[contextly_auto_sidebar]

CRUDE OIL

- US crude oil inventories increased 1.2 MMbbl the week that ended Jan. 3, according to last week’s report from the US Energy Information Administration. Gasoline inventories increased 9.1 MMbbl while distillate inventories increased by 5.3 MMbbl. Total petroleum inventories posted a very large increase of 14.8 MMbbl. US crude oil production was flat from the previous week, while crude oil imports rose 0.38 MMbbl/d to 6.7 MMbbl/d.

- Crude oil prices sharply reversed direction before the inventory report was released last Wednesday. Prices had been consolidating higher until that morning, including a sharp spike in afterhours trading Tuesday on news of an Iranian missile attack against US forces in Iraq. However, by Wednesday morning it was apparent that Iran deliberately sought to avoid US and Iraqi casualties. There were also reports that Iran gave the Iraqi government forewarning of the attack. Although the American ballistic missile early warning system gave US forces in Iraq adequate time to prepare, many interpreted Iran’s communications with Iraq as a sign that the attacks were mainly for show. Both the US and Iran declared victory the following morning, apparently deciding to de-escalate tensions for the time being. Without a major risk of war or supply disruption in the Middle East, crude oil futures went back to trading in line with fundamentals.

- As recently stated in Enverus’ monthly Fundamental Edge report, the global supply-demand balance for petroleum liquids in Q1 is oversupplied. Geopolitical risks to supply may still return, and the accidental downing of a civilian airliner by Iranian air defenses last Wednesday is going to have consequences. However, those consequences are going to come in the form of tougher economic sanctions and not pose a significant risk to Middle Eastern crude flows in the same way that a war between the US and Iran would have done.

- The Commodity Futures Trading Commission report released last Monday for positions on Dec. 31, which was delayed due to the New Year’s Day holiday, showed gains in the Managed Money long position, which increased by 6,370 contracts. The following CFTC report last Friday, showing positions on Jan. 7, had the Managed Money long positions adding 8,873 contracts. Combined, the two reports showed the Managed Money short sector reducing positions by 1,564 contracts.

- Market internals flipped to a neutral to bearish bias after the weak retaliation by Iran took the wind out of the bullish action of the previous weeks. The correction off the high of $65.65 occurred with higher volume and a gain in open interest, flipping the bias.

- The WTI market showed a bearish reversal off of the mid-week highs. Declines should moderate, and the market should consolidate in the previous range between $55.00 on the low side and $62.50 on the high end, short of any additional conflicts with Iran.

NATURAL GAS

- US Lower 48 dry natural gas production decreased 0.40 Bcf/d last week, based on modeled flow data analyzed by Enverus, while Canadian imports increased 0.54 Bcf/d. Demand was up across the board, increasing 4.03 Bcf/d in the Res/Com sector, 1.57 Bcf/d for power, 0.39 Bcf/d for industrial, 0.06 Bcf/d for LNG export and 0.33 Bcf/d for exports to Mexico. Overall, the market saw a 0.14 Bcf/d increase in total supply and total demand gaining 6.55 Bcf/d.

- The EIA storage report last week showed a bearish withdrawal of 44 Bcf, below the market expectation of a 52 Bcf draw. Total inventories are now 521 Bcf higher than at this time last year and 74 Bcf above the five-year average for this time of year. Current weather forecasts from the National Oceanic and Atmospheric Administration show a shift in the coming week to below-normal temperatures in the upper Midwest and normal temperatures south of Kansas. These colder expectations expand into the entire US in the eight-day to 14-day forecast.

- The CFTC report released last Monday, showing positions on Dec. 31, had an increase of just 632 contracts in the Managed Money short position while the Managed Money long position increased by 4,759 contracts. The following report, released last Friday with positions as of Jan. 7, showed the short sector rebounding with an increase of 24,673 contracts. Interestingly, the Managed Money long position was also more active with an increase of 15,295 contracts, suggesting that a base may be building for the speculative bulls.

- The market internals flipped to a neutral bias as prices rallied after the bearish storage release. Prices gained on the week with increasing open interest and a significant gain in volume, settling on Friday just off the highs at $2.202.

