[contextly_auto_sidebar]

CRUDE OIL

- US crude oil inventories posted a substantial decrease of 10.0 MMBbl last week, according to the weekly EIA report. Gasoline and distillate inventories both decreased 2.1 MMBbl. Total petroleum inventories posted a significant decline of 11.2 MMBbl. US crude oil production was up 200 MBbl/d from the week before, per EIA.

- The market continues to follow trends of late, correlating any directional movements in prices to the tweets of President Trump and the statements of the Chinese regarding the trade war between the world’s two largest economies. Confusion reigns as the US and China appear to be willing to reduce the recent escalating tensions. Trump stated that China was seeking a trade deal and that US officials had received requests from the Chinese negotiators to return to discussions. That was followed by the Chinese trade negotiator, Vice President Liu He, stating that Beijing hopes to resolve the trade war through calm negotiations without escalating tensions any further. However, when the Chinese declined to confirm the Trump announcement regarding the requests, the market could not confirm a potential trade deal and lost any support brought by the comments. It is becoming evident that any trade deal will have to allow both parties in the negotiations to declare success. Price action does not show evidence of any success, as the highs sold off toward the end of the week.

- The EIA inventory release on Wednesday confirmed substantial crude inventory declines that were announced by an industry report on Tuesday. This decline, coupled with a very strong decline in total petroleum inventories, brought a positive impact to prices. The rally sent prices to the highs of the week on Thursday, before giving up many of those gains on Friday as traders were forced to assess a dramatic gain in the US dollar going into the long weekend.

- In the coming week, the market will have to assess the impact brought about by the French announcement that the Iranian minister is traveling to France to further negotiations on the nuclear agreement that the Trump administration left last year. Clearly, the goal of the Iranians is to increase exports by working around the US restrictions. Any success in this endeavor will add more crude to the already oversupplied market going into 2020.

- The CFTC report released Friday (dated August 27) showed the Managed Money long sector (speculating on higher prices) reducing positions by 19,191 contracts while the short position added 7,560 contracts.

- As prices closed $0.93 over the previous week’s close, market internals shifted to a neutral bias. Volume gained week over week, while open interest increased slightly. The market remains in a consolidation phase for prices, having failed four times in the past seven weeks to break above the commonly watched 20-week moving average ($57.60/Bbl, currently).

- This consolidation phase has prices in a tight range on either side of the 50-day average (currently $56.46/Bbl). The recent range between $53.00 and $58.00 may hold in the coming week without developments on the US and China trade war, while the long-term range between $50.00 and $61.00 will likely hold without similar developments. China’s attempt to bring tariffs on US crude imports may indicate a shift to utilize Iran imports. Prices would be pressured if Iran were to increase output because of demand from China or a nuclear deal with France. Once again, the market will trade around the news event or Twitter feeds in the coming week.

NATURAL GAS

- Natural gas dry production showed a decrease of 0.31 Bcf/d. Canadian imports decreased 0.55 Bcf/d.

- Res/Com demand fell 0.38 Bcf/d, while power demand dropped 4.66 Bcf/d as temperatures became more seasonal. Industrial demand was up on the week, gaining 0.21 Bcf/d. Secondary components had LNG exports rising by 0.96 Bcf/d, while Mexican exports gained 0.11 Bcf/d.

- These events left the totals for the week showing the market decreasing 0.86 Bcf/d in total supply while total demand decreased 3.93 Bcf/d.

- The storage report last week showed the injections for the previous week at 60 Bcf. Total inventories are now 363 Bcf higher than last year and 100 Bcf below the five-year average. Current weather forecasts, in the near term (coming week), show above-average temperatures throughout the central and southern US, with the hurricane potentially lowering power demand along the east coast in the near term, according to current tracking information.

- The contract expiration last week followed the recent two-year trend of providing strength to prices. Prices held strength as the October contract took over as prompt, with some concerns over the direction of the hurricane. This week the support provided by the hurricane path may pressure prices, as it becomes a demand liability in the southern and eastern US. The new LNG facilities are adding additional demand for natural gas (last two week’s gains), bringing support for prices.

- The CFTC report released last week (dated August 27) provides a slight reversal of the data from the previous week’s data, as the Managed Money short position increased their exposure by adding 2,764 contracts, while the long positions decreased 2,289 contracts. The total Managed Money short position remains at levels not seen since late December ’17.

