[contextly_auto_sidebar]

CRUDE OIL

- A spectacular collapse in oil prices followed last week’s disastrous OPEC+ meeting, with front-month WTI dropping $4.62/bbl Friday to settle at $41.28/bbl and subsequently opening Monday morning at $32.29/bbl. Russia refused to go along with OPEC’s plan to cut 1 MMbbl/d on the condition that non-OPEC participants to the OPEC+ deal also cut 0.5 MMbbl/d, which would have fallen mostly on Russia. In response, Saudi Aramco slashed official selling prices for its customers over the weekend.

- In what can be viewed as the opening salvo in what is now an open price war between the world’s second-largest and third-largest oil producing countries, the Saudi OSP cuts were deliberately targeted at Russia’s key export markets in an effort to pressure them back to the negotiating table. The price collapse sent the Russian ruble to its lowest level against the dollar since 2016, leading the Russian finance ministry to commit to propping up the currency by selling foreign reserves.

- Meanwhile, the International Energy Agency has made significant downward revisions to its outlook for global oil demand growth this year. Under its revised base case, the IEA now sees annual average demand growth grinding to a halt this year due to the spread of coronavirus beyond China. The IEA also sees the potential for demand growth to contract by as much as 0.73 MMbbl/d if conditions further deteriorate.

- The US Energy Information Administration last week reported a 0.8 MMbbl increase in US commercial crude inventories for the week that ended Feb. 28. Although crude was up modestly, gasoline and distillate stocks were down by 4.3 MMbbl and 4.0 MMbbl, respectively. Total petroleum inventories drew 11.9 MMbbl.

- The Commodity Futures Trading Commission reported an increase in managed-money short positions in light sweet crude futures, up 32,992 contracts on the week to stand at 114,473 contracts. Managed money long positions were also up, but by a fraction of that amount. Managed money longs in WTI futures increased by 9,049 contracts and were last reported at 224,961 contracts.

NATURAL GAS

- US Lower 48 dry natural gas production decreased 0.56 Bcf/d last week, based on modeled flow data analyzed by Enverus, largely due to production decreases of 0.40 Bcf/d in the South Central region and 0.21 Bcf/d in the Mountain region. Canadian imports decreased 0.60 Bcf/d due to fewer imports into the Northeast and Midwest. Res/Com accounted for most of the weekly demand drop week-over-week, falling 5.32 Bcf/d, while Power and Industrial demand decreased 1.68 Bcf/d and 1.00 Bcf/d, respectively. LNG export demand decreased 0.94 Bcf/d on the week largely due to fewer exports from Sabine Pass. Mexican exports gained 0.07 Bcf/d. Weekly average totals show the market dropping 1.16 Bcf/d in total supply while total demand fell by 9.14 Bcf/d.

- The storage report for the week that ended Feb. 28 showed a draw of 109 Bcf. Total inventories now sit at 2.091 Tcf, which is 680 Bcf higher than at this time last year and 176 Bcf above the five-year average for this time of year. With the decrease in demand outpacing the decrease in supply, expect the EIA to report a weaker draw next week. The ICE Financial Weekly Index report currently expects a draw of 56 Bcf for the week that ended March 6.

- Current weather forecasts for the six- to 14-day period from the National Oceanic and Atmospheric Administration’s Climate Prediction Center show normal to above-average temperatures in the eastern half of the Lower 48, while the western half of the Lower 48 shows normal to below-average temperatures.

- While the failure of OPEC+ to achieve further production cuts and the flooding of the market with Saudi crude severely impacted oil prices over the weekend, gas prices remained steady. At the time of writing, the April 2020 contract was trading at $1.705/MMbtu, in line with where prices closed on Friday. Oil prices are now hovering around $33/bbl, a price that would put most crude-focused areas in the Lower 48 out of the economic window for operators to drill, without hedges in place. Should the market see these prices for an extended period of time, it could ultimately prop up gas prices as associated gas production would likely decline.

NATURAL GAS LIQUIDS

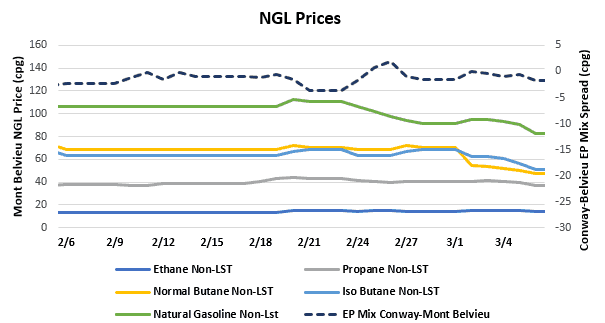

- Purity product prices were mostly down last week. Ethane was the only product that didn’t see declines and remained flat on the week. Propane saw a drop of $0.009/gallon to $0.396, normal butane fell $0.071/gallon to $0.516, isobutane was down $0.029/gallon to $0.586, and natural gasoline was down $0.071/gallon to $0.913. The losses in purity products are mostly associated with the declines in crude.

- The EIA reported a 3.62 MMbbl draw of propane/propylene stocks for week that ended Feb. 28. Stocks now stand at 69.95 MMbbl, which is 18.58 MMbbl higher than the same week in 2019 and 18.79 MMbbl higher than the five-year average. The five-year average draw for next week’s report is 1.26 MMbbl, while last year saw a draw of 1.21 MMbbl.

SHIPPING

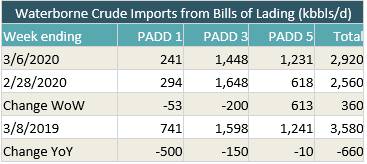

- US waterborne imports of crude oil rose last week, according to Enverus’ analysis of manifests from US Customs and Border Protection. As of this morning, aggregated data from customs manifests suggested that overall waterborne imports increased by 360,000 bbl/d on the week. PADD 5 imports rose by 613,000 bbl/d. PADD 1 fell by 53,000 bbl/d while PADD 3 fell by 200,000 bbl/d.

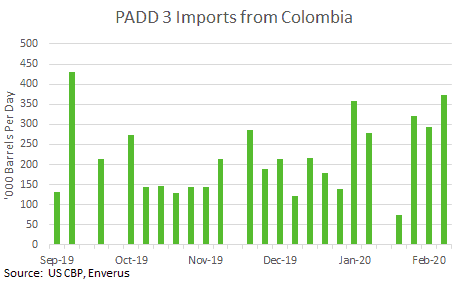

- PADD 3 imports of Colombian crude rose to their highest levels since September with cargoes of Castilla Blend being received by Citgo Corpus Christi, Enterprise’s Houston Ship Channel terminal and Semgroup’s Houston Ship Channel terminal. Citgo Lake Charles received a cargo of Vasconia.