Your guide to navigating the North American and international energy landscape in 2024. Explore commodity prices, well costs, M&A’s impacts and the energy transition challenges and opportunities.

Enverus Intelligence® Research, Inc., a subsidiary of Enverus, provides the Enverus Intelligence® | Research (EIR) products. See additional disclosures.

Select “Get Started” below if you would like to unlock EIR’s in-depth reports on the 2024 Energy Outlook and Trends, available exclusively for EIR members.

Research written by:

Dane Gregoris, Managing Director

Ian Nieboer, P.Eng., CFA, Manager Director

Dai Jones, Senior Director

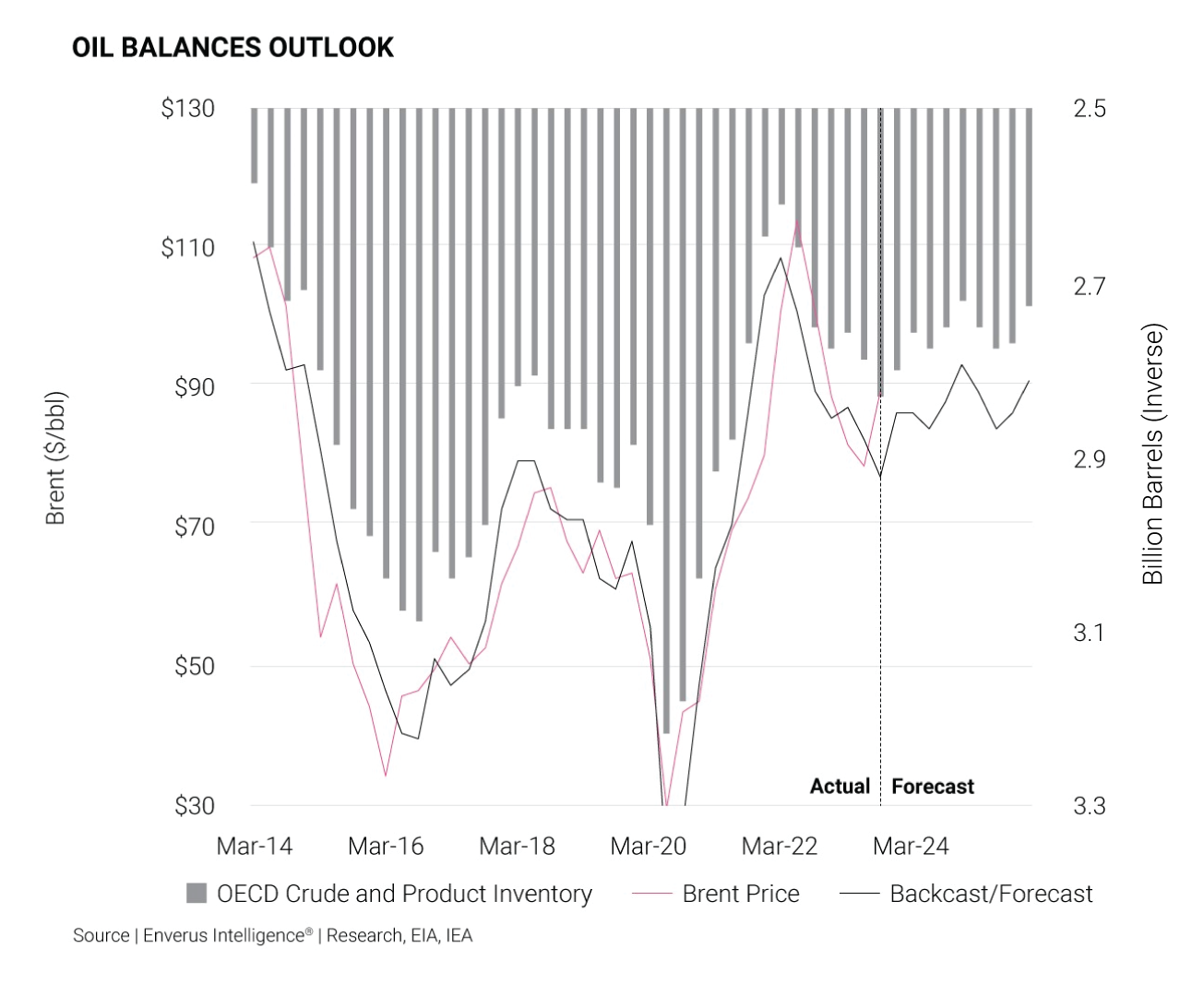

EIR predicts Brent prices can reach ~$90/bbl by 2H24, reliant on OPEC+ cuts easing in Q1 and Saudi Arabia maintaining ~9 MMbbl/d production. The market expresses concerns over OPEC+ discipline and potential U.S. supply growth outperformance in 2024. In case of OPEC+ failure, a ~$70 WTI floor price exists due to President Biden’s actions to refill the U.S. Strategic Petroleum Reserve (SPR).

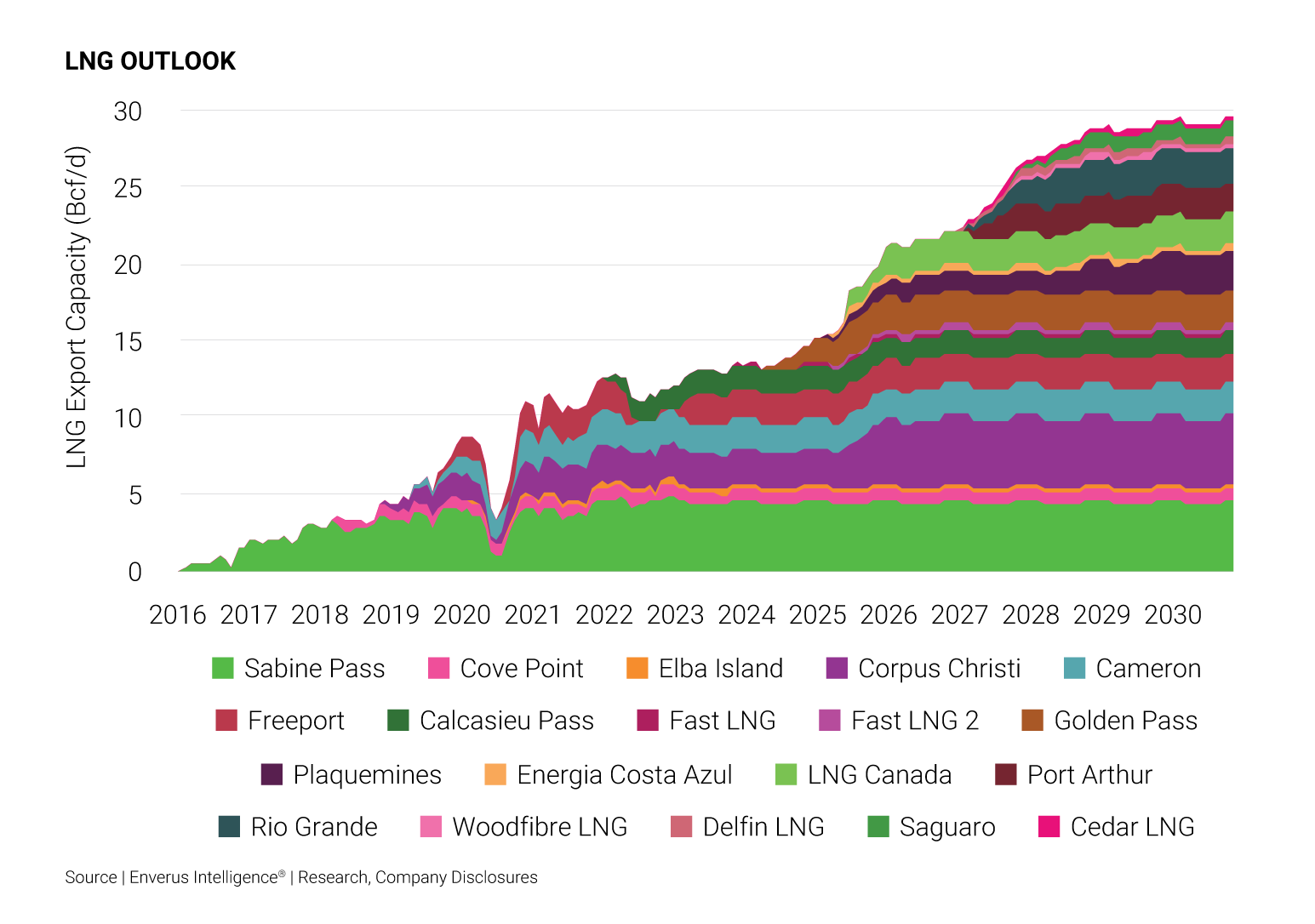

The 2024 North American gas market will echo 2023, coming off a year of strong supply growth and high gas-in-storage levels. Higher prices are anticipated by late 2024 considering upcoming LNG facilities. Despite a delay to the North American LNG buildout, 10 Bcf/d of capacity may go online in the next 36 months, making 2024 an opportune time to acquire gas-weighted E&P assets.

