[contextly_auto_sidebar]

CRUDE OIL

- US crude oil inventories posted an increase of 2.9 MMBbl last week, according to the weekly EIA report. Gasoline and distillate inventories decreased 1.2 MMBbl and 3.9 MMBbl, respectively. Total petroleum inventories decreased 8.3 MMBbl. US crude oil production increased 200 MBbl/d, per EIA, while crude oil imports were down 0.67 MMBbl/d, to an average of 6.2 MMBbl/d.

- Crude spent the beginning of the week drifting lower, but closing the first three days of the week was flat. Concerns over the health of the global economy continued to drag on sentiment. On Tuesday, the new head of the IMF, Kristalina Georgieva, announced plans to reduce the 2020 global GDP growth outlook by 0.8 percentage points. This would take 2020 growth down to just 2.7%, the slowest pace of economic expansion since the 2008 financial crisis. On Friday, the International Energy Agency cut its demand growth forecasts to 1 MMBbl/d in 2019 and 1.2 MMBbl/d in 2020. The release also raised the forecasts for supply growth in 2020 from non-OPEC sources by 0.4 MMBbl/d.

- Amid the weak macro sentiment early in the week, futures markets largely ignored the upswell of political unrest in Ecuador, which has affected oil production and transport. After halting operations on the Trans-Ecuadorian Pipeline System on Wednesday, Petroecuador declared force majeure on some crude and product deliveries. The market also shrugged off reports that an Iranian tanker came under fire in an apparent missile attack in the Red Sea.

- Prompt futures found support later in the week as US and Chinese negotiators met in Washington to discuss a possible end to the ongoing trade war. Although details remain lacking, Friday’s announcement of a tentative agreement sent November WTI to close at $54.70/bbl (up from the prior day’s close of $53.55/bbl). Nevertheless, contango has crept into the first three months of the WTI term structure, and there has been further flattening of the Brent structure as well.

- The CFTC report released Friday (showing positions from October 8) showed a continuing shift in the expectations. The Managed Money long positions dropped 7,301 contracts, while the Managed Money short positions increased by 36,859 contracts. The Managed Money short position has now doubled in the last two weeks, confirming the concerns around global demand.

- Market internals last week maintained a slightly neutral to negative bias, with prices closing above the previous week on higher volume and very slight gains in open interest. The volume was fairly consistent throughout the week. With markets cautiously optimistic about some type of trade deal emerging between the US and China, a floor is likely to remain around $50.00. Upside could emerge on the back of short covering if a breakthrough is met or another geopolitical event occurs. However, any rally would likely be met with selling between $57.50 and $59.00.

NATURAL GAS

- Natural gas dry production decreased 0.31 Bcf/d last week, while Canadian imports decreased 0.44 Bcf/d.

- Res/Com demand showed an increase of 1.66 Bcf/d, while power demand decreased 5.15 Bcf/d. Industrial demand gained by 0.15 Bcf/d. Secondary components showed LNG exports gaining 0.15 Bcf/d, while Mexican exports increased by 0.22 Bcf/d.

- These events left the totals for the week showing the market dropping 0.76 Bcf/d in total supply, while total demand fell by 3.08 Bcf/d.

- The storage report last week showed the injections for the previous week at 98 Bcf. Total inventories are now 472 Bcf higher than last year and 9 Bcf below the five-year average. The current weather forecasts from the NOAA, in the near term (coming week), show above-average temperatures east of the Mississippi, while the 8- to 14-day forecast has above-average temperatures from Ohio to the east. The eastern region of the US showing above-average temperatures creates a more bearish outlook for prices due to limited power demand and very small heating demand.

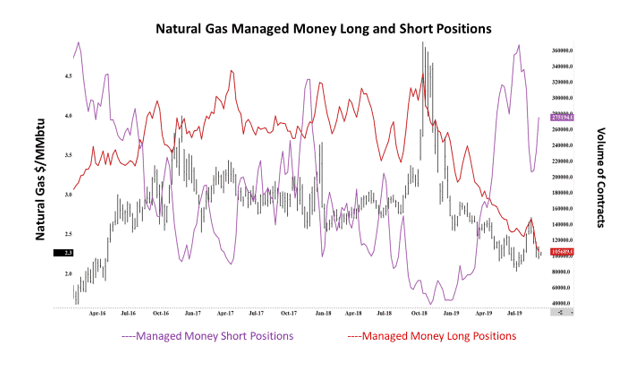

- The CFTC report released last week (dated October 8) showed the Managed Money long position selling 6,716 contracts, while the Managed Money short position added 42,458 contracts. The chart below shows the Managed Money shorts chasing the highs established in early August prior to the short covering rally in late August and early September, which took prices up to $2.70.

