[contextly_auto_sidebar]

CRUDE OIL

- June WTI settled at $19.78/bbl last Friday, up 17.5% from last Monday’s open. Prices were supported by smaller-than-expected US inventory builds as well as early indications that production cuts are beginning to take effect globally. Despite the recent easing in the rate of inventory builds, physical markets still remain oversupplied. Supply pressures persist even as refined product demand begins to come out of its vegetative state, and it is likely to take some time before demand recovers to its pre-COVID level.

- The Energy Information Administration last Wednesday reported a 9 MMbbl build in total US commercial crude oil inventories for the week that ended April 24. Although the nationwide build was smaller than those seen in recent weeks, the increases were concentrated in PADD 3 (up 7.2 MMbbl) and Cushing (up 3.4 MMbbl). Working storage utilization is now at 60.0% and 80.6% respectively in those locations. Meanwhile in products, total gasoline stocks fell by 3.7 MMbbl as product supplied (a proxy for demand) picked up by 549,000 bbl/d week-on-week. Distillate inventories, however, rose by 5.1 MMbbl. Total non-government petroleum inventories increased by 10.4 MMbbl.

- The Commodity Futures Trading Commission reported another increase in net managed-money long positions for NYMEX light sweet crude futures last week. Total long positions increased by 59,659 on the week to stand at 384,326 contracts, while total short positions were down by 11,229 at 65,960 contracts.

NATURAL GAS

- US Lower 48 dry natural gas production decreased 1.47 Bcf/d week that ended May 1 largely due to drops of 0.73 Bcf/d in the South Central region and 0.52 Bcf/d in the Mountain region, based on modeled flow data analyzed by Enverus. Net imports from Canada decreased 0.61 Bcf/d, as US exports to Canada picked up in the Midwest and imports to the US decreased in the Pacific Northwest, North Midcon and Northeast. Res/Com and power demand saw decreases of 5.09 Bcf/d and 0.64 Bcf/d on the week, respectively, while industrial demand gained 0.65 Bcf/d. LNG export demand decreased 0.75 Bcf/d due to decreases at Corpus Christi and Sabine Pass, while exports to Mexico fell 0.23 Bcf/d. Weekly average totals show the market dropping 2.08 Bcf/d in total supply while total demand decreased by 6.42 Bcf/d.

- The EIA storage report for the week that ended April 24 showed an injection of 70 Bcf. Total inventories now sit at 2.210 Tcf, which is 783 Bcf higher than at this time last year and 360 Bcf above the five-year average for this time of year. With the decrease in demand outpacing the decrease in supply, expect the EIA to report a stronger injection this week. The ICE Financial Weekly Index report currently predicts an injection of 94 Bcf for the week that ended May 1.

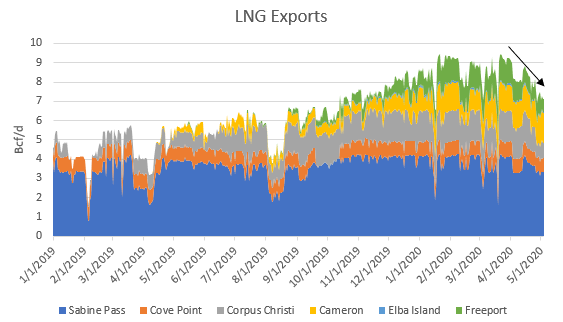

- As the crude oil industry copes with the demand hit from COVID-19 and wonders when things will get back to normal, the US LNG export industry is also feeling the hit as global demand for the liquefied gas has diminished in the last month. In late March, LNG exports reached an all-time high, with 9.44 Bcf flowing to terminals. However, demand destruction has caused reduced flows to LNG terminals, leaving the month of April averaging 8.13 Bcf/d of exports and the first four days of May showing 7.15 Bcf/d of exports. Recently, some LNG importers in Asia and Europe, including Kogas, Tokyo Gas, CNOOC, Petronas and Petronet, have announced deferrals in response to the COVID-19 demand fallout. As the world continues to get through the pandemic and begins to reopen, demand for LNG will rebound, but it will not likely return to pre-pandemic levels until at least late 2020. To learn more about how COVID-19 is impacting the crude and natural gas markets, preview Enverus’ latest FundamentalEdge report.

NATURAL GAS LIQUIDS

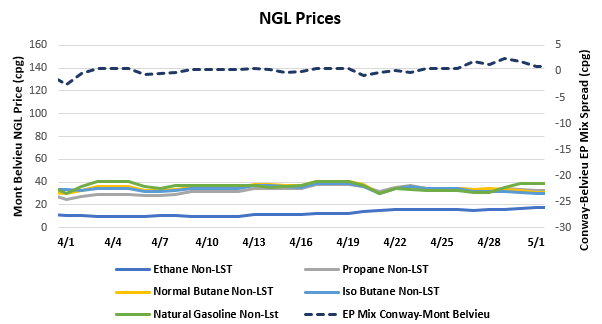

- Ethane saw another slight uptick this week, gaining $0.011/gallon to $0.164, while natural gasoline also gained week over week, jumping $0.012/gallon to $0.346. Propane saw a drop this week, falling $0.015/gallon to $0.335, while normal butane fell $0.018/gallon to $0.330 and isobutane fell $0.018/gallon to $0.310.

- The EIA reported a draw in propane/propylene stocks (excluding propylene at terminals) for the week that ended April 24, showing inventories dropping 607,000 bbl. Stocks now stand at 56.84 MMbbl, which is 3.56 MMbbl higher than the same week in 2019 and 6.65 MMbbl higher than the five-year average for this time of year. The five-year average for next week’s report shows a build of 1.45 MMbbl, while the same week last year saw a build of 926,000 bbl.

SHIPPING

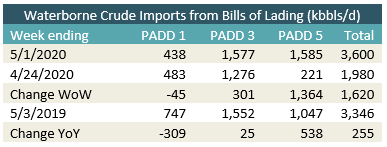

- US waterborne imports of crude oil rose last week, according to Enverus’ analysis of manifests from US Customs and Border Patrol. As of today, aggregated data from customs manifests suggested that overall waterborne imports rose by 1.620 MMbbl/d from the prior week. PADD 3 imports increased by 301,000 bbl/d and PADD 5 imports increased by 1.364 MMbbl/d. PADD 1 imports fell by 45,000 bbl/d.

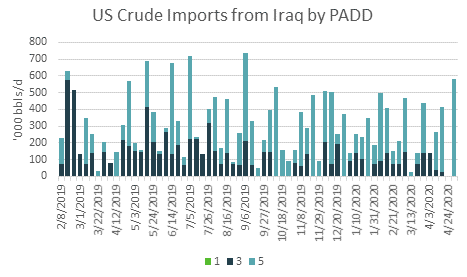

- Imports from Iraq rose last week with 580,000 bbl/d imported to PADD 5. This represents the highest overall level of imports from Iraq since the week of Sept. 13, 2019. Among these imports, Basrah Heavy was received by Chevron Richmond and Basrah Light was received by Valero Wilmington, Marathon Carson and Phillips 66 Los Angeles.