[contextly_auto_sidebar]

CRUDE OIL

- Talk of $10-$15/bbl crude oil is permeating conversations among traders and market analysts as prompt WTI treads water just below $22.50/bbl. Given the inability of non-OPEC production to respond quickly to the precipitous drop in global oil demand just as Saudi Arabia and others ramp up production, inventory builds in April and May are expected to be historically unrivaled in both the size and the speed at which they develop.

- Stepped-up quantitative easing announced by the Federal Reserve this morning is certainly a welcome development, but Congress also needs to act swiftly and produce a stimulus package that will support systemically important industries as well as households reeling from the sharp increase in layoffs. Doing so may not mitigate the drop in petroleum demand today or in the next two months, but it will head off potential lasting damage to the real economy and therefore allow demand to recover later this year.

- The Energy Information Administration last Wednesday reported that total US commercial crude inventories increased by 2 MMbbl the week that ended March 13. Meanwhile, principal products gasoline and distillate fuel oil posted draws of 6.2 MMbbl and 2.9 MMbbl, respectively. Refinery crude runs dipped slightly from 15.8 MMbbl/d to 15.7 MMbbl/d and are expected to trend lower in the coming weeks as refiners respond to the drop in finished product demand resulting from state-led efforts to contain the spread of novel coronavirus.

- The Commodity Futures Trading Commission reported last week a net increase of 11,383 contracts in managed-money NYMEX WTI futures positions. This came as speculators reduced short positions to a tune of 37,003 contracts. Managed-money long positions also declined week-on-week, but by only 25,620 contracts.

NATURAL GAS

- US Lower 48 dry natural gas production increased 0.93 Bcf/d last week, based on modeled flow data analyzed by Enverus, mainly due to increases in the South Central and East regions, which increased 0.57 Bcf/d and 0.31 Bcf/d, respectively. Canadian net imports increased 0.52 Bcf/d due to fewer exports from the Midwest and increased imports in the Pacific Northwest. Res/Com accounted for most of the weekly demand gain week-over-week, adding 2.47 Bcf/d, while power and industrial demand gained 1.82 Bcf/d and 0.04 Bcf/d, respectively. LNG export demand decreased 0.35 Bcf/d on the week, while Mexican exports were flat. Weekly average totals show the market gaining 1.45 Bcf/d in total supply while total demand jumped up by 4.14 Bcf/d.

- The storage report for the week that ended March 13 showed a draw of 9 Bcf. Total inventories now sit at 2.034 Tcf, which is 878 Bcf higher than at this time last year and 281 Bcf above the five-year average for this time of year. With the increase in demand outpacing the increase in supply, expect the EIA to report a stronger draw next week. The ICE Financial Weekly Index report currently predicts a draw of 21 Bcf for the week that ended March 20.

- Current weather forecasts for the six- to 10-day period from the National Oceanic and Atmospheric Administration’s Climate Prediction Center show normal to above-average temperatures throughout the Lower 48, except for the West Coast where below-average temperatures are expected. In the eight- to 14-day forecast, the warmer temperatures extend to the West Coast, resulting in an above-average forecast for the entire Lower 48. With the market being in shoulder season, the above-average temperatures don’t have too much impact on demand, as it’s not hot enough to cause significant cooling demand.

- The bullish sentiment for natural gas as a result of the OPEC+ production cuts falling apart hasn’t taken hold in the market. Natural gas prices have traded between $1.60 and $2.00 since the news and broke below that range in early trading yesterday, falling as low as $1.519. At the time of writing, the April 2020 contract was trading at $1.593. However, with numerous companies announcing less ambitious drilling plans in 2020 because of poor oil economics, associated gas production is expected to decline throughout the year. Some of the associated gas that would normally fall off at current price levels will still hit the market, as operators have hedges in place and will continue to produce. As operator hedges roll off, liquids storage begins to fill, and the market still sees poor production economics, operators will stop completing oil-directed wells and associated natural gas production will decline. This will likely lead to higher natural gas prices to incentivize completing wells in gas-directed areas, as demand still needs to be met.

NATURAL GAS LIQUIDS

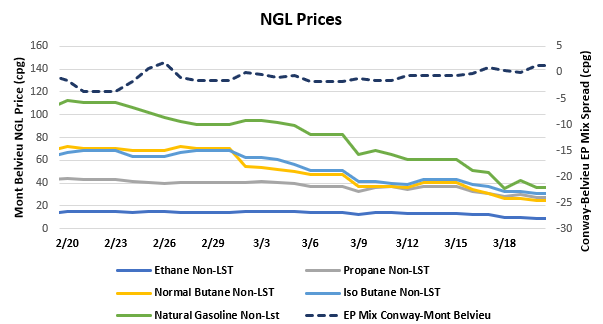

- NGL prices saw declines week-over-week as crude oil prices continued to drop. Ethane fell $0.030/gallon to $0.108, propane declined $0.057/gallon to $0.296, normal butane fell $0.089/gallon to $0.286, isobutane fell $0.065/gallon to $0.342, and natural gasoline fell $0.214/gallon to $0.430.

- The EIA reported a draw of propane/propylene stocks for week that ended March 13, showing inventories decreasing 301,000 bbl. Stocks now stand at 66.73 MMbbl, which is 15.62 MMbbl higher than the same week in 2019 and 16.93 MMbbl higher than the five-year average. The five-year average draw for next week’s report is 344,000 bbl, although the same week last year saw a build of 527,000 bbl.

SHIPPING

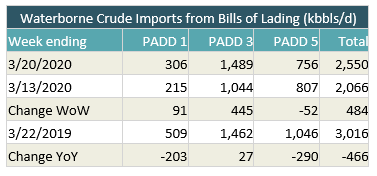

- US waterborne imports of crude oil rose last week, according to Enverus’ analysis of manifests from US Customs and Border Protection. As of this morning, aggregated data from customs manifests suggested that overall waterborne imports increased by 484,000 bbl/d from the prior week. PADD 1 imports rose by 91,000 bbl/d and PADD 3 imports rose by 445,000 bbl/d. PADD 5 imports fell by 52,000 bbl/d.

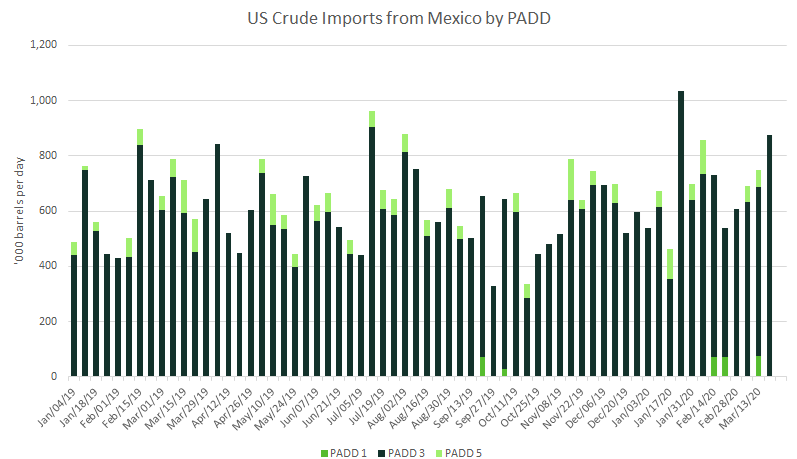

- Crude imports from Mexico rose to 877,000 bbl/d, all of which was brought into PADD 3. That’s the highest level since the week of Jan. 24. The majority of the barrels were Maya; however, some Isthmus crude was received by Total Port Arthur and Valero Corpus Christi.