Upstream resilience and OFS companies’ capital discipline will sustain costs in 2024 similarly to 2023. However, increasing lateral lengths will drive per foot cost decreases. A 25% drop in OCTG production costs since June 2022 offers potential for reduced contract prices. The higher costs of shifting from diesel to gas and electric fracture fleets can be balanced with concurrent completions and fuel savings. Labor costs remain steady. While overall well cost volatility could decrease, individual operator strategies may cause significant changes impacting key capital efficiency metrics.

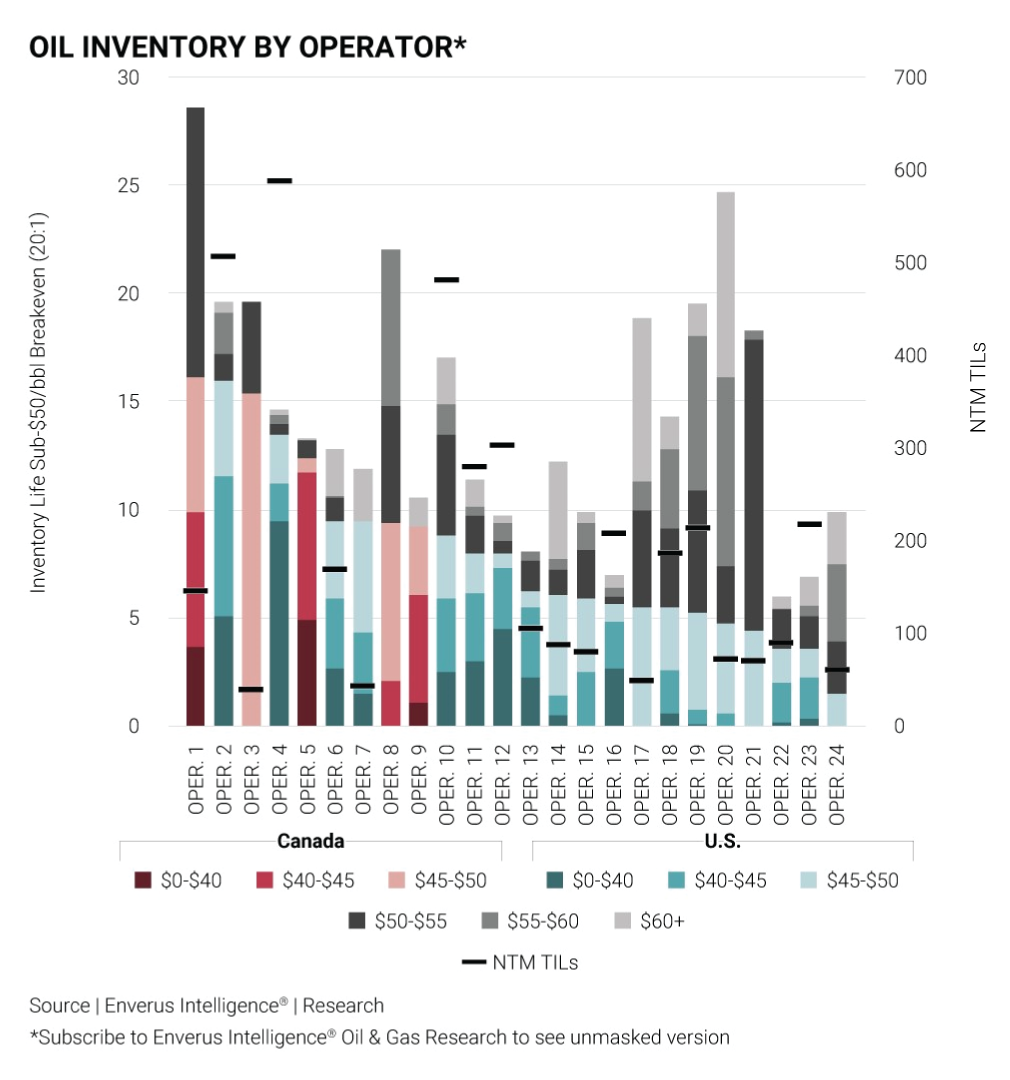

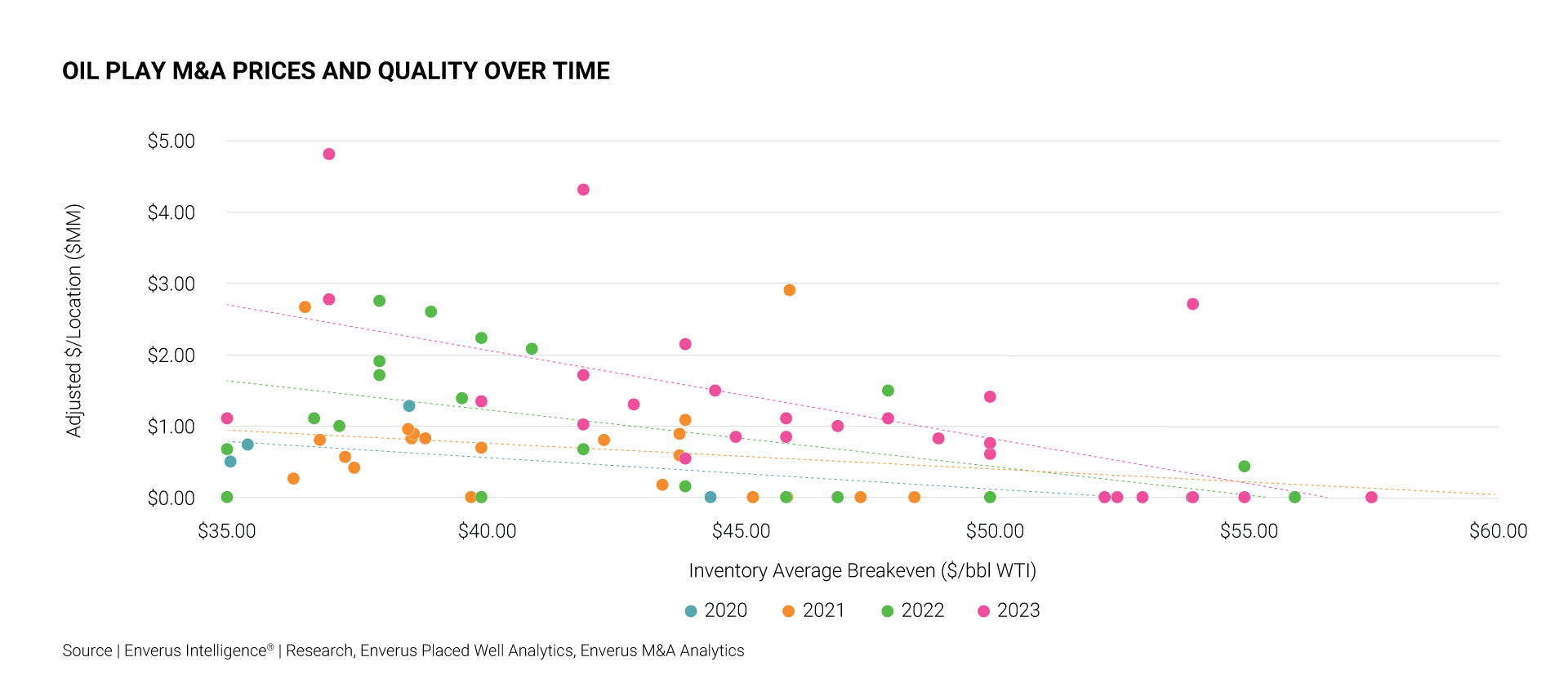

Tier-1 shale oil inventory is dwindling in the Lower 48 and E&Ps are responding with heightened M&A activity, a trend we expect to continue in 2024. Given the lack of long-duration oil assets outside of the Permian, we believe investors will increasingly look north of the border, to the Alberta Montney and oil sands, for better value relative to duration of high-quality reserves. While significant cross-border M&A is unlikely this year, we see potential for it to emerge as a trend after 2024.

