[contextly_auto_sidebar]

CRUDE OIL

- US crude oil inventories posted a decrease of 6.9 MMBbl last week, according to the weekly EIA report. Gasoline inventories decreased 0.7 MMBbl, while distillate inventories increased 2.7 MMBbl/d. Total petroleum inventories posted a decline of 3.1 MMBbl. US crude oil production was flat week over week per EIA, while crude oil imports were down 0.2 MMBbl/d to an average of 6.7 MMBbl/d.

- WTI opened last week on solid footing with comments by the Chinese Ministry of Commerce that US and Chinese officials would meet in October to resume negotiations on trade disputes and intellectual property rights. This news was followed by further commitments by the new Saudi energy minister, Prince Abdulaziz bin Salman, that Saudi Arabia will remain committed to the supply cuts and manage supplies to the potential demand declines associated with the global economic slowdown.

- Of course, that was before the early Saturday morning attack against key Saudi oil installations by Houthi rebels. The attack struck the Abqaiq stabilization and processing facility, resulting in the immediate loss of 5.7 MMBbl/d of Saudi crude production (over half of the country’s total output). Saudi Aramco aims to restore 2 MMBbl/d on Monday. Expectedly, Brent and WTI were both up over 10% on Monday morning. The Saudis have confirmed that they will draw down crude inventories to meet near-term obligations. To help alleviate supply availability concerns, the United States also announced that it is considering tapping into its Strategic Petroleum Reserve (SPR). With immediate supply availability covered by Saudi commercial inventories and the US SPR, the question for the market right now is how long it will take to restore the remaining output lost due to the attacks. The fact that the United States is blaming Iran (which is backing the Houthis in Yemen) for the attack also raises the prospect of US airstrikes. In short, geopolitical risk is back.

- The CFTC report released Friday (dated September 10) showed the Managed Money longs (speculating on higher prices) adding to their positions by 19,995 contracts, while the Managed Money shorts decreased positions by covering 20,897 contracts. This flip in the positions (after the recent lack of action) suggests that the market was looking for positive directional gains on the heels of the OPEC+ discussions. However, the collapse of prices on Thursday and Friday setting the lows of the week suggests those objectives were not met. The weekend attack will now shuffle the decks of the trade positions, so be ready for some volatility.

- Prompt WTI has extended the recent trading range over $60/bbl in reaction to this weekend’s events in Saudi Arabia. Until the market quantifies the length of the affected shortfall, flat price is likely to be volatile. Market internals last week had developed a neutral to slightly positive bias as prices rallied early in the week on very strong volume and gains in open interest, only to give up those gains toward the end of the week.

- The recent consolidation phase of the market has led to a breakout for prices with the attacks on the Saudi infrastructure. WTI may find enough support to challenge the $63.80/bbl area up to $66/bbl, which established the highs from last spring.

NATURAL GAS

- Natural gas dry production declined 0.66 Bcf/d last week, while Canadian imports increased 0.25 Bcf/d.

- Res/Com demand increased 0.04 Bcf/d, while power demand dropped 0.96 Bcf/d as more seasonal temperatures countered the previous week’s late summer heat. Industrial demand was up on the week, gaining 0.04 Bcf/d. LNG exports were flat to the previous week, while Mexican exports lost 0.09 Bcf/d.

- These events left the totals for the week with the market dropping 0.40 Bcf/d in total supply while total demand dropped 1.03 Bcf/d.

- The storage report last week showed the injections for the previous week at 78 Bcf. Total inventories are now 393 Bcf higher than last year and 77 Bcf below the five-year average. Current weather forecasts in the near term (coming week) show above-average temperatures from the Rockies to the East. Further out, forecasts have above-average temperatures throughout the US.

- The CFTC report released last week (dated September 10) provides significant information explaining the recent gains in prices. The Managed Money short position covered their short exposure by buying back 73,802 contracts. With this short covering and the previous week’s covering, nearly one-third of the open short interest has left the market as prices ran over $2.30 up to last week’s high ($2.648). The Managed Money long positions increased positions by only 5,362 contracts, which indicates little new length coming into the market, but the recent run is all short covering. History has told us that rallies based on short covering are limited in duration.

