[contextly_auto_sidebar]

CRUDE OIL

- US crude oil inventories posted a decrease of 4.8 MMBbl last week, according to the weekly EIA report. Gasoline and distillate inventories decreased 2.4 MMBbl and 2.5 MMBbl, respectively. Total petroleum inventories posted a decline of 4.9 MMBbl. US crude oil production decreased 100 MBbl/d from the week before, per EIA, while crude oil imports were up 0.9 MMBbl/d, to an average of 6.9 MMBbl/d.

- The WTI market opened the week falling on its face, as traders felt the impact of the US imposing 15% tariffs on some Chinese products and China placing new duties on US crude. Adding to this negativity was the US manufacturing data, which showed activity declining in August for the first time in three years.

- The market regained support on economic data showing continued resilience in China’s manufacturing and service sectors. Support was further bolstered by the announcement that the US and China have agreed to resume face-to-face negotiations in October. However, this support remains tepid at best.

- The key thing for the crude market is the deterioration of demand conditions globally. As such, the ongoing trade war between the world’s two largest economies will continue to put a damper on market sentiment. Currently, there is little support to had from the supply side given the historically low production from Venezuela and Iran, as well as from the OPEC+ countries as they continue to hem in supply. A meeting of the OPEC+ Joint Ministerial Monitoring Committee will be held in Abu Dhabi this Thursday to discuss the supply issues, but the market is focusing on the gloomy economic outlook. Ahead of the meeting, incoming Saudi Energy Minister Prince Abdulaziz reaffirmed the Kingdom’s commitment to the production cuts.

- The EIA inventory release brought some support to prices and printed the highs of the week, but prices could not hold and retraced most of the gains by the end of the day. There was less pressure on prices from the US dollar, as the dollar consolidated lower after a large run in the previous week.

- The CFTC report released Friday (dated September 3) showed the Managed Money long sector (speculating on higher prices) reducing positions by 8,584 contracts, while the short position increased by 5,501 contracts. The lack of directional commitment from the speculative sector was confirmed with the second-largest open interest position in the report, currently held by the Managed Money Spreading component (spreading occurs when a trader is long/short one month, with the opposite position in a later month). This activity can be considered a low-risk trade while waiting for a directional lead.

- Prices expanded the range to $4.82 last week, but market internals continue to point to a neutral bias. Volume gained week over week, while open interest increased slightly. Prices remain in a consolidation phase and are bunching up around several commonly traded areas: 1) the 20-week moving average at $57.23, 2) the 200-day moving average at $56.06, and 3) the 50-day moving average at $56.27.

- The recent range between $53.00 and $58.00 that held prices last week may hold in the coming week without developments on trade. The long-term range between $50.00 and $61.00 will likely hold trade without significant resolution on the trade wars or additional reductions in OPEC output. The longer the market stays in this tight range, the more likely significant volatility will occur when it breaks out of the range, either up or down.

NATURAL GAS

- Natural gas dry production showed an increase of 0.05 Bcf/d, while Canadian imports decreased 0.40 Bcf/d.

- Res/Com demand decreased 0.03 Bcf/d, while power demand rose 1.75 Bcf/d with the late summer heat. Industrial demand was up on the week, gaining 0.02 Bcf/d. Secondary components had LNG exports declining by 0.51 Bcf/d, while Mexican exports lost 0.05 Bcf/d. LNG facilities shed some demand for natural gas last week, but the new facilities will support prices this fall.

- These events left the totals for the week showing the market increasing 0.45 Bcf/d in total supply while total demand increased by 1.2 Bcf/d.

- The storage report last week showed the injections for the previous week at 84 Bcf. Total inventories are now 383 Bcf higher than last year and 82 Bcf below the five-year average. Current weather forecasts in the near term (coming week) show above-average temperatures throughout the US.

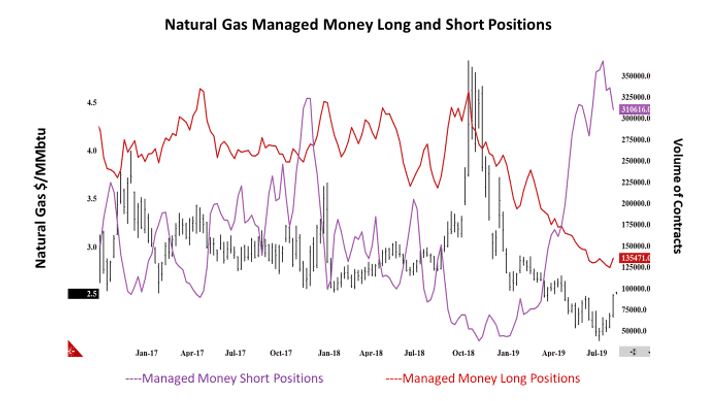

- The CFTC report released last week (dated September 3) provides additional evidence that the speculative trade may be changing some of its expectations. The Managed Money short position covered their short exposure by 25,375 contracts, while the long position increased by 10,777 contracts. The chart below displays the number of short positions covered by the Managed Money short sector from its recent historical level (second only to November ’15).