After nearly $80 billion in sales since 2021, high-quality private-equity backed E&P options in the Permian are becoming scarce, potentially leading to a slowdown in Permian M&A activity in the coming years. Despite a calmer year, a few mergers caused by family-owned firms cashing in on high inventory prices are not ruled out. Beyond the core Permian, A&D activity is predicted to continue, fueled by big public acquisitions. With supermajors getting rid of large assets following mergers to meet internal capital competition, and operators securing spots to meet new LNG demand, the gas M&A market is positioned for a resurgence.

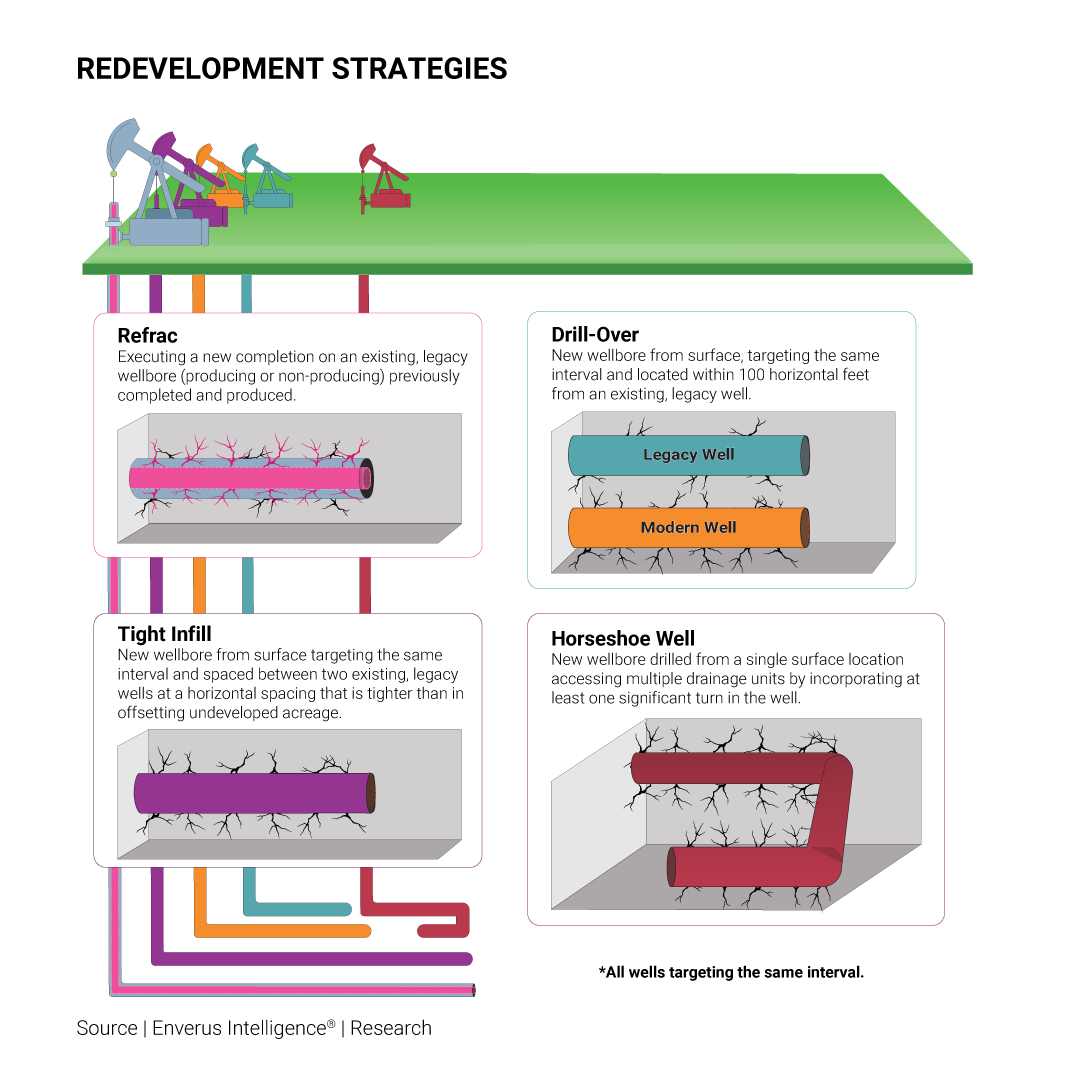

Anticipated cost savings are linked to longer laterals and streamlined completion in all play types, notably with the suggested 3-mile lateral design in Bakken and Midland. This follows steady per-foot recovery rates and increasing efficiencies in frac and drill methods. Focus for 2024 lies in innovative late-stage development strategies in Eagle Ford, Bakken and Haynesville, considering inventory rerates from horseshoe wells, re-fracs, tight infills and drill-overs, which have so far offered limited but positive results.

