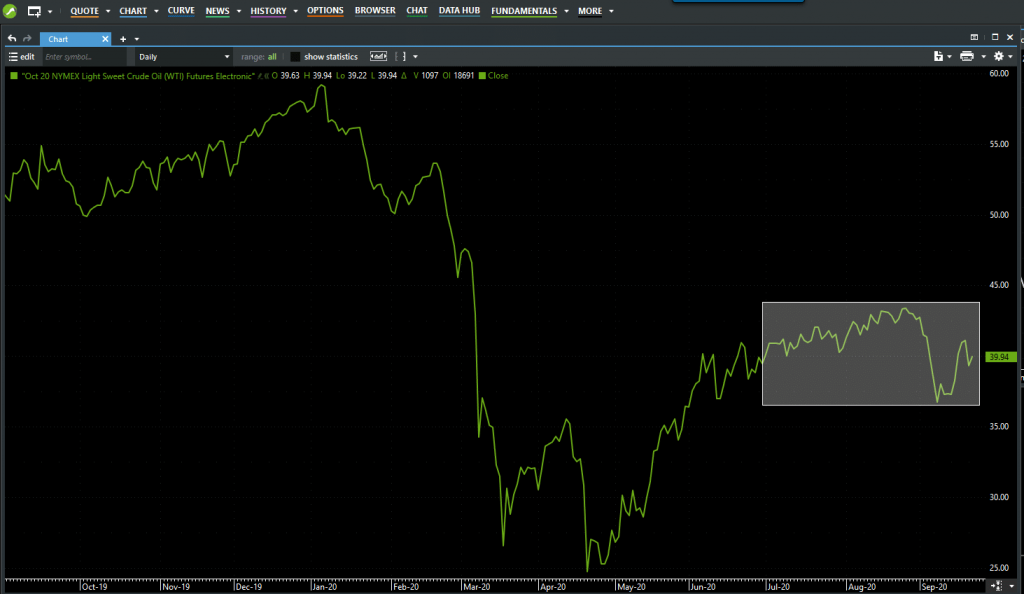

For the oil traders who feed off volatile price movement and market inefficiencies to make profits, the past few months have been a bit of a drag. After the first half of 2020, which was the most volatile period of many crude traders’ careers, the third quarter brought oil merchants a calm, range bound WTI futures market that hovered between $36/bbl and $43/bbl.

Yes, oil prices are higher now than they were in the crude market’s darkest days of 2020 in March and April. But that doesn’t necessarily mean more profits for traders. Price volatility, and the fundamental market mismatches that create it, give oil traders the opportunity to take profits regardless of the price level. The larger the price swing, the bigger the opportunity to maximize returns.

WTI Futures Draw Calm in Q3 2020

A Fully Equipped Crude Trading Desk Always Wins

As we enter the fourth quarter of this unforgettable year, it’s a great time to reflect on the ways to gain an edge on the market, especially when price action is calm. Margins are getting thinner and trading liquidity has fallen in oil futures markets. Now’s the time to dig deeper into data and analytics to ensure your view of the market is comprehensive and accurate.

In September, we brought the best of Enverus production forecasting into MarketView, our flagship software for energy and commodity price analysis. It’s now possible to view Enverus base case production forecasts directly in MarketView Desktop. Here are three new ways to uncover new trading ideas by incorporating MarketView Oil & Gas Intelligence data into your workflows.

- OPTIMIZE YOUR HEDGING STRATEGY.

Get a comprehensive view of the market. See your market’s monthly production forecast alongside price forward curves to hedge production volumes. - ENHANCE BASIN-BY-BASIN ANALYTICS.

Quickly compare the production forecasts in multiple basins to get a better understanding of regional price movements.

- GAIN A BETTER UNDERSTANDING OF HISTORICAL PRODUCTION TRENDS.

Compare new production forecasts against prior assessments to monitor the changing forecast over time.

The new data in MarketView covers 69 North American basins and is updated every day to reflect the market settlements that impact basin economics. On a monthly basis, our team is also feeding newly collected state wellhead performance data into the oil and gas production forecasts, ensuring timely and comprehensive outlooks.

Now oil traders and analysts can assess fundamentals outlooks and adjust trading strategies with a quick overview, and easily transfer output forecast data to supply and demand models while also assessing market price movements.

Want to see what our data can do? We are happy to help. Learn more here, email us at [email protected] or call us at 1-800-282-4245. We’ll set you up with a two-week trial of our tool.