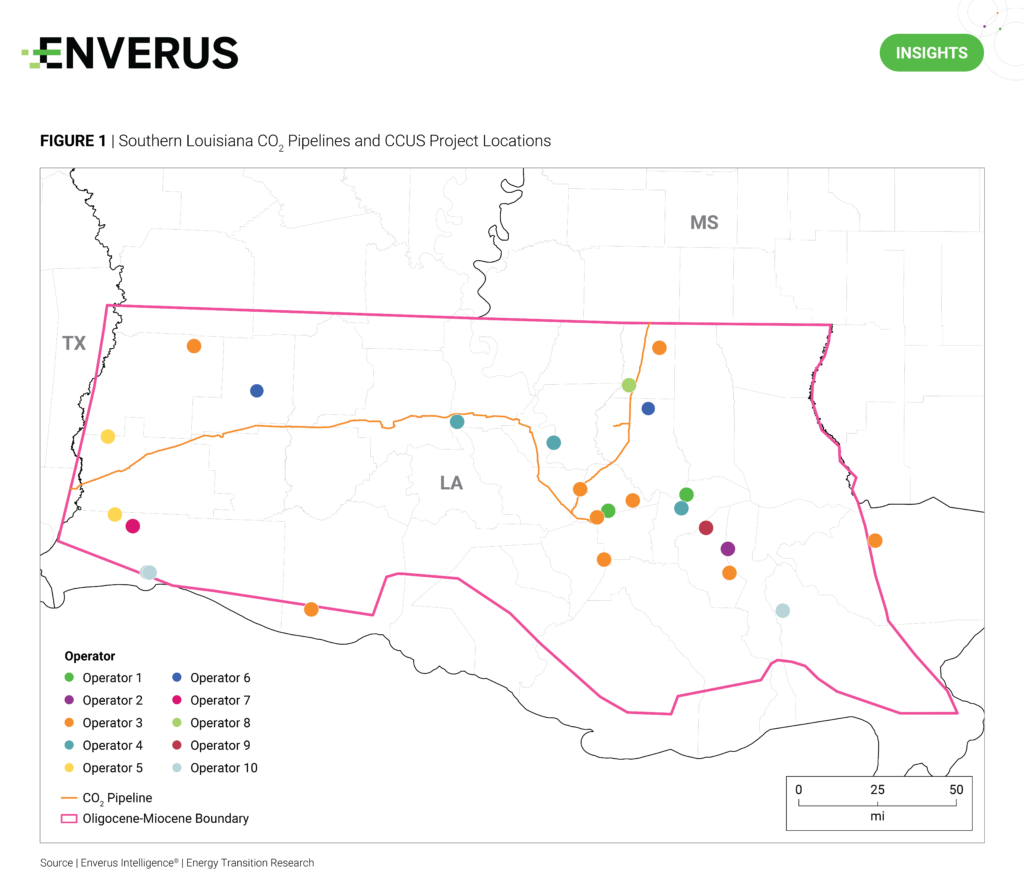

XOM’s recent acquisition of DEN for nearly $5 billion firmly places the buyer and its low carbon solutions business as a leader in carbon capture, utilization and storage (CCUS). Its dominant position is even more apparent in southern Louisiana where DEN was very active in securing midstream partnerships and storage sites around its Green and NEJD CO2 pipelines. XOM is now a midstream and/or storage partner in nine of the 22 announced CCUS project in southern Louisiana, as well as being the owner and operator of the only CO2 pipelines in the region. Its CCUS participation includes storing at least 48 mtpa of the 84 mtpa of total planned storage in the area. This does not include volumes related to recent storage announcements for its Libra and Virgo projects that currently do not have annual storage targets.

Current throughput for XOM’s Green pipeline is about 4 mtpa, only 25% of the 16 mtpa capacity. The remaining capacity, however, is far from enough to satisfy the demands of the rapidly expanding southern Louisiana CCUS market. If all announced capture and storage projects in the area go through, at least 50 mtpa of additional transportation capacity will be needed by 2030. Expansion of XOM’s existing CO2 infrastructure and the addition of new CO2 pipelines through new builds or repurposing existing pipelines and rights of way will need to happen in relatively short order to meet project timelines.

Highlights from Energy Transition Research

- Power Generation BeatBox 2Q23 – Calling for big beats from CEG and VST – This report series attempts to predict beats and misses on consensus revenue expectations for public power producers using a proprietary data-driven quantitative model.

- Going Green With Hydrogen – IRA economics and technology benchmarking – This report explores green hydrogen technology and incentives available in the U.S and models the resulting project-level economics.

- Renewables Performance Drivers – Design choices that matter – This report analyzes the impact of wind and solar project design decisions made by developers and quantifies the choices that result in the strongest asset performance.

Energy is changing. Connect weekly with the ideas that are leading the way.

About Enverus Intelligence®| Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies, and capital providers worldwide. EIR is registered with the U.S. Securities and Exchange Commission as a foreign investment adviser. Click here to learn more.