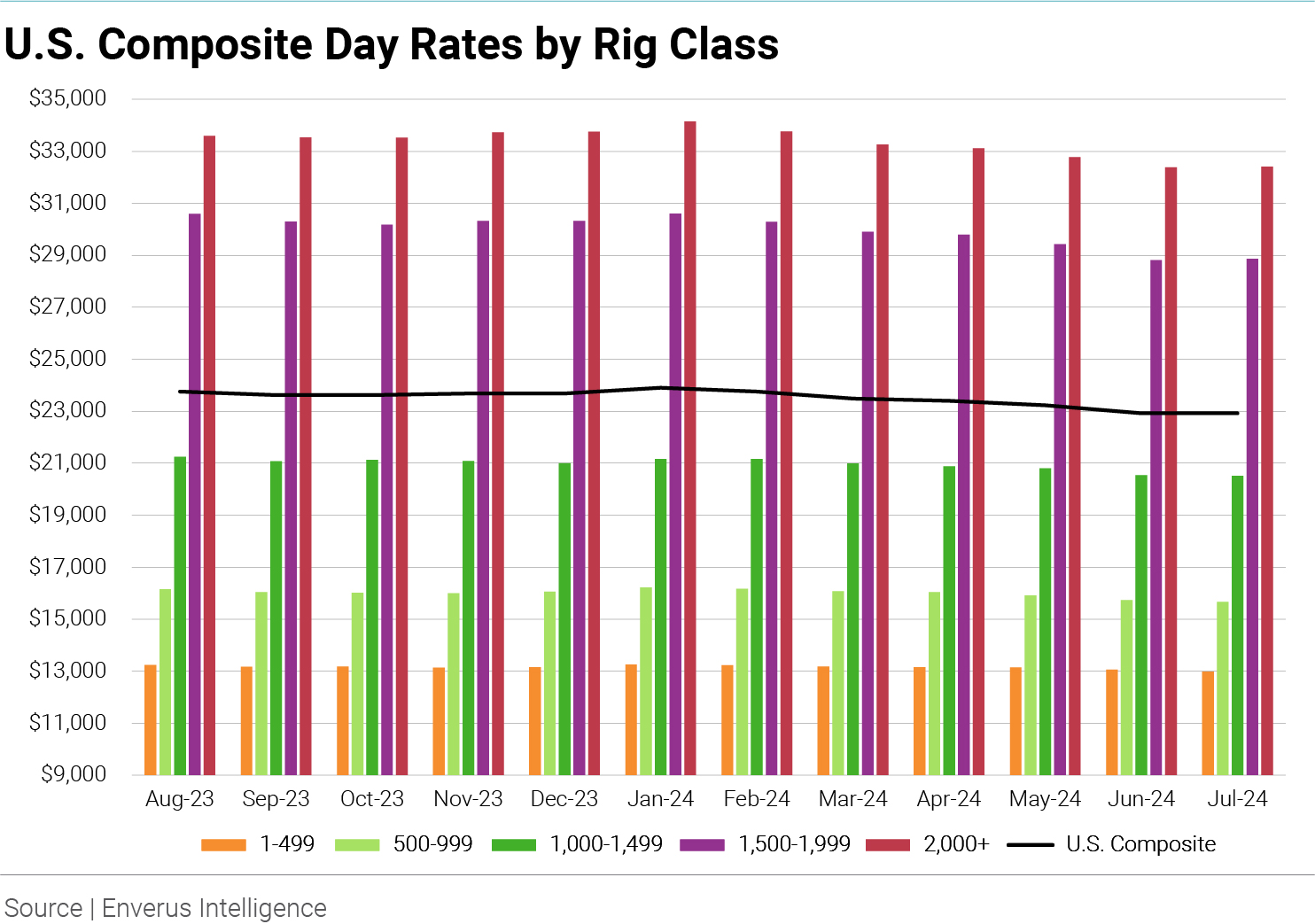

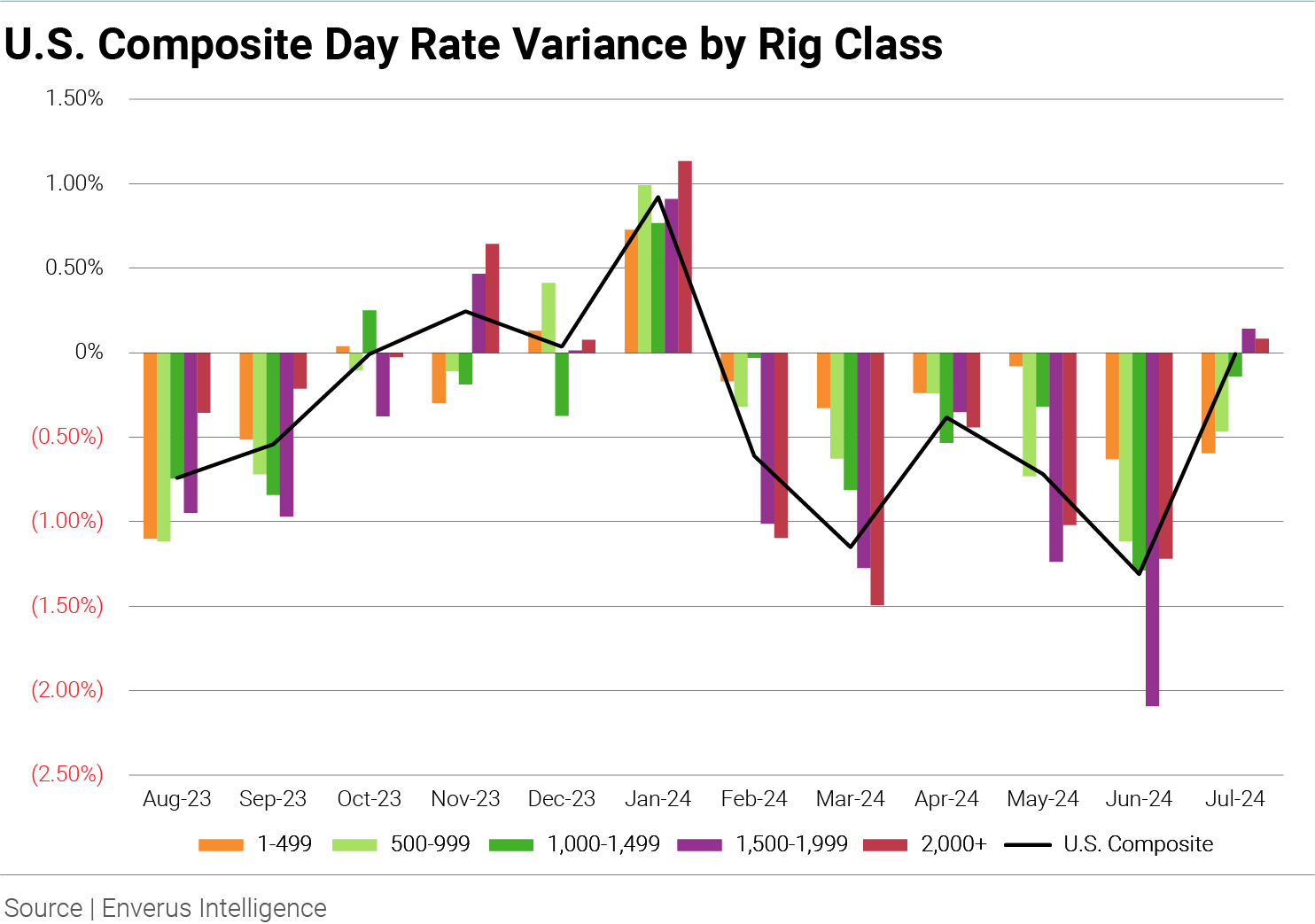

The U.S. composite day rate slipped just $2 lower in July to $22,921, according to the Enverus Day Rate Survey. While the miniscule decline was a dramatic change from June’s $308 plummet, an immediate recovery seems unlikely, as drillers surveyed in July were much more likely than June respondents to see stagnating rig demand.

Roughly 86% of July respondents said bid inquiries were decreasing or steady compared with three months ago, versus 36% in the June survey. Drilling rigs have already been hired and are on contract for the high summer drilling season. This could be as good as it gets for U.S. drilling activity as Q4 and its typical seasonal slowdown awaits.

More than three-fourths of day rate survey respondents expect the same amount of work during the next six months, though some are questioning the effect recent consolidation among E&P clients will have on future drilling plans. Q2 saw just over $30 billion in upstream M&A transactions, continuing a remarkable consolidation run that started in 2H23 and has seen about $250 billion transacted in the last 12 months. The M&A wave is not concentrated in just one basin, either; Permian deals accounted for less than 10% of value in 2Q24 compared with more than 50% in 1Q24 and 4Q23.

“Acquisitions are probably the biggest reason the number of bids we are getting are decreasing,” a Rockies driller told the survey team. The Rockies were the location of the biggest transaction in July—Devon Energy’s $5 billion acquisition of Williston Basin-focused Grayson Mill Energy LLC, an EnCap Investments LP portfolio company.

The average day rate in five of the seven regions in the Enverus Day Rate Survey gained ground sequentially in July, ending a three-month stretch of all seven regions declining. July gains were modest, however, ranging from $11 to $50, while the Ark-La-Tex fell by $112 and the Mid-Continent fell by $116. The losers more than offset the winners, sending the U.S. composite lower.