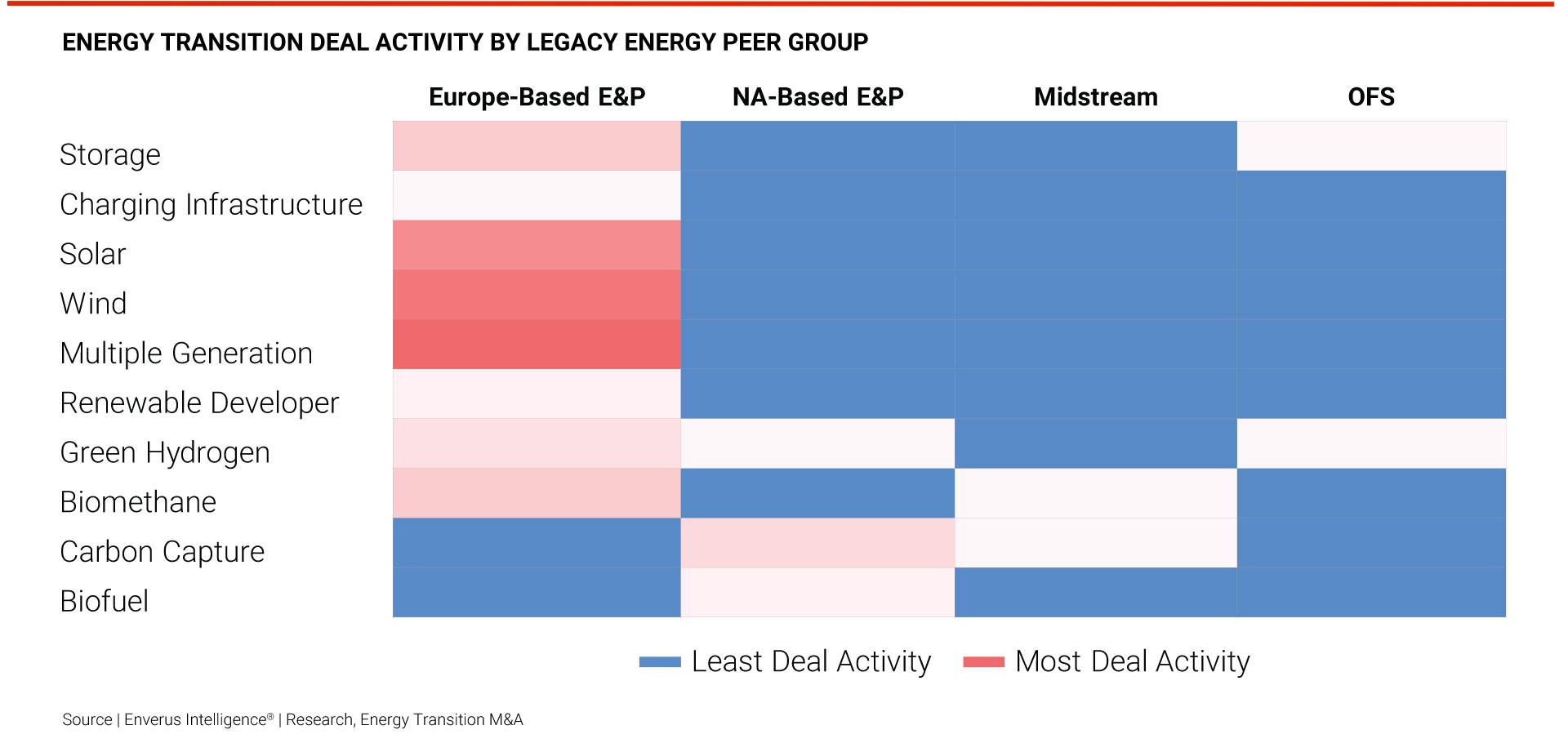

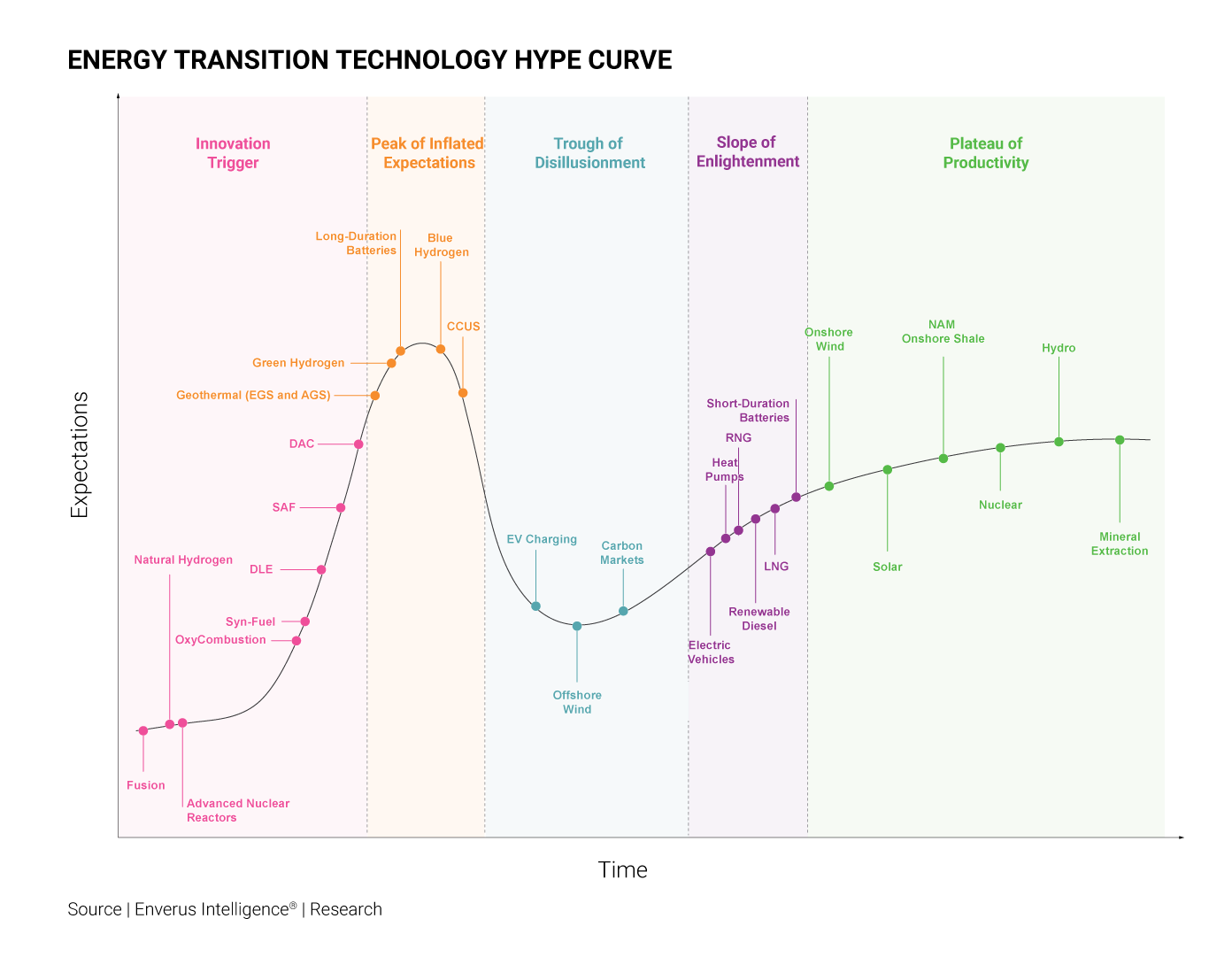

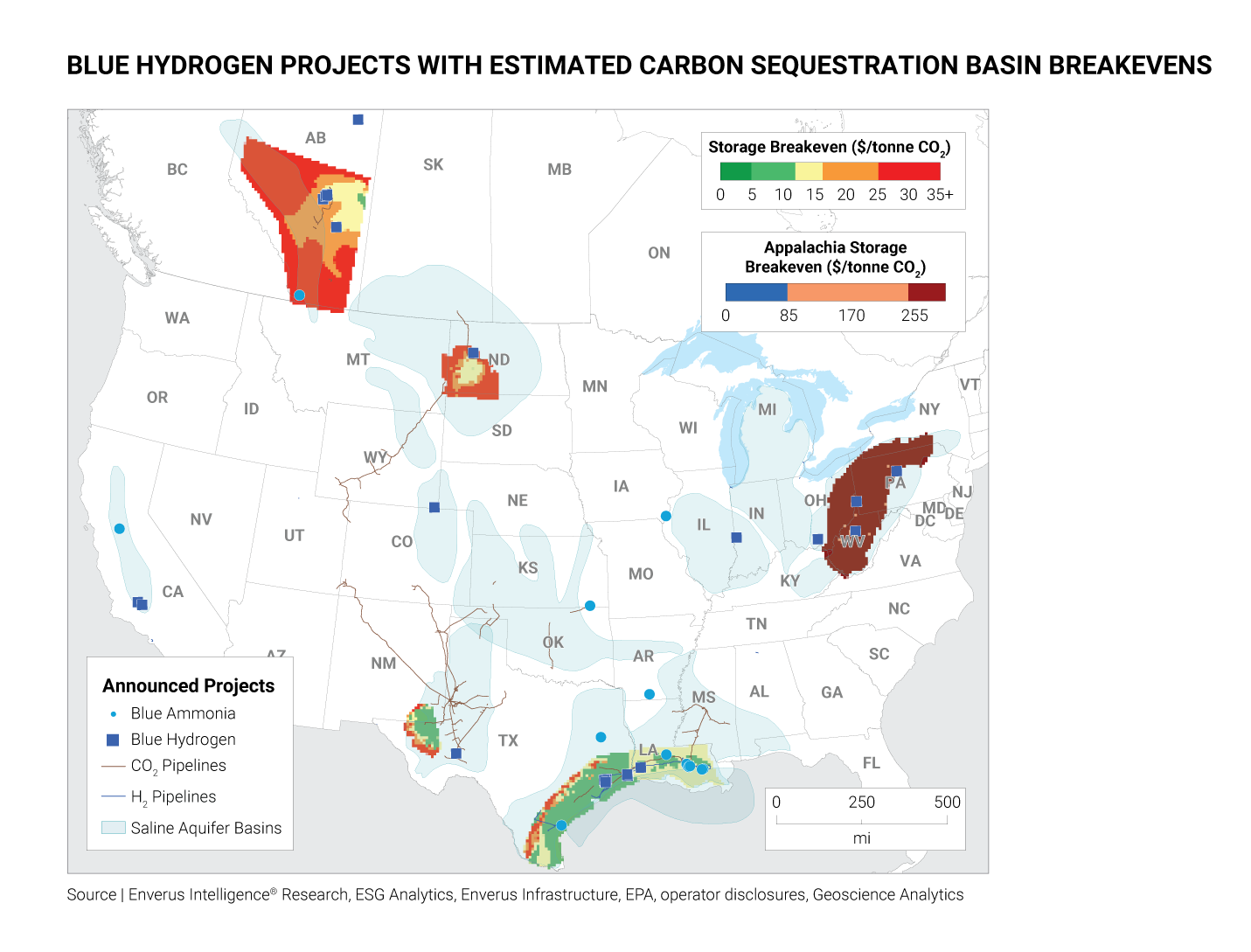

In 2023, oil and gas companies sought shale and energy transition assets in the M&A market, balancing traditional energy and renewable assets into 2024. Success in energy transition requires the careful stacking of technologies and multiple revenue streams, hinting at future increases in partnerships, investment and creative deal structures in the years ahead. Whether it’s through adjacent oil and gas technologies like CCUS, direct lithium extraction (DLE) and blue hydrogen with oil and gas assets or diversifying revenues through investing in renewable natural gas (RNG), renewable diesel/sustainable aviation fuels (RD/SAF), direct air capture (DAC) and wind and solar assets, real returns can be found through careful selection and stacking.

Technological advancements continue to push energy transition technologies forward along the ‘hype curve. Use fundamental asset valuations, forecasts and analysis to exploit opportunities.

