[contextly_auto_sidebar]

CRUDE OIL

- US crude oil inventories posted a substantial increase of 9.3 MMBbl last week, according to the weekly EIA report. Gasoline and distillate inventories decreased 2.6 MMBbl and 3.8 MMBbl, respectively. Total petroleum inventories decreased 1.6 MMBbl. US crude oil production was unchanged from the previous week, per EIA, while crude oil imports were up 0.7 MMBbl/d to an average of 6.3 MMBbl/d.

- WTI spent the early portion of the week drifting lower as the enthusiasm from the Phase 1 trade deal between the US and China was replaced with skepticism, as details of the agreement have yet to be put on paper. Weak global economic growth prospects presented by the IMF reinforced the primary concern of traders. Indeed, China’s GDP grew at a rate of only 6% compared to the same period in 2018, the slowest rate of expansion since the early 1990s.

- The data points that continue to confirm the anemic global economy will keep a lid on any rally in prices. Last week, prompt WTI futures traded in the narrowest range (high to low) since July, staying within the previous week’s range. Some volatility can be expected, though, as the November contract heads into expiry tomorrow.

- The EIA inventory report on Thursday had a substantial build in crude stocks. October data are likely to continue to reflect builds due to planned refinery maintenance and difficult export price capacity due to the steep freight rates. The EIA’s Drilling Productivity Report, released last week, shows stronger US tight oil production in November will likely exacerbate the issue.

- The CFTC report released Friday (showing positions from October 15) represents hesitancy on behalf of the directional trade. The Managed Money long sector added 720 contracts, while the Managed Money short positions increased positions by 7,321 contracts. The Managed Money short position continues to expect lower prices due to doubts about global demand.

- Market internals last week maintained a slightly neutral-to-negative bias, with prices closing below the previous week on lower volume and a slight loss in open interest. Prices tested but closed the week above the key area ($53.00). Prices are not reflecting previous historic activity typical when the Mideast is showing signals of unrest. Instead, the unrest is outweighed by the fears associated with the lack of global demand. The uncertainties about geopolitical unrest and the implications of the Phase 1 trade deal not being completed will keep prices above $50.00 in the coming weeks. Rallies will have difficulty with the selling that will occur should prices extend above $55.00 to $56.00.

NATURAL GAS

- Natural gas dry production increased 0.56 Bcf/d last week, while Canadian imports increased 0.17 Bcf/d.

- Seasonal demand was seen this week, as Res/Com demand increased 4.06 Bcf/d due to cooler weather and increased heating demand. Power demand decreased 1.93 Bcf/d, while Industrial demand gained 0.55 Bcf/d. LNG exports increased 0.29 Bcf/d, while Mexican exports decreased 0.12 Bcf/d.

- These events left the totals for the week showing the market gaining 0.73 Bcf/d in total supply while total demand increased 2.96 Bcf/d.

- The storage report last week showed injections for the previous week at 104 Bcf. Total inventories are now 494 Bcf higher than last year and 14 Bcf above the five-year average. Current weather forecasts from NOAA in the near term (coming week) show below-average temperatures throughout the middle of the US and above-average temperatures in the mid-Atlantic region and the West Coast. The 8-to-14-day forecast has the below-average temperatures expanding east.