The $2 dip means the U.S. composite has fallen for six consecutive months, but the other regions’ July gains leave the Ark-La-Tex as the only region that has fallen six straight months; the Mid-Continent had a small increase in March. The Ark-La-Tex has also lost the most dollar value over the past six months, down $1,583 since January to its $23,182 July result.

The Gulf Coast has fallen the most by percentage since January, down 6.41% compared with the Ark-La-Tex’s 6.39%. It would have had the deepest dollar cut had it not risen $11 in July. “We see the rig market improving as people are signing contracts and getting in line,” a Gulf Coast driller told the survey team.

Appalachia continues to be an outlier as July’s top gainer, rising $50 to $21,952. The region has only lost $233 since January, a 1.05% decline compared with the national composite’s 4.12% drop. “We are seeing bid requests increase in our area because the number of customers is increasing,” an Appalachia driller told the survey team.

Higher-power drilling rigs are consistently performing better than their lower-power counterparts. In all of the survey’s seven regions, Class D rigs (1,500-1,999 hp) have fallen less YOY than Class C rigs (1,000-1,499 hp). In South Texas, the Class C rigs’ average of $28,946 is 6.53% lower than in July 2023, while the Class D average of $32,847 is down just 1.65%. In sequential results, five of the seven regions saw Class D fall by less in percentage than Class C. The U.S. composite day rate for super-spec rigs rose $393 from June to $30,250, its highest reading since last September.

To see the full results of the Enverus Day Rate Survey for July, check out the latest issue of Oilfield Pulse.

About Enverus Intelligence Publications

Enverus Intelligence Publications presents the news as it happens with impactful, concise articles, cutting through the clutter to deliver timely perspectives and insights on various topics from writers who provide deep context to the energy sector.