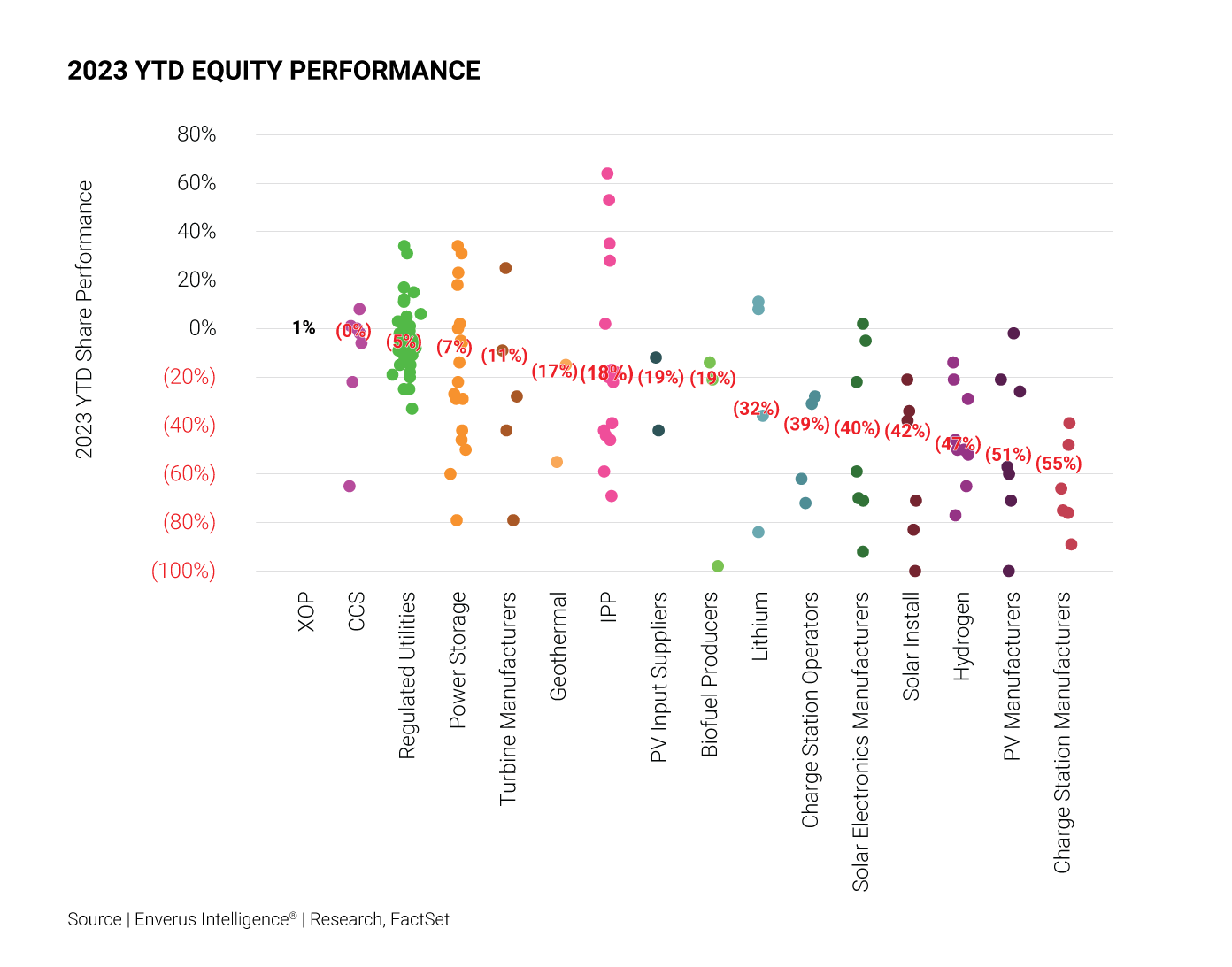

High interest rates and supply chain issues in 2023 led to underperformance of many energy transition equities, but with falling interest rates and advancing technology, improved returns are predicted in 2024. Growth is anticipated in storage, residential solar and lithium sectors next year, due to storage innovation, commercialization of solid-state batteries, and increased EV demand resulting in likely stabilization of lithium prices. However, traditional power generators that are poorly hedged could face challenges due to falling natural gas prices. The residential solar loan model disrupted by high interest rates in 2023 should recover in 2024 with declining rates and rising retail power costs, making rooftop solar more economical. This recovery will be mainly led by Texas, Florida, California and New York.

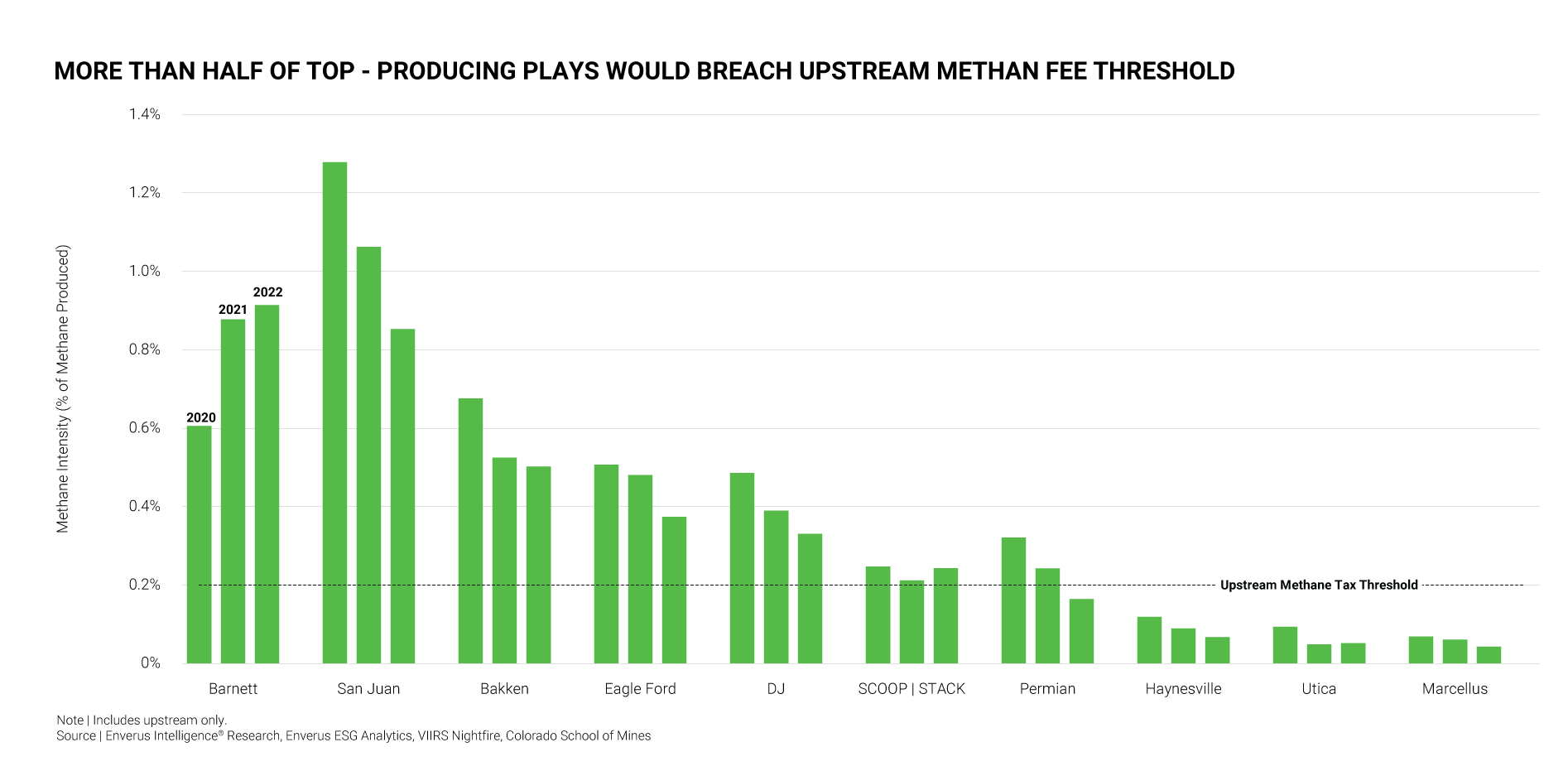

The EPA’s latest revisions to Subpart W of the Greenhouse Gas Reporting Program, as prompted by the IRA, set out more stringent requirements for the monitoring, reporting and managing of emissions. Increased operator disclosures, standardized industry reporting and emission-reduction targets have quieted investor demands, but these factors haven’t kept government bodies from hardening their stance on emissions. New regulations, like the IRA’s methane fee in the U.S., the newly announced oil and gas emissions cap in Canada and the proposed SEC rules on climate-related disclosures (including Scope 3 emissions), pose a material risk for traditional oil and gas participants.

Policy clarity in 2024, driven by the election cycle, should clear up some of the frustration felt in 2023 from unclear guidance surrounding the transferability of tax credits. Increased guidance will support capital deployment in renewable power developers, solar equipment providers, residential solar firms and companies involved in CCUS, hydrogen and RNG. Investors favor complex tax equity structures to fully benefit from accelerated depreciation and step-up credits.