- Market internals reflect a neutral to bearish bias. Volume was higher last week than the previous week, while total open interest declined week over week (according to preliminary data from the CME), likely due to the expiration of the September contract.

- The fundamentals may allow for strength in prices in the coming week as the market heads into a historically bearish time of the year (either side of the Labor Day weekend). The market has ranged between $2.03 and $2.30 since the breakdown in July. While the storage levels will provide some daily volatility, the market has received enough information on summer injections to start looking forward to the upcoming winter forecasts. It is important for the market to hold $2.244 (the commonly traded 50-day average). A break below this price will likely set up a test of the $2.10 to $2.12 area. Should prices break below this zone, a test of $2.02 will find buyers. Should prices hold the initial support at $2.24, a test of the July expiration high at $2.324, up to $2.333, is likely. Significant additional strength will be necessary to push the run up to the breakdown area from the spring, at $2.49.

NATURAL GAS LIQUIDS

- EIA reported another record for daily NGL production in May, producing 4,838 MBbl/d. This tops the previous daily production record set in April 2019 of 4,786 MBbl/d. All the increase in production came from PADD 3, which increased ~79 MBbl/d, while all other PADDs showed slight declines month over month. May 2019 production was ~516 MBbl/d and 1,067 MBbl/d higher than May 2018 and May 2017, respectively.

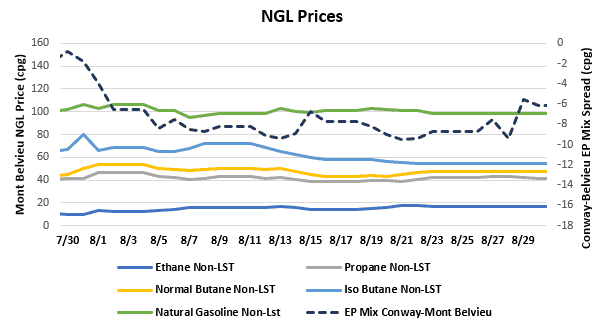

- Ethane was down $0.007 to $0.170, propane was up $0.017 to $0.423, normal butane was up $0.017 to $0.478, isobutane was down $0.005 to $0.548, and natural gasoline was down $0.015 to $0.988.

- US propane stocks increased ~3.66 MMBbl for the week ending August 23. Stocks now sit at 94.16 MMBbl, roughly 22.76 MMBbl and 20.60 MMBbl higher than the same week in 2018 and 2017, respectively.

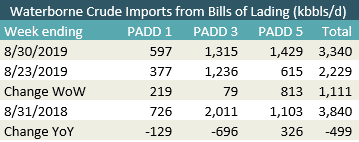

SHIPPING

- US waterborne imports of crude oil rose for the week ending August 30 according to Enverus’s analysis of manifests from US Customs & Border Patrol. As of September 3, aggregated data from customs manifests suggested that overall waterborne imports increased by nearly 1.1 MMBbl/d from the previous week. PADD 1 and PADD 3 both increased somewhat, with PADD 1 up by nearly 220 MBbl/d and PADD 3 up by nearly 80 MBbl/d. The big driver of the increase was PADD 5, which increased by 813 MBbl/d.

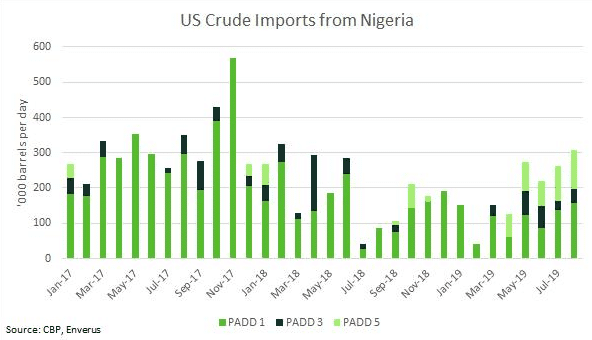

- US crude imports from Nigeria appeared to have ticked up in August to the highest level since February 2019. On the East Coast, refiner PBF appears to have resumed importing barrels from the West African country for the first time since February 2018, while Phillips 66 Freeport has imported a cargo of medium sweet Ebok in each of the past two months.