- Prices broke below the lows of early October with a decline to $2.187 before ending the week at lows not seen since mid-August. The market internals now show a neutral to bearish bias as the market declined on gaining volume and gains in open interest (according to preliminary data from the CME).

- As discussed last week, prices drifted lower all week and broke below the previous month’s low, only to find buyers at $2.20. Due to the amount of short interest in the market, rallies may find short covering support. Should the declines continue, additional support will be found from $2.18 down to $2.12. Should the market find support, it may create the need for the shorts to cover a rally and could take prices to $2.36, up to $2.40.

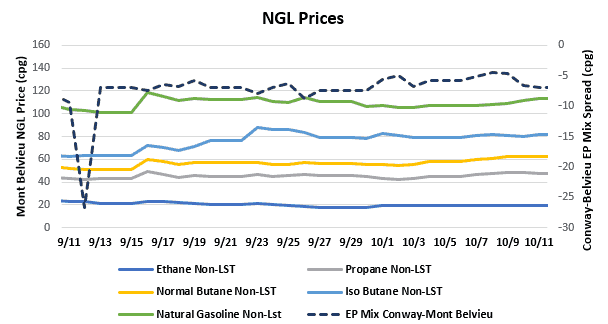

NATURAL GAS LIQUIDS

- Enterprise has announced that they will proceed with the expansion of their Appalachia-to-Texas (ATEX) ethane pipeline. The expansion would increase capacity on the pipeline by 45 MBbl/d and is currently expected to be in service in 2022.

- Prices were up across the board last week. Ethane was up $0.004 to $0.195, propane was up $0.038 to $0.476, normal butane was up $0.058 to $0.615, isobutane was up $0.010 to $0.811, and natural gasoline was up $0.038 to $1.101.

- US propane stocks gained ~132 MBbl for the week ending October 4. Stocks now sit at 100.77 MMBbl, roughly 20.51 MMBbl and 21.85 MMBbl higher than the same week in 2018 and 2017, respectively.

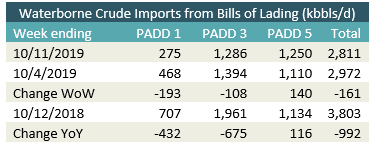

SHIPPING

- US waterborne imports of crude oil fell for the week ending October 11, 2019, according to Enverus’s analysis of manifests from US Customs & Border Patrol. As of October 14, aggregated data from customs manifests suggested that overall waterborne imports decreased by 161 MBbls/d from the previous week. The drop was driven by declining imports in PADD 1 and PADD 3. PADD 1 waterborne crude imports fell by 193 MBbls/d, while for PADD 3 the drop was more than 160 MBbls/d. PADD 5 imports increased, up by 140 MBbls/d.

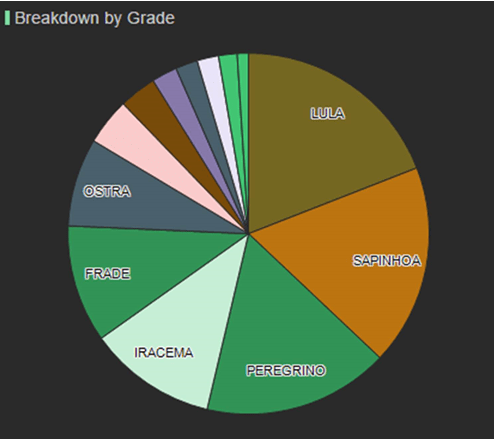

- US imports of Brazilian crude have been strong so far this month, with 293 MBbls/d imported so far in October. That is the highest level since May, when the US imported more than 300 MBbls/d. Chevron has imported nearly 77 MBbls/d to their El Segundo refinery near LA, while Marathon has brought in nearly 75 MBbls/d to their Carson refinery, which is also in the LA area. On the Gulf Coast, Valero has increased their imports of Brazilian crude at their Texas City refinery, importing cargoes of Frade in both September and October. The chart below shows a breakdown of Brazilian imports by grade so far in 2019.