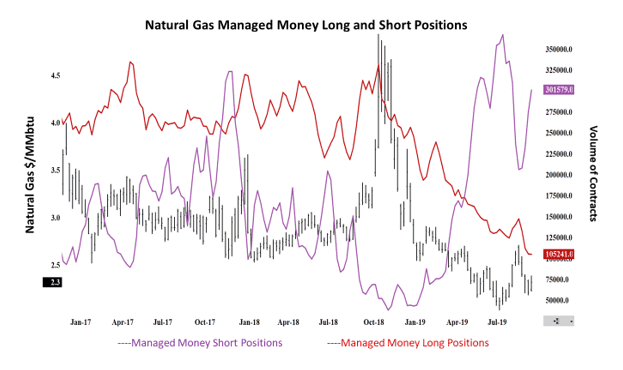

- The CFTC report released last week (dated October 15) showed further expansion of the Managed Money short position, adding 26,385 contracts, while Managed Money long positions sold 448 contracts. The chart below shows the Managed Money shorts eclipsing 300,000 contracts and creeping up to the high levels of short positions established in early August. These levels will eventually lead to a covering rally, similar to those in August and early September, which took prices up to $2.70. Should the forecasts continue to bring unseasonal cold further into November, this may force the shorts to reconsider positions and bring another short covering rally.

- Prices started the week stronger and rallied to the highest level since early October before giving up some of those gains to close the week. However, the close of the week was still a dime higher than the previous week. The market internals continue to show a neutral-to-bearish bias, as the market gained on lower volume and reductions in total open interest (according to preliminary data from the CME). For rallies to extend higher, the gains should be met with higher volume and initial declines in open interest as the short interests buy back to cover positions.

- The market continues to be in a range environment ($2.18 to $2.39) until the upcoming winter becomes better defined. Continued weather forecasts having below-normal temperature trends into November and may create some volatility as the expectations among traders shift. If the forecasts adjust to warmer, the declines will extend below the $2.18 area, down to $2.12.

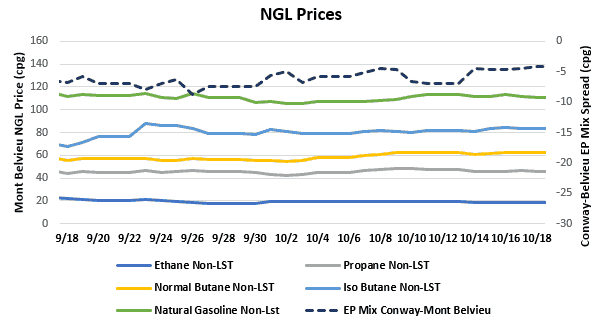

NATURAL GAS LIQUIDS

- Ethane and propane prices were down $0.010 and $0.016 to $0.184 and 0.460, respectively. Normal butane was up $0.006 to $0.620, isobutane was up $0.022 to $0.832, and natural gasoline was up $0.017 to $1.118.

- US propane stocks fell ~328 MBbl for the week ending October 11. Stocks now sit at 100.45 MMBbl, roughly 18.15 MMBbl and 21.61 MMBbl higher than the same week in 2018 and 2017, respectively.

SHIPPING

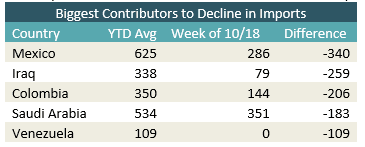

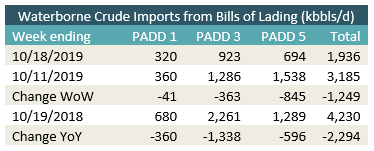

- US waterborne imports of crude oil fell for the week ending October 18, according to Enverus’s analysis of manifests from US Customs and Border Protection. The level of imports suggested by these manifests is the lowest since at least the beginning of 2017, at 1.936 MMBbl/d for the entire US. PADD 3 regularly exceeded that level on its own in 2017 and 2018. As of October 21, aggregated data from customs manifests suggested that overall waterborne imports decreased by 1.25 MMBbl/d from the previous week. The biggest decline in imports came in PADD 5, where imports fell by 845 MBbl/d week over week. PADD 1 declined by 41 MBbl/d WoW, and PADD 3 declined by 363 MBbl/d WoW. The level of PADD 3 imports is the lowest for a week since early February.

- The biggest driver of the week’s decline was lower imports from Mexico. US imports of Mexican crude have averaged 625 MBbl/d so far this year, but only 286 MBbl/d of imports were reported last week, a difference of 340 MBbl/d. Imports from Iraq were also lower, down nearly 260 MBbl/d from their 2019 weekly average.