- With the price gains last week, market internals maintained a neutral/bullish bias as volume significantly increased on the gains in price, while open interest declined week over week (according to preliminary data from the CME). The market is entering an extremely overbought condition with the daily momentum indicators. It is unlikely that this condition will maintain itself for an extended period of time.

- The fundamentals (weather forecasts) may allow for some additional price strength in the coming week. Late Sunday night, prices traded higher with a gap, indicating strength coming this week, and some of those gains remained on Monday morning. Some of this run may be attributable to the Saudi loss, but any upward pressure on LNG prices due to the attacks will be slow due to capacity limitations. It is more likely that the run has more to do with the late summer forecasts and a tropical disturbance the Weather Service is tracking off the coast of Texas. Hurricane Humberto is tracking off the southeast coastline and will likely limit heat-related demand.

- Prices will run into selling at the 200-day average (continuous prices) at $2.724 up to several highs from last spring. Trade seems to be indicating that the bearish elements that set up the weakness during the summer may be mitigated, but the fundamentals do not support a reversal of outlook. For a long-term rally to take hold in the market, the rally needs to be supported by new length coming into the market rather than just short covering. A rally in prices supported with high volume and growing open interest will signal a potential shift in perspective.

NATURAL GAS LIQUIDS

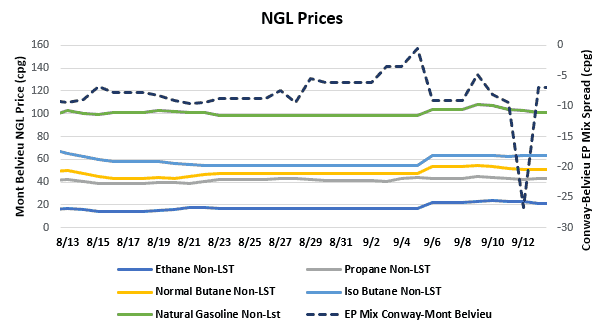

- Ethane was up $0.048 to $0.227; propane was up $0.010 to $0.434; normal butane was up $0.036 to $0.526; isobutane was up $0.068 to $0.632; and natural gasoline was up $0.048 to $1.045.

- US propane stocks increased ~0.74 MMBbl for the week ending September 6. Stocks now sit at 97.76 MMBbl, roughly 23.12 MMBbl and 15.58 MMBbl higher than the same week in 2018 and 2017, respectively.

SHIPPING

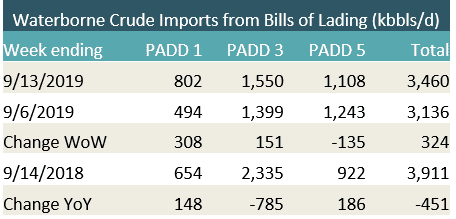

- US waterborne imports of crude oil rose for the week ending September 13, 2019, according to Enverus’s analysis of manifests from US Customs and Border Patrol. As of September 16, aggregated data from customs manifests suggested that overall waterborne imports increased by 324 MBbl/d from the previous week and PADD 1 and PADD 3 rose by 308 MBbl/d and 151 MBbl/d, respectively. PADD 5 showed a decrease of 135 MBbls/d over the course of the week.

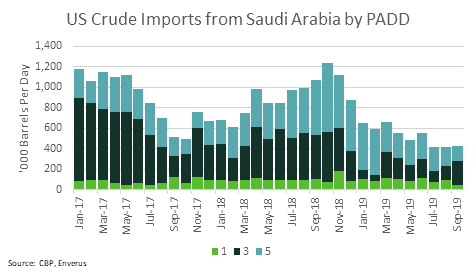

- While the attack on Saudi Aramco’s Abqaiq facility is causing global oil prices to soar, US refiners over the past three months have been less dependent on Saudi Arabian crude than they have been in recent history. US crude imports from the Kingdom, the world’s largest exporter of crude oil, fell to around 420 MBbls/d in July and have remained in that range since. That is the lowest level since 1985.