- While the short covering will cause prices to rally, long-term price runs will need not only short covering but also new length entering the market. To date, the majority of the gains in price have been attributable to the short covering. The other issue the market will potentially need to address is the total amount of short positions that it could be forced to cover and the potential volatility that covering will likely produce.

- With the price gains last week, the market internals maintained a neutral bias as volume increased on the gains in price. Total open interest also increased slightly week over week (according to preliminary data from the CME).

- The fundamentals (weather forecasts) may allow for additional price strength in the coming week. History shows that there is price weakness in early September, but this year seems to be contrary. The gains of last week have set up an interesting struggle for near-term action. Prices are currently running up on key resistance from the breakdown last May, when prices broke below the key support (at that time), between $2.52 and $2.49. That area will likely bring some selling this week. A break above that area will take prices to the 200-day moving average ($2.629), potentially disavowing the bearish sentiment that has held the market for the past three months. Should prices retrace and challenge support, then the key area is between $2.26 and $2.24, which will likely bring buying.

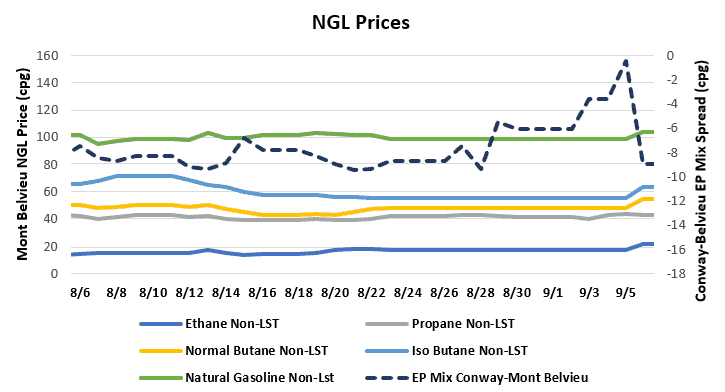

NATURAL GAS LIQUIDS

- Ethane was up $0.010 to $0.180, propane was relatively flat on the week at $0.425, normal butane was up $0.013 to $0.490, isobutane was up $0.017 to $0.564, and natural gasoline was up $0.010 to $0.997.

- US propane stocks increased ~2.86 MMBbl for the week ending August 30. Stocks now sit at 97.02 MMBbl, roughly 23.62 MMBbl and 17.12 MMBbl higher than the same week in 2018 and 2017, respectively.

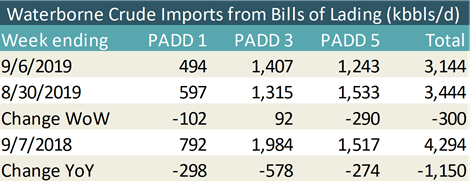

SHIPPING

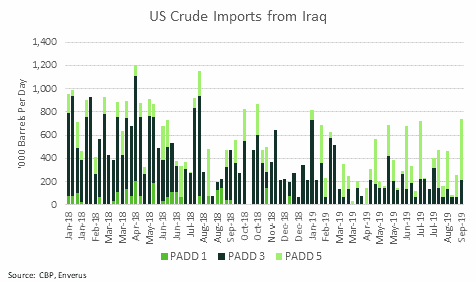

- US waterborne imports of crude oil fell for the week ending September 6, according to Enverus’s analysis of manifests from US Customs & Border Patrol. As of September 9, aggregated data from customs manifests suggested that overall waterborne imports decreased 300 MBbl/d from the previous week. PADD 1 and PADD 5 both fell, with PADD 1 down by more than 100 MBbl/d and PADD 5 down by 290 MBbl/d. PADD 3 imports rose slightly, up 92 MBbl/d.

- Imports from Iraq were significant this week, the highest weekly total since January. Though imports were high, the destination for Iraqi crude within the US has shifted. In 2018, the majority of Iraqi crude went to PADD 3, the Gulf Coast. In 2019, PADD 5 has been the primary destination for Iraqi crude, as it was this week. Valero’s refineries on the West Coast have become bigger consumers of Iraqi crudes, with both Wilmington and Benicia taking deliveries several times in 2019. This was a rarity in 2017 and 2018.