CALGARY, Alberta (Oct. 30, 2024) — Enverus Intelligence® Research (EIR), a subsidiary of Enverus, the most trusted energy-dedicated SaaS company that leverages generative AI across its solutions, has released a report that explores the renewable diesel market, including supply-demand dynamics, key players and deal activity over the past four years.

“Weaker diesel demand and strong compliance credit prices in 2020 catalyzed a surge in renewable diesel capacity,” said Alex Nevokshonoff, analyst at EIR.

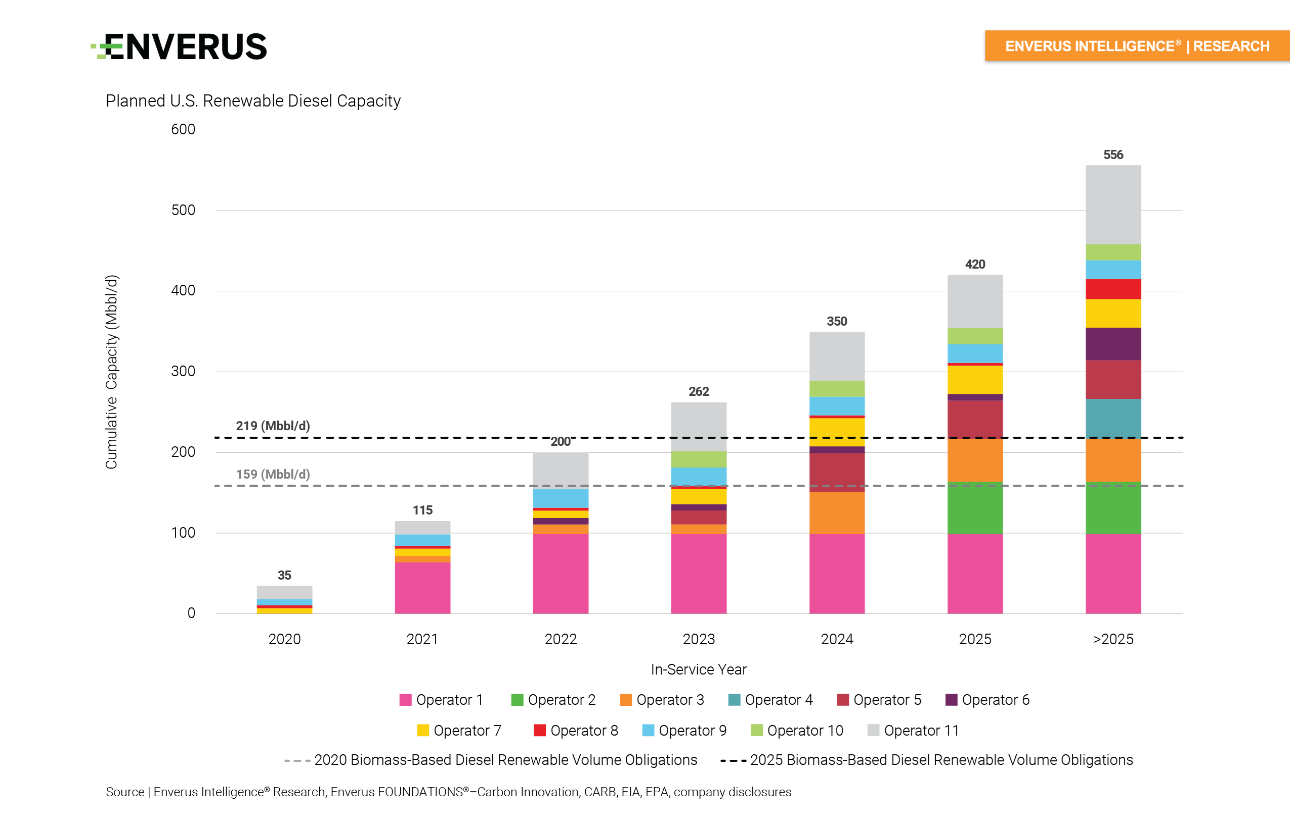

“However, production growth quickly surpassed annual renewable volume obligations for biomass-based diesel, weakening forward-looking credit market fundamentals. We anticipate heightened risks for renewable diesel projects and companies, and compressed transaction multiples in the near-medium term because of the current depressed credit prices,” Nevokshonoff said.

Key takeaways from the report:

- Favorable credit market conditions in 2020 enabled companies like VLO, PSX and MPC to rapidly expand their capacity for renewable diesel (RD). Our modeling shows that the combined benefits of state and federal incentives could increase conventional diesel revenues by roughly 30%-40% for the four common feedstocks we analyzed.

- However, production growth of RD has surpassed the required renewable volume obligations for biomass-based diesel, resulting in a surplus. As a result, Low Carbon Fuel Standard prices have decreased by 75% since 2020 and D4 RINs prices are down by 59% from 2022.

- The number and size of R&D deals have fallen sharply this year, signaling a pessimistic outlook. The only deal announced is valued at about 10% of the average deal size from the previous two years.

- Recent transactions by Neste, E, CVX and Cielo had a capacity-weighted average deal value-to-capacity multiple of $4.01/gal, contrasting with the canceled Camber Energy and NEXT Renewable Fuels deals that had multiples of $23.3/gal and $43.2/gal, respectively.

- Neste, Tidewater Renewables and Vertex have seen their stock prices drop by 58%-98% since October 2022 and Vertex has filed for Chapter 11 bankruptcy. We anticipate heightened risks for renewable fuel companies in the near-medium term due to the current depressed credit prices.

EIR’s analysis pulls from a variety of Enverus products including Enverus Intelligence® Research, Enverus FOUNDATIONS® – Carbon Innovation and Enverus Energy Transition M&A.

You must be an Enverus Intelligence® subscriber to access this report.

About Enverus Intelligence® Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations and macro-economic forecasts; and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. Enverus is the most trusted, energy-dedicated SaaS company, with a platform built to create value from generative AI, offering real-time access to analytics, insights and benchmark cost and revenue data sourced from our partnerships to 95% of U.S. energy producers and more than 40,000 suppliers. Learn more at Enverus.com.

Media Contact: Jon Haubert | 303.396.5996