[contextly_auto_sidebar]

CRUDE OIL

- Front-month WTI futures settled at $52.05/bbl on Friday, breaking a five-week streak of down prices. An easing of concerns over the spread of COVID-19 has been widely cited by the trade press for the perceived increase in market optimism, but some amount of short covering likely played a role in sending futures higher later in the week given the strength of the price move last Wednesday. Near-term physical market conditions remain weak, and there are increasing reports of older VLCCs being put on time charters for use in floating storage. Meanwhile, Russia has yet to decide whether to accept the OPEC+ technical committee’s proposal to cut production by 600,000 bbl/d, and the next OPEC+ ministerial meeting is not scheduled until March 5-6. Having already taken more than week to discuss further cuts with both domestic Russian stakeholders and other non-OPEC participants in the OPEC+ agreement, a decision from the Kremlin is expected soon.

- The Energy Information Agency posted a mixed inventory report last Wednesday. Commercial crude oil inventories increased by a sizable 7.5 MMbbl for the week that ended Feb. 7, but total gasoline stocks remained relatively flat (down 0.1 MMbbl) and distillates drew by 2.0 MMbbl. Total petroleum inventories were down by 1.0 MMbbl versus the prior week, but the bulk of the draws were in propane and propylene (down 6.2 MMbbl).

- The Commodity Futures Trading Commission reported yet another drop in managed-money long positions in WTI futures last week, with the latest figure down by 13,644 contracts to 236,316. Meanwhile, managed-money short positions in WTI futures increased by 672 contracts to stand at 123,923. This represents a significant slowing in the number of new short positions versus the prior two weeks. With shorts making up a third of all managed-money futures positions and momentum waning, there is potential this week for another upward move in flat price if Russia gets off the fence in support of additional OPEC+ production cuts.

NATURAL GAS

- US Lower 48 dry natural gas production increased 0.81 Bcf/d last week largely due to production increases of 0.62 Bcf/d in the South Central region, based on modeled flow data analyzed by Enverus, while Canadian imports increased 0.48 Bcf/d due to increased imports into the Northeast. Res/Com demand saw an increase of 5.47 Bcf/d on the week, while power and industrial demand increased 1.57 Bcf/d and 0.69 Bcf/d, respectively. LNG export demand fell 1.14 Bcf/d due to fewer shipments from Sabine Pass with maintenance on the Creole Trail pipeline and from Cameron LNG, whose Train 2 is undergoing maintenance. Mexican exports rebounded from the prior week, gaining 0.40 Bcf/d. Weekly average totals show the market gaining 1.29 Bcf/d in total supply while total demand increased by 7.27 Bcf/d last week.

- The storage report for the week that ended Feb. 7 showed a draw of 115 Bcf. Total inventories now sit at 2.494 Tcf, which is 601 Bcf higher than this time last year and 215 Bcf above the five-year average for this time of year. Based on the supply-demand dynamics from last week, expect the EIA to report a stronger draw this week for the week that ended Feb. 14. The current expectation is a 134 Bcf withdrawal, according to the ICE Financial Weekly Index report.

- Weather forecasts for the 6-to-10-day period from the National Oceanic and Atmospheric Administration’s Climate Prediction Center show below-average temperatures from the northern Midcontinent south to Texas and to the West Coast, with above-average temperatures from the Midwest to the East Coast. In the 8-to-14-day period, the below-average temperatures extend to the Midwest and above-average temperatures are only seen in the Northeast and southern Florida.

- Prices opened higher today as weather forecasts changed over the weekend to show below-average temperatures extending into the two-week forecast. This forecast change brought higher demand expectations to high-gas-usage areas in the Midwest, causing prices to increase to $1.961, at the time of writing, from Friday’s close of $1.837.

- The CFTC report last week, showing positions as of Feb. 11, had managed-money long positions dropping 25,315 contracts, while short positions dropped 10,206 contracts. Price strength continuation is possible should weather forecasts continue to show below-average temperatures in high-demand areas, but also with a short-covering rally as speculative traders begin to cover short positions. Continue to watch weather forecasts and the CFTC report to explain price swings.

NATURAL GAS LIQUIDS

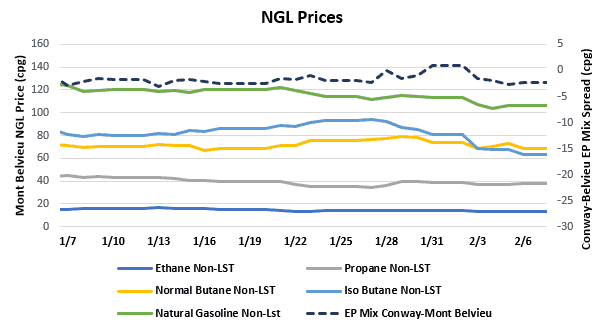

- Ethane, propane and natural gasoline saw price increases last week, while normal butane and isobutane saw declines. Ethane gained $0.001/gallon to $0.133, while propane jumped $0.006/gallon to $0.380, and natural gasoline gained $0.005/gallon to $1.065. Normal butane saw a decline of $0.011/gallon to $0.688, while isobutane fell $0.027/gallon to $0.638.

- Propane prices last week were supported by gains in crude and the EIA reporting a large inventory draw, while butane prices continue to be pressured lower with declines in gasoline blending demand.

- The EIA reported the largest draw of the