[contextly_auto_sidebar]

CRUDE OIL

- Prompt WTI futures struggled to tread water just above $50/bbl last Friday after Russia said it would need more time to formulate its position vis-à-vis the proposed 600,000 bbl/d of additional OPEC+ production cuts. The coronavirus outbreak in China has led to a major reassessment of global supply/demand fundamentals, with all eyes now on OPEC and allied non-OPEC countries to manage deteriorating physical market conditions. Even before the deadly coronavirus outbreak, early 2020 was set to be marked by large inventory builds. Now the situation is much more dire; deep demand destruction has prompted Chinese refiners to drastically reduce crude runs, flipping Dubai into contango last week. Although the economics are not there yet, there is increased talk of floating storage potentially making a comeback if OPEC+ fails to stem the rising tide of surplus crude.

- The US Energy Information Administration reported a 3.4 MMbbl increase in US commercial crude inventories for the week that ended Jan. 31. Of this amount, 1.1 MMbbl was in Cushing, but the overwhelming majority was in PADD 3. Although crude stocks were up, gasoline and distillate inventories drew by 0.1 MMbbl and 1.5 MMbbl respectively. Total petroleum inventories were down 0.9 MMbbl, essentially flat, versus the prior week.

- The Commodity Futures Trading Commission’s Commitments of Traders report again reflected the bearish sentiment sweeping the market. Managed-money long positions in WTI futures dropped another 14,211 contracts to stand at 249,960 for the week that ended Feb. 4. In contrast, managed-money short positions in WTI futures increased by 37,539 contracts to reach 123,251. The ratio of managed-money longs to shorts continues to narrow to 2:1, down from 3:1 a week ago and 12:1 in mid-December.

NATURAL GAS

- US Lower 48 natural gas dry production decreased 0.76 Bcf/d the week that ended Feb. 7, based on modeled flow data analyzed by Enverus, largely due to production declines in the Mountain region, while Canadian imports decreased 0.20 Bcf/d. Res/Com demand saw a decrease of 2.50 Bcf/d on the week, while Power and Industrial demand decreased 1.21 Bcf/d and 0.29 Bcf/d, respectively. LNG export demand fell 0.10 Bcf/d, while Mexican exports fell by 0.70 Bcf/d. Weekly average totals show the market dropping 0.96 Bcf/d in total supply while total demand decreased by 4.99 Bcf/d last week.

- The storage report for week that ended Jan. 31 showed a draw of 137 Bcf. Total inventories now sit at 2.609 Tcf, which is 615 Bcf higher than at this time last year and 199 Bcf above the five-year average for this time of year. Based on the supply/demand dynamics from last week, expect the EIA to report a weaker draw this week. The current expected draw for week that ended Feb. 7 is 106 Bcf, according to the ICE Financial Weekly Index report.

- Weather forecasts for the 6-to-14-day period from the National Oceanic and Atmospheric Administration’s Climate Prediction Center show below-average temperatures from the Rockies to the West Coast, while the Midcontinent region to the East Coast is expected to have above-average temperatures.

- Prices opened lower today and fell to $1.783/MMbtu at the time of writing from the Friday close of $1.858. This drop in price is largely due to weather forecasts turning warmer over the weekend. With what are typically high demand areas, such as the Northeast, having normal to above-normal temperatures through most of the winter, market oversupply has pressured prices downward.

- The CFTC report last week showed traders adding 15,667 contracts to the record-setting short position, while the long position dropped 4,147 contracts. The speculative trade continues to expect prices to decline. The next area lower to be tested is the 2016 low of $1.61.

NATURAL GAS LIQUIDS

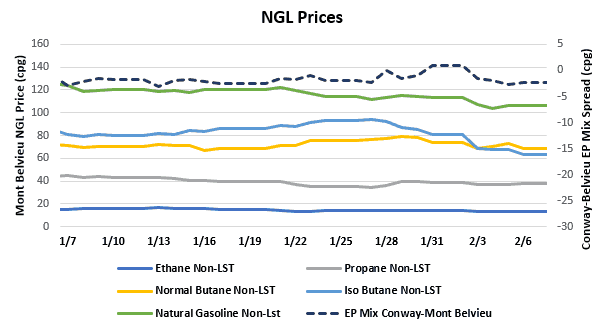

- Purity product prices were down across the board last week on a weekly average basis. Ethane prices continued to decline, falling $0.007/gallon to $0.132, while propane fell $0.002/gallon to $0.375, normal butane fell $0.071/gallon to $0.699, isobutane fell a drastic $0.215/gallon to $0.665, and natural gasoline fell $0.076/gallon to $1.061.

- The steep declines in butane and natural gasoline prices stems mainly from international pricing decreases. The coronavirus continues to disrupt Asian markets, and the impacts of the virus are being felt in US export markets.

- The EIA reported an unseasonable injection in propane/propylene stocks for the week that ended Jan. 31, resulting in a 560,000 bbl inventory jump. Stocks now stand at 83.45 MMbbl, which is 25.93 MMbbl higher than the same week in 2019 and 21.94 MMbbl higher than the five-year average. For next week, the five-year average draw would be 2.17 MMBbl, while the same week last year saw an injection of 651,000 bbl.

SHIPPING

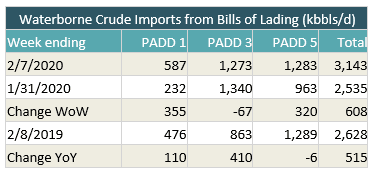

- US waterborne imports of crude oil rose the week that ended Feb. 7 according to Enverus’ analysis of manifests from US Customs and Border Patrol. As of this morning, aggregated data from customs manifests suggested that overall waterborne imports fell by more than 600,000 bbl/d from the prior week. The decrease was driven by an increase in imports to PADDs 1 and 5. PADD 1 rose by 355,000 bbl/d while PADD 5 rose by 320,000 bbl/d. PADD 3 imports fell by 67,000 bbl/d.

- Last week marked the arrival of the first cargo of Liza crude oil from offshore Guyana. The Liza Phase 1 development startup in December pumped first oil from the Stabroek block offshore Guyana, one of the world’s most important new oil and gas finds in the last 10 years. The crude, produced by ExxonMobil and partners Hess and CNOOC, was received at Exxon’s Baytown refinery. The Aframax tanker Kapten Caroq delivered the cargo, which it had received from the Suezmax Yannis P, which in turn had loaded it from the FPSO Liza Destiny in mid-January. Yannis P also appeared to be lightered by another Aframax, Leyte Spirit, and that vessel is still sitting offshore the Houston area, with a destination of Baytown. Yannis P was the first tanker to load crude from offshore Guyana for export, and it was followed by Eagle San Antonio in early February. That tanker appears destined for Chiriqui Grande, the Gulf of Mexico terminus for the Trans-Panama Pipeline. After traversing Panama, those barrels could be loaded onto a tanker for transit to the West Coast or Asia.