New oil production, led by the U.S., Canada, Guyana and Brazil, will offset recent OPEC quotas. However, Saudi Arabia is unlikely to cut below 9 MMbbl/d, and the market appears balanced through 2024.

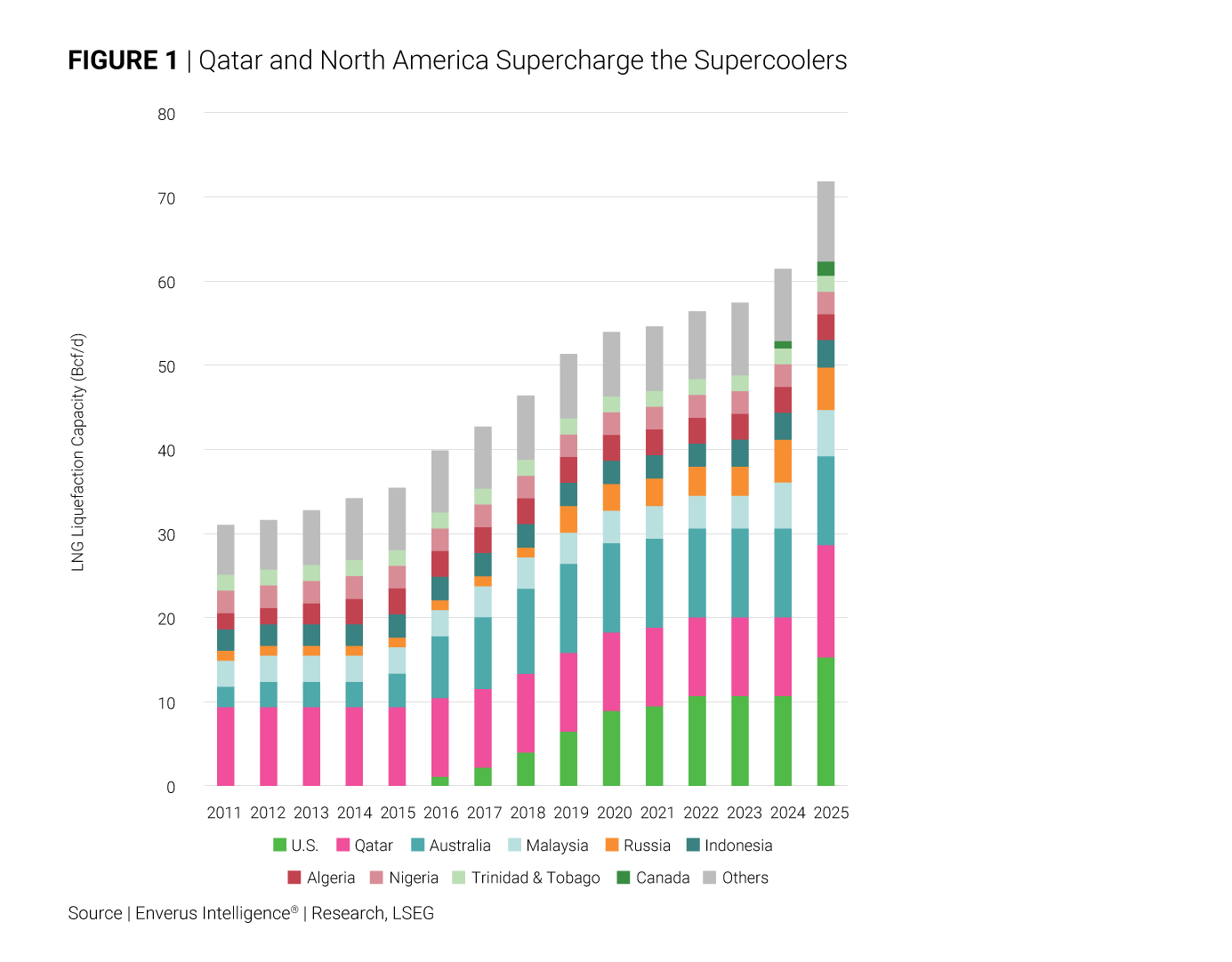

The Israel-Hamas war highlighted both gas market sensitivity and improved response mechanisms. The global LNG market will grow by 25 mtpa (3 Bcf/d) in 2024, a relative calm ahead of a massive buildout of 85 mtpa (10 Bcf/d) in 2025, dominated by North America and Qatar.

The signing of multiple long-term deals supports expectations that Qatari LNG capacity could almost double, rising from 77 mtpa (3.7 Tcf/y) currently to 126 mtpa (6 Tcf/y) by 2027. We estimate Qatar could account for as much as 40% of new global LNG deals.

Russian gas pipeline exports to Europe will be limited in 2024, down more than 50% in 2023 to below 3 Bcf/d. Transit through Ukraine is likely to end in 2024. China’s growth is reliant on the 1.7 Tcf/y Power of Siberia 2 pipeline, but Beijing is hesitant on their final investment decision as it holds out for better terms. Russia currently has 33 mtpa (4 Bcf/d) of LNG capacity, but it’s aiming for 100 mtpa (13 Bcf/d) by 2030, including the Arctic 1 and Murmansk project. Costs and technical capabilities make it unlikely to us that Russia can triple its LNG capacity in just six years. In addition, the EU has enabled its members to restrict LNG imports from Russia.

Turkmenistan has more than 400 Tcf reserves but only 3 Tcf/y production, with about half of that going to China. The CAC pipeline expansion (Line D) will add 1 Tcf/y of export capacity to China. Longer term, construction is imminent for the TAPI (Turkmenistan-Afghanistan-Pakistan-Indian) pipeline. It would add 0.4 Tcf/y of export capacity to South Asia but is unlikely to be online before 2026. Later expansion could increase capacity to 1.5 Tcf/y.

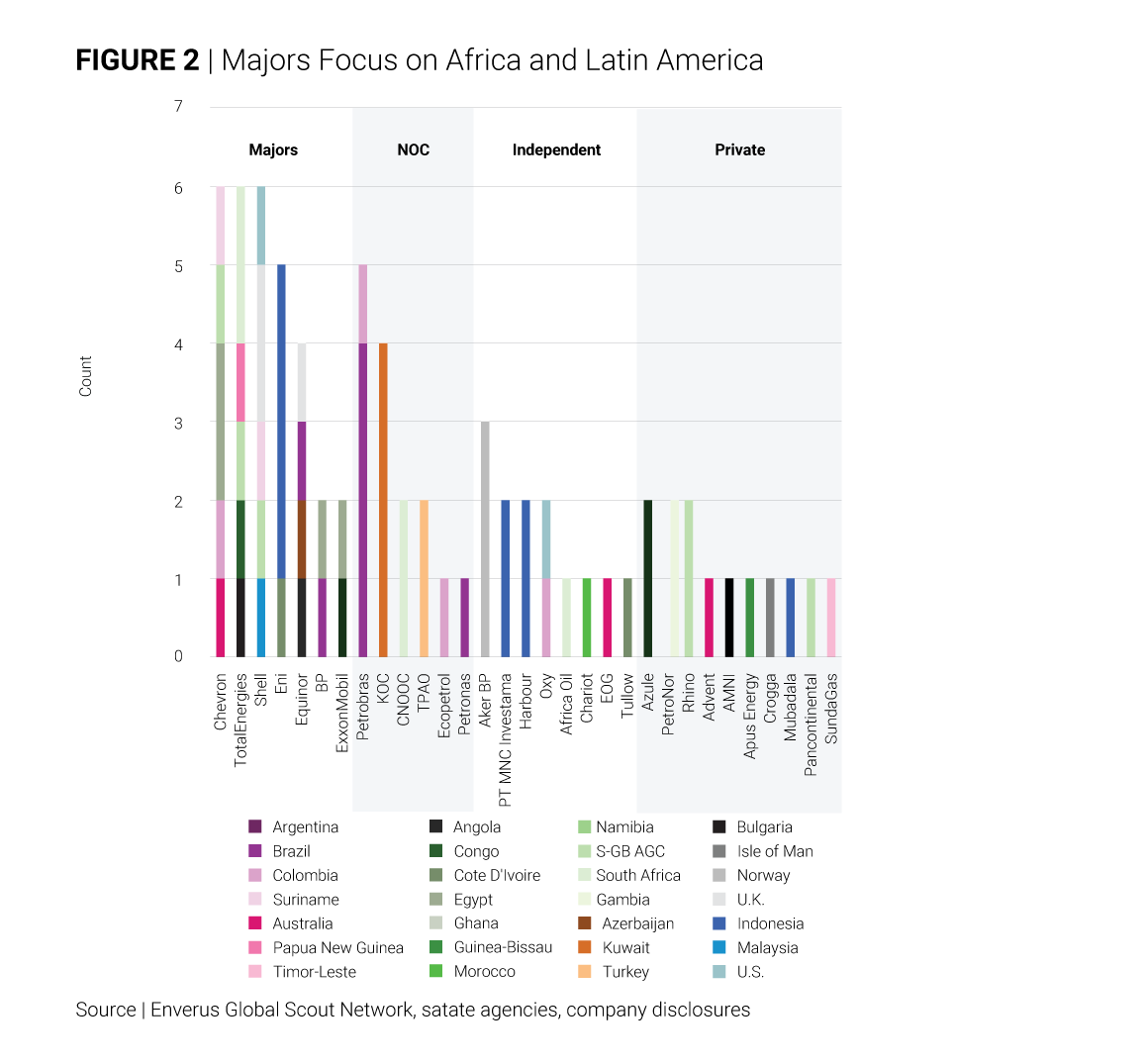

We expect supermajors, majors, large independents, NOCs and other well-capitalized explorers to dominate the search for significant new reserves. Without operational strength, large-project experience and clear paths to commerciality, owners of wildcat exploration prospects are likely to suffer.

