[contextly_auto_sidebar]

CRUDE OIL

- Crude oil futures continued their downward slide last week, with March WTI opening last Monday at $53.70/bbl and settling Friday at $52.92/bbl. Front month WTI opened lower this morning at $51.01/bbl. Coronavirus concerns continue to dominate the headlines and market participants are bracing for a sharp slowdown in refined product demand as China takes aggressive efforts to contain the spread of the disease and countries around the world impose restrictions on air travel from China. OPEC and allied non-OPEC countries have been discussing further production cuts on top of the ones recently agreed upon in December. So far discussions center around a supplemental 500,000 bbl/d cut, but nothing has been written in stone yet. If the OPEC+ Joint Technical Committee decides action is required, an extraordinary OPEC+ ministerial meeting could be called in mid-February, according to recent reports.

- The US Energy Information Administration reported last week that US crude oil stocks were up 3.5 MMbbl for the week that ended Jan. 24. Gasoline stocks increased by 1.2 MMbbl and distillates posted a modest draw of 1.3 MMbbl. Total petroleum inventories, excluding the Strategic Petroleum Reserves, were up by 1 MMbbl.

- The Commodity Futures Trading Commission reported a decrease in Managed Money net length in NYMEX WTI futures. Long positions stood at 264,171 contracts, down by 27,701 from the prior week’s report, and short positions saw in increase of 37,536 to 85,712 contracts. The ratio of Managed Money longs to shorts in NYMEX WTI futures hit 12:1 in mid-December, but has since dropped to 3:1 as market sentiment turned decidedly bearish.

NATURAL GAS

- US Lower 48 dry natural gas production increased 0.37 Bcf/d last week, based on modeled flow data analyzed by Enverus, while Canadian imports decreased by 0.37 Bcf/d. The major demand components all saw decreases, with Res/Com demand down 6.41 Bcf/d, power down 2.12 Bcf/d and industrial demand down 0.64 Bcf/d. However, LNG exports increased by 0.80 Bcf/d due to export recoveries at Sabine Pass and Cove Point, while exports to Mexico increased by 0.49 Bcf/d as maintenance on Valley Crossing was completed. Weekly average totals show the market flat in total supply while total demand decreased by 8.21 Bcf/d on the week.

- The EIA storage report for week that ended Jan. 24 showed a draw of 201 Bcf, slightly lower than the anticipated 204 Bcf withdrawal. Total inventories now sit at 2.746 Tcf, which is 524 Bcf higher than at this time last year and 193 Bcf above the five-year average for this time of year. Based on the supply and demand economics from last week, expect the EIA to report a weaker draw this week. The current expected draw for week that ended Jan. 31 is 131 Bcf, according to the ICE Financial Weekly Index report.

- Weather forecasts for the next 6 to 14 days from National Oceanic and Atmospheric Administration’s Climate Prediction Center show above-average temperatures from Texas all the way up the East Coast, while regions from the northern Midcontinent to the West Coast should experience below-average temperatures.

- The February contract took over as prompt trading at $2.186/MMbtu but couldn’t gain any traction throughout January. The contract closed last week at $1.877, the lowest close for a February contract since at least 2012. The March contract began trading as prompt at $1.829, and at the time of writing was trading between $1.81 and $1.82. This level of trading for a prompt month March contract is the lowest since 2016, when it traded in a range of $1.711 to $2.152 and ultimately closed at the low end of that range.

NATURAL GAS LIQUIDS

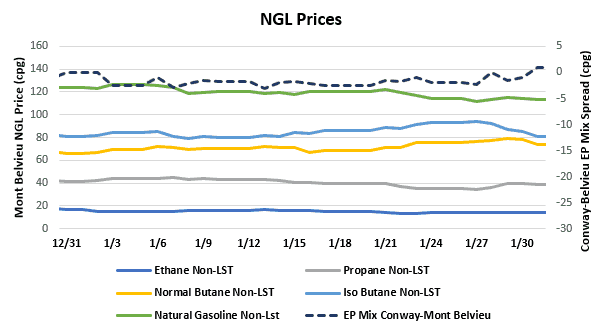

- Ethane prices saw another decrease last week, falling by $0.002 to $0.139/gallon, while isobutane fell $0.015 to $0.880/gallon and natural gasoline fell $0.050 to $1.137/gallon. Propane saw a slight increase, climbing $0.006 to reach $0.377/gallon, while normal butane gained $0.045 to $0.770/gallon.

- Ethane continues its declines with natural gas, while butane is being supported by strong blending and export demand. Natural gasoline fell to open the week on declines in crude and remained lower throughout the week.

- The EIA reported a draw in propane/propylene stocks for week that ended Jan. 24, showing inventories falling 3.62 MMbbl. Stocks now stand at 82.89 MMbbl, which is 22.73 MMbbl higher than the same week in 2019 and 17.11 MMbbl higher than the five-year average. The five-year average draw for next week’s report is about 4 MMbbl, while last year saw a draw of 2.64 MMbbl.

SHIPPING

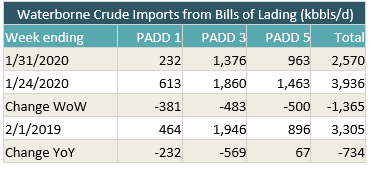

- US waterborne imports of crude oil fell last week, according to Enverus’ analysis of manifests from US Customs and Border Patrol. As of today, aggregated data from customs manifests suggests that overall waterborne imports fell by more than 1.35 MMbbl/d from the prior week. The decrease was seen across the board: PADD 1 imports fell by 381,000 bbl/d, PADD 3 by 483,000 bbl/d, and PADD 5 by 500,000 bbl/d.

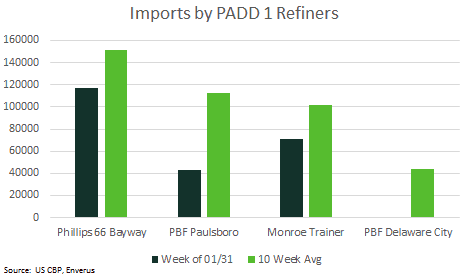

- The overall level of PADD 1 imports was 232,000 bbl/d. That is the second-lowest level since 2017 with only the week of Nov. 29, 2019, coming in lower. Imports to Phillips 66’s Bayway refinery were down by 117,000 bbl/d from the past three months’ average of 175,000 bbl/d. Imports to PBF Energy’s Paulsboro refinery were about 43,000 bbl/d, down from the more than 135,000 bbl/d that refinery has been averaging. Delta Air Lines’ Trainer refinery imported 71,000 bbl/d, down from its three-month average of 95,000 bbl/d. PBF’s Delaware City refinery did not import any crude; it has been averaging more than 40,000 bbl/d.