- Although the market tried to break down last week on the storage data, it ran into significant buying below $2.10. Prices have not been able to break below this area and challenge the August low of $2.029, regardless of the bearish fundamental data. Looking forward, rallies will need to break above the $2.258-$2.297 range to force the large short interest to start covering positions. As for the shorts, they will need a flip in forecasts to find the strength to challenge the lows from August, as the last three attempts have fallen short of the breakdown.

NATURAL GAS LIQUIDS

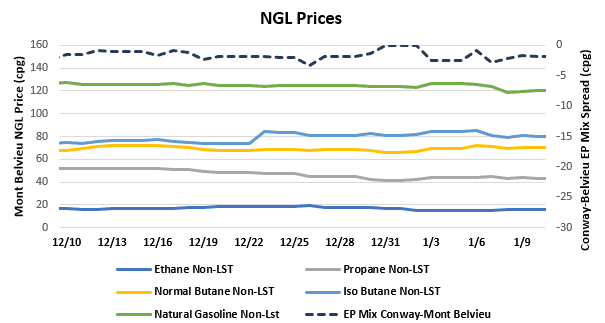

- NGL price movement was mixed last week. Ethane saw a drop of $0.006 to average $0.157/gallon for the week, while isobutane fell $0.009 to $0.813/gallon and natural gasoline dropped $0.026 to $1.217/gallon. Propane saw an increase on the week, gaining $0.014 to reach $0.438/gallon, while normal butane also gained $0.034 to average $0.706/gallon.

- Propane closed higher on Jan. 3, and those gains carried into last week. Trading was between $0.433 and $0.446 for the week, closing last Friday at the lower end of the range. Butane opened the week stronger on international strength, but these gains could not hold, and pricing fell to the week’s lows by mid-week. Butane prices showed a slight rally to rebound off those lows toward the end of the week.

- The EIA reported an unseasonable build in propane/propylene stocks for week ending Jan. 3, with inventories gaining 699,000 bbl. Stocks now stand at 88.89 MMbbl, which is 20.15 MMbbl higher than the same week in 2019 and 27.20 MMbbl higher than the same week in 2018.

SHIPPING

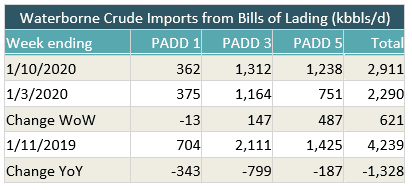

- US waterborne imports of crude oil rose last week, according to Enverus’ analysis of manifests from US Customs and Border Patrol. As of today, aggregated data from customs manifests suggests that overall waterborne imports rose by more than 620,000 bbl/d from the previous week. The increase was driven by PADD 5, where waterborne imports jumped by 487,000 bbl/d. PADD 3 imports also rose, by 147,000 bbl/d, while PADD 1 imports fell by 13,000 bbl/d.

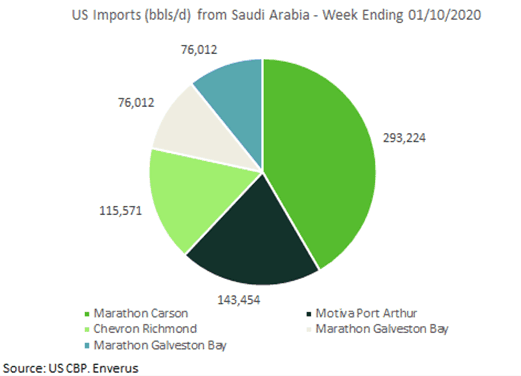

- US crude imports from Saudi Arabia hit 628,000 bbl/d for the week, the highest level of crude shipments from the kingdom since the week of Sept. 20. Marathon Petroleum’s Carson refinery received the highest portion of those Saudi imports, while Motiva Port Arthur and Chevron Richmond rounded out the Top Three. Chevron Richmond was the largest importer of Saudi crude in 2019, surpassing Saudi Aramco-owned Motiva Port Arthur.