Meanwhile, less-risky infrastructure-led exploration (ILX) will continue to flourish, given its potential to get hydrocarbons to market quickly.

What’s Not?

The latest headlines out of Venezuela and Guyana have industry repricing geopolitical risk back into Stabroek-exposed operators. This land dispute is unlikely to be resolved over the course of 2024, and stories will continue to have market impact.

Argentina’s new right-leaning President Javier Milei is being framed as pro-market and pro-oil and gas. The Vaca Muerta continues to impress from a well performance perspective compared to onshore U.S. shale plays. Capital controls, oil price realizations and transportation policy impacts are of top-of-mind concerns for operators and investors with exposure to the Vaca Muerta.

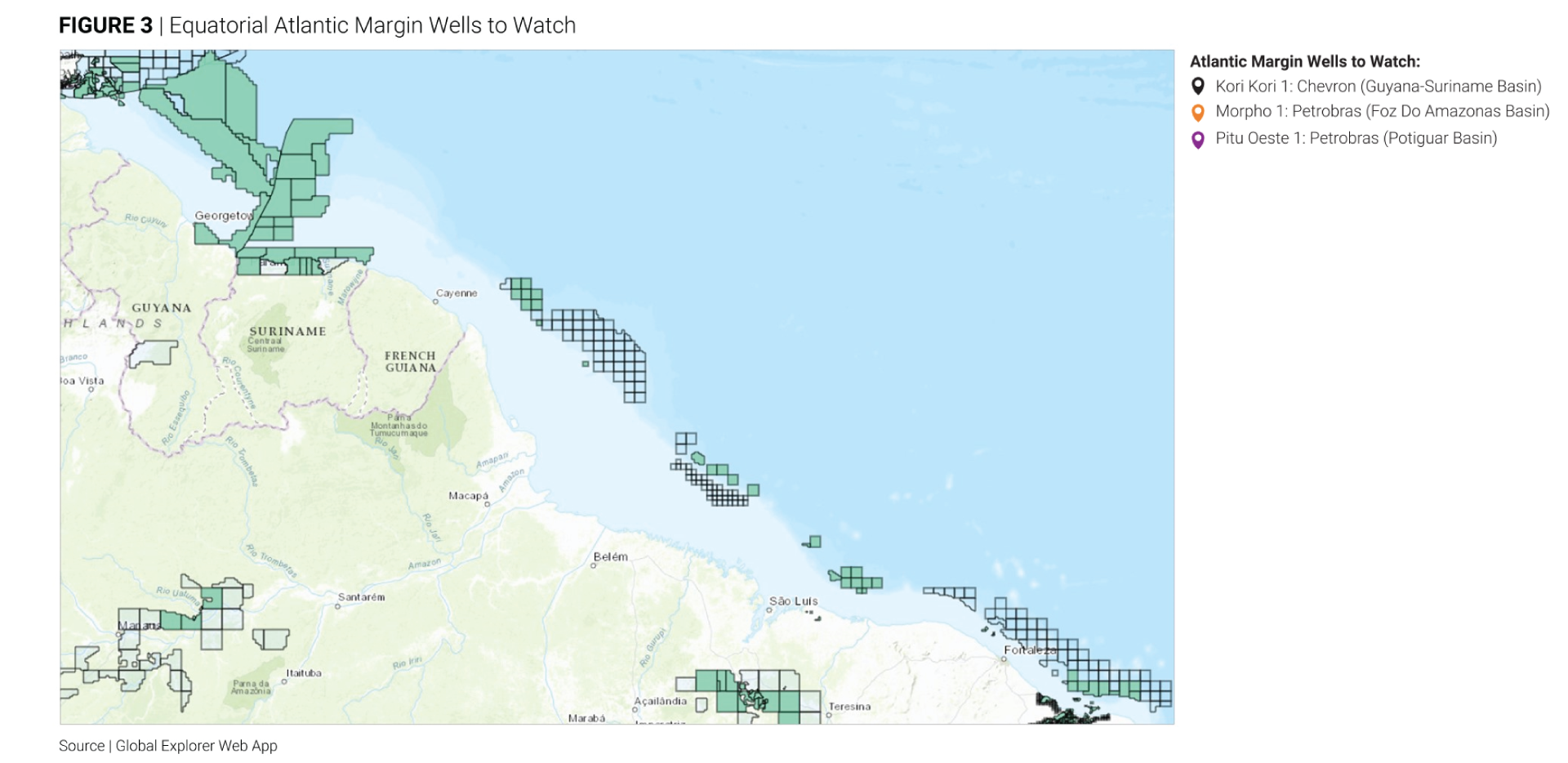

In the equatorial Atlantic Margin, wells to watch include the Chevron-operated Kori Kori wildcat, which is targeting the migration pathway between the offshore “kitchen” and onshore Suriname discoveries, as well as Petrobras-operated wells (Morpho and Pitu Oeste) in Brazil’s equatorial margin basins. These are heavily underexplored compared to cousins on the African side of the conjugate margin.

