Accurately understanding bid prices at lease sales is an arduous task for exploration teams. Several variables contribute to a block’s risk and cost, such as the presence of de-risked play concepts, an operator’s confidence in prospect interpretation, proximity to infrastructure, macro environment and political landscape, among others. While some of those factors are subjective and non-disclosed, Enverus analysts explore the objective data points to identify areas and scenarios in which operators are more likely to pay a premium.

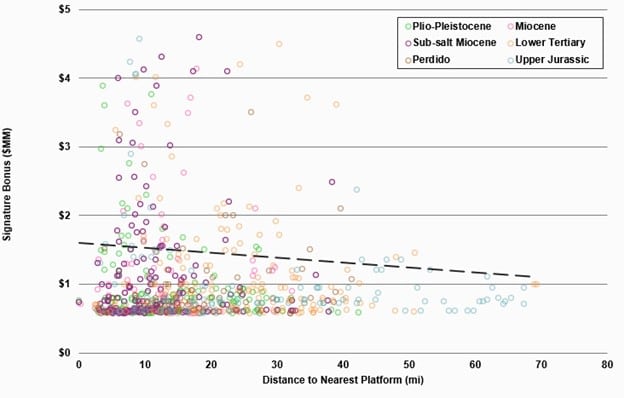

As an example, in the Gulf of Mexico 70% of all blocks won at lease sales since 2016 have been within 20 miles of existing production hubs, placing a premium on acreage exposed to the infrastructure-led exploration strategy. Additionally, we estimate tieback acreage is more than two times likely to have multiple bids per block and garners an average of 1.3 times higher bonuses paid than non-tieback acreage. Using Enverus’ GOM lease, geologic, production and economic data sets, we help clients navigate lease sales.

Gulf of Mexico Lease Sale 257 will take place Nov. 17, 2021, the first since the temporary federal lease moratorium was lifted earlier this year.