[contextly_auto_sidebar]

CRUDE OIL

- US crude oil inventories posted an increase of 2.4 MMBbl last week, according to the weekly EIA report. Gasoline inventories increased 0.5 MMBbl, while distillate inventories decreased 3.0 MMBbl. Total petroleum inventories increased 0.7 MMBbl. US crude oil production increased 100 MBbl/d, per EIA, while crude oil imports were down 0.7 MMBbl/d to an average of 6.4 MMBbl/d.

- WTI flat price spent the past week doing much the same thing it did the week prior: retracing the brief gains caused by the September 14 attack on Saudi crude oil production and treatment facilities. Production from the Khurais oilfield has reportedly returned to 1.3 MMBbl/d, and it was announced that capacity at the processing facility at Abqaiq has been restored (although production has not resumed). Detracting further from the withering geopolitical risk premium was Friday’s announcement of a Saudi-Yemeni ceasefire. With geopolitical risk diminishing, the trade war between the US and China has returned to the forefront amid growing concerns about a global economic slowdown.

- The CFTC report released Friday (showing positions from September 24) showed that on the rally from the Iranian attacks, speculators increased their positions as the Managed Money short positions increased by 13,740 contracts. The Managed Money long sector took profits as they sold off 4,362 contracts.

- Market internals last week reversed the slight positive bias that had developed with the declines throughout the week, and the market now has a neutral to negative bias. Volume was well below the previous week’s as open interest continued to decline (likely due to profit taking by the speculative long sector).

- Flat price is back in the low end of the trading range from two weeks ago, with potential for extensions down to $53.00. The market has now clearly defined the high side of the range with the failure to extend gains beyond $63.58. Regardless of the potential for geopolitical issues to provide upward volatility, the market has now defined the near-term area that will find significant selling.

NATURAL GAS

- Natural gas dry production increased 0.58 Bcf/d last week, while Canadian imports decreased 0.01 Bcf/d.

- Res/Com demand gained 0.27 Bcf/d, while power demand dropped 0.59 Bcf/d as more seasonal temperatures are developing in the Lower 48. Industrial demand fell from the week prior, dropping 0.02 Bcf/d. LNG exports lost 0.53 Bcf/d from the week prior, while Mexican exports increased 0.18 Bcf/d.

- These events left the totals for the week showing the market gaining 0.57 Bcf/d in total supply while total demand dropped by 0.67 Bcf/d.

- The storage report last week showed injections for the previous week at 102 Bcf. Total inventories are now 444 Bcf higher than last year’s and 47 Bcf below the five-year average. Current weather forecasts for the near term (coming week) and further out show above-average temperatures in key areas for cooling demand, but the seasonal climatology for the upcoming periods will limit the amount of cooling demand days. Enverus expects ending inventories to end at around 3.7 Tcf.

- The CFTC report released last week (dated September 24) provides insight into the selling from the speculative long sector after prices rallied to $2.70, as the Managed Money long positions took profits and sold 14,190 contracts. The Managed Money short positions added just 1,679 contracts.

- With the price declines last week, the market internals changed slightly to a more neutral to bearish bias, as volume dropped dramatically with declines in open interest (likely associated with the contract expiration).

- The key area discussed last week provided some buying opportunities until the bearish storage release on Thursday. The storage report provided cover for additional shorts to enter the market as well as any weak bulls to reassess the seasonal trend of prices rising in the fourth quarter. We mentioned last week that should prices break down, a test of the low $2.30s should be expected, which is likely coming this week. Rallies will now face strong selling at the area where prices collapsed last week, around $2.50.

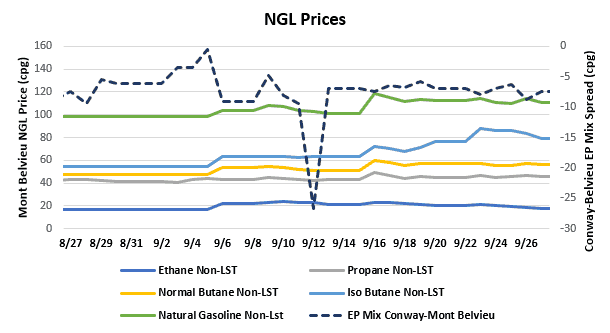

NATURAL GAS LIQUIDS

- Prices were mostly down last week. Ethane was down $0.026 to $0.193, propane was down $0.004 to $0.460, normal butane was down $0.013 to $0.563, and natural gasoline was down $0.024 to $1.120; isobutane was the only purity product up on the week, gaining $0.132 to $0.847.

- US propane stocks saw their first decrease since May, falling ~1.02 MMBbl for the week ending September 20. Stocks now sit at 99.67 MMBbl, roughly 23.31 MMBbl and 21.27 MMBbl higher than the same weeks in 2018 and 2017, respectively.

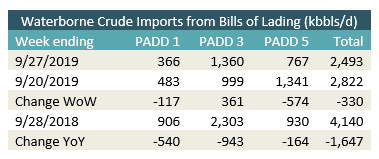

SHIPPING

- US waterborne imports of crude oil fell for the week ending September 27, 2019, according to Enverus’s analysis of manifests from US Customs and Border Protection. As of September 30, aggregated data from customs manifests suggested that overall waterborne imports decreased by 330 MBbl/d from the previous week. The drop was driven by declining imports in PADD 1 and PADD 5. PADD 1 waterborne crude imports fell by more than 115 MBbl/d, while for PADD 5 the drop was nearly 575 MBbl/d. PADD 3 imports rebounded from last week, increasing by more than 360 MBbl/d.

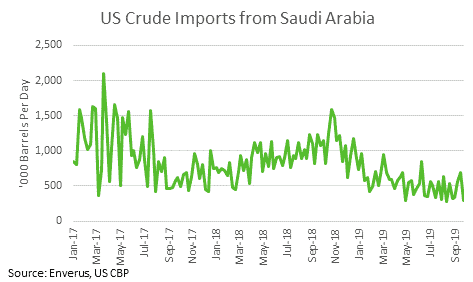

- After zero imports into PADD 3 last week, imports of Iraqi crude returned to PADD 3 this week. More should be on the way this week as the Richmond Voyager is still offshore with additional crude waiting to discharge. Weekly imports from Saudi Arabia were nearly 277 MBbl/d. That’s the third-lowest weekly level since 2017, with the lowest level occurring the week of August 16, 2019. Of the 10 lowest weeks since 2017, five have occurred in the past 10 weeks, as US imports of Saudi crude have continued to dwindle.