carbon capture and storage (BECCS).

With carbon capture and storage (CCS) economics remaining strained, and companies competing in the race for commercialization, EIR is pointing to potentially overlooked strategies emerging through opportunities connected to BECCS. Through the 45Q tax credit and the renewable energy credit (REC) markets, BECCS opportunities are more lucrative in the U.S. compared to other places around the world when stacked alongside carbon dioxide removal credits (CDR). With the current 9 GW of operating biomass power plants in the Lower 48 and the expected load growth driven by large demands, such as those created by data centers, the opportunity for BECCS is significant and economically attractive, potentially facilitating CCS at a commercial scale.

“The CDR market has seen a 688% compound annual growth rate (CAGR) since 2019 and is emerging as a key enabling factor for the commercialization of carbon capture and storage CCS. BECCS has the potential to unlock CDR credits averaging $387/tonne and composes 60% of total CDR credits transacted to date,” said Jeffery Jen, senior analyst at EIR.

“The BECCS opportunity in the U.S. is unique with the $85/tonne 45Q tax credit and REC markets, which are stackable with CDR credits, alongside the existing 9 GW of operating biomass power plants. EIR forecasts load growth in regions with existing biomass power plants, of up to 4.4 GW by 2035 due to large loads such as those predicted for data centers,” Jen said.

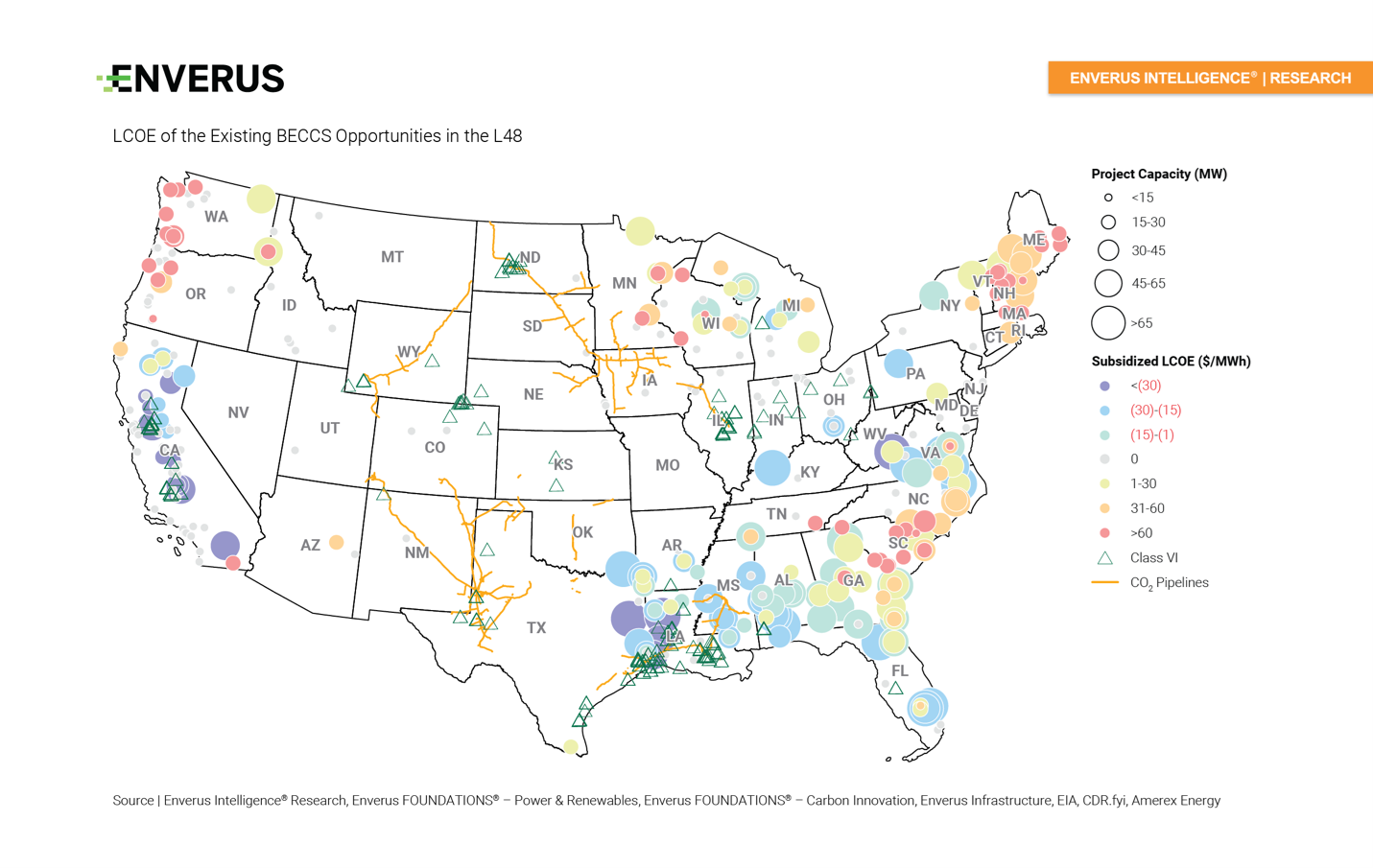

“Through leveraging BECCS, EIR calculated a capacity-weighted average of $13.34/MWh across the L48 and subsidized levelized cost of energy at the plant level as low as -$57.82/MWh. That makes the opportunity economically lucrative for operators who are best positioned from a power and CCS perspective.”

Key takeaways from the report:

- A capacity-weighted average cost of $13.34/MWh can be achieved by implementing BECCS with the current 9.5 GW of biomass power, leveraging 45Q, RECs and CDR incentives.

- With projected load growth of between 3.7-4.4 GW through 2035, the Southeastern (SE) and Midcontinent Independent System Operator (MISO) regions are best positioned for greenfield BECCS deployment.

- The CDR market has experienced a 688% CAGR since 2019, with BECCS credits making up 60% of the transacted volume. Microsoft leads the BECCS market, accounting for 95% of sales to date.

- BECCS credits average $387.49/tonne, with transactions typically around 500,000 tonnes. By comparison, DAC credits are three times more expensive and trade at significantly lower volumes, averaging just 9,318 tonnes per deal.

EIR’s analysis pulls from a variety of Enverus products including Enverus Foundations® | Power & Renewables, Enverus Foundations® – Carbon Innovation and Enverus Infrastructure.

You must be an Enverus Intelligence® subscriber to access this report.

About Enverus Intelligence® Research

Enverus Intelligence ® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations and macro-economic forecasts; and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. Enverus is the most trusted, energy-dedicated SaaS company, with a platform built to create value from generative AI, offering real-time access to analytics, insights and benchmark cost and revenue data sourced from our partnerships to 95% of U.S. energy producers, and more than 40,000 suppliers. Learn more at Enverus.com.