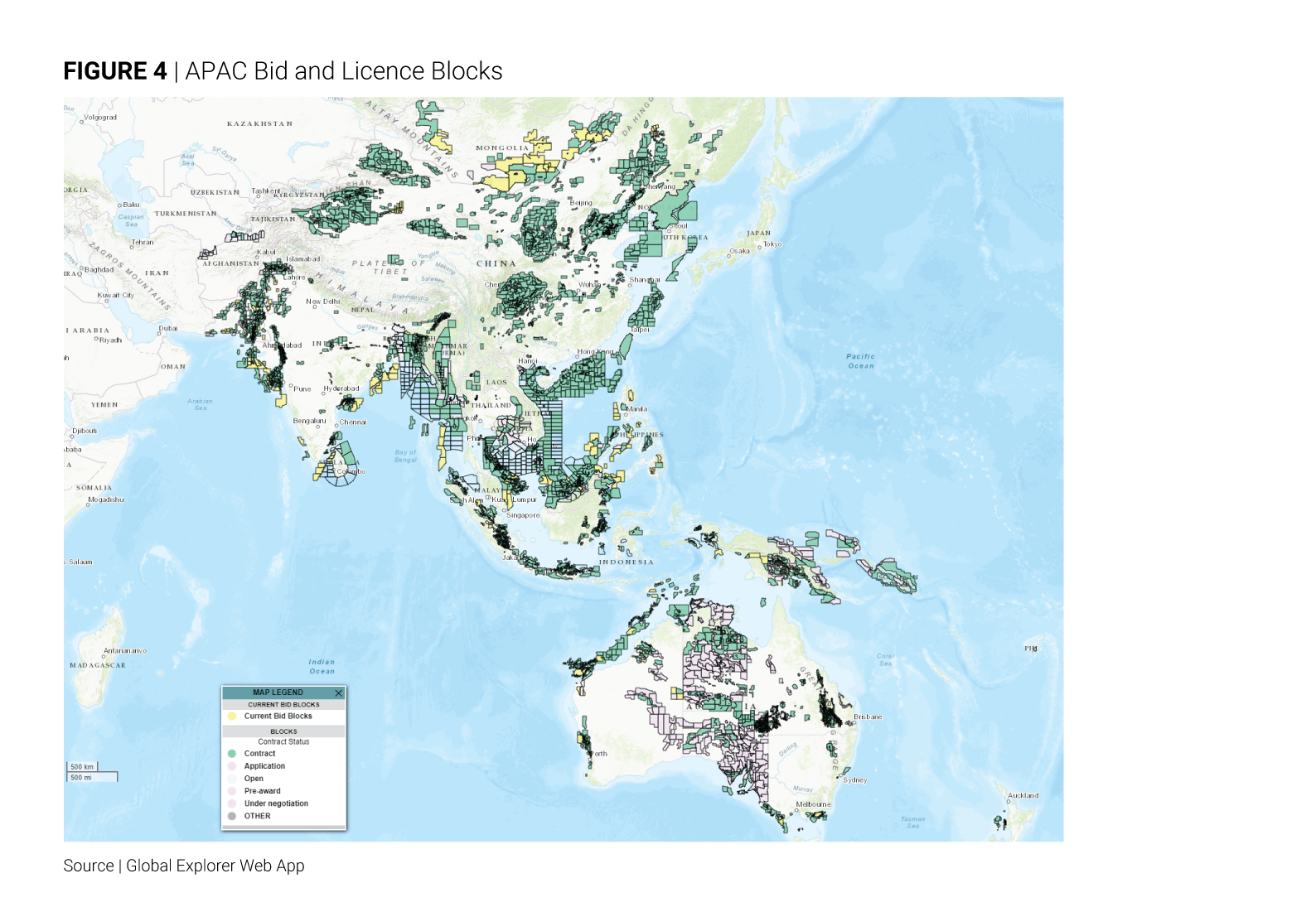

Northeast Asia Manufacturing Powerhouses Seeking CCUS Solution Abroad Indonesia and Malaysia

Indonesia and Malaysia lead exploration and field development with successful projects and discoveries. Eni’s drilling success and operatorship of the Indonesia Deepwater Development project and 19 successful ILX discoveries highlight the region’s attractiveness and prospectivity. Supermajors are all re-engaging with regional CCUS developments, potentially providing new business opportunities.

With increasing demand from Northeast Asia manufacturing powerhouses like Japan and South Korea seeking a CCUS solution outside their respective countries, we expect faster CCUS regulatory framework progress in APAC countries to facilitate such cross-border projects. This will speed up CCUS developments in countries like Indonesia, Malaysia and Australia, led by supermajors and Japanese (backed by JOGMEC) and South Korean companies partnering with local NOCs.

In Australia, we expect regulatory and environmental authorities to clarify their approval processes and reject pressure from environmental activists, allowing stalled exploration and development to proceed. A clearer picture of Australia’s oil and gas future will emerge when the government releases its Future Gas Strategy findings in 2024.

The South Asia region is uplifted by highly anticipated bid round offerings (deepwater/ultra-deepwater) in Bangladesh and Sri Lanka, with supermajors already committing interests. Facing increasing energy demand, South Asia’s existing resources find hungry domestic markets, with any excess easily exported within the region. Governmental stability is one major risk, with bid rounds already delayed because of internal politics.

The majors will drive frontier exploration across Africa in 2024, with the Orange Basin in Namibia and South Africa being a global exploration hot spot. We expect the supermajors and large independents to consolidate their positions, with new entrants likely. Emerging exploration provinces will include the Namibe Basin (southern Angola) and part of the West Africa Transform Margin (Sierra Leone, Liberia and Côte d’Ivoire). Further African coup d’état attempts are anticipated in 2024, with francophone nations most at risk. Potential knock-ons include production shut-ins and resource nationalization.

The ramifications of the Israel-Hamas war will be felt across the Middle East into 2024. An Eastern Mediterranean gas supply crunch is probable if the conflict widens. Israeli gas exports are at risk of being stranded, with knock-on effects including a perceived tightening of the LNG market. GCC countries will ramp up production, particularly gas.

The EU’s “REPowerEU” initiative will drive further renewables investment, with exploration activity declining. North Africa and the Middle East will play an increasingly large role in supplying gas to Europe, while EU countries are also likely to continue to sanction domestic oil and gas projects.

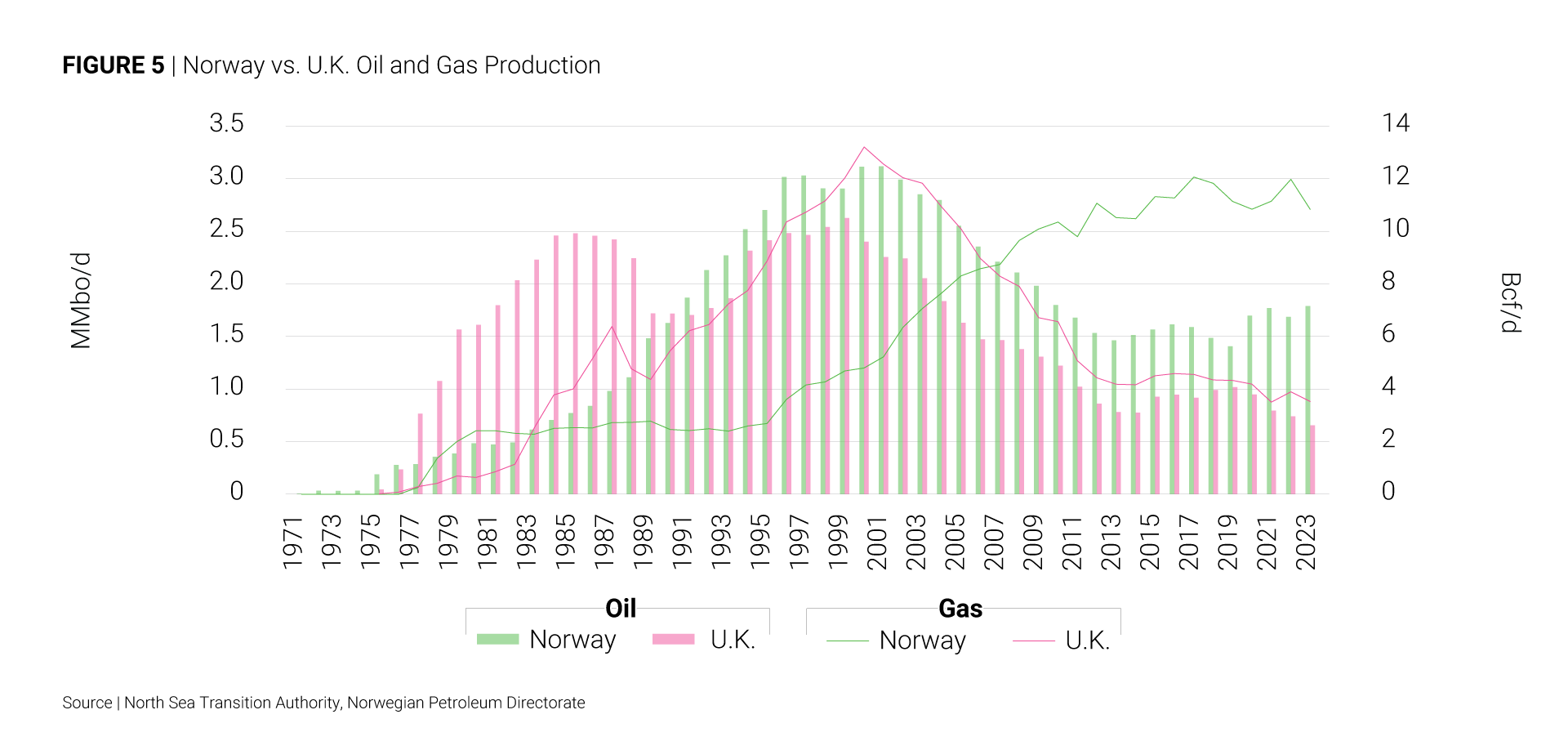

The U.K. and Norway have diverging outlooks, with activity and production declining in the former. The Energy Profits Levy (windfall tax) will stem investment in the U.K. sector; consolidations via M&A will occur. Frontier exploration opportunities remain, with wildcat drilling expected in the Barents Sea in 2024. Infrastructure-led exploration will prevail, particularly for gas.

People, process and technology for E&P innovators looking to disrupt the old and usher in the future of energy.

Read More About our E&P Solutions

Respond faster to rig and activity trends with real-time GPS and satellite telemetry data analytics.

Read More About Activity Analytics

An essential set of O&G data analytics. Redeploy your team’s bandwidth to higher value analysis and strategy with clean analytics-ready data sets.

Read More About Foundations

Track activity in near-real time to get the most recent and actionable insights on operators, leases, rigs, permits and more across the industry.

Read More About Oilfield Services

Technical research, publications and direct access to industry experts that leverage today’s most advanced analytics and technology to deliver independent, third-party insight into oil and gas, power, liquefied natural gas and renewables.

Read More About Intelligence

Discover

About Enverus

Resources

Follow Us

© Copyright 2024 All data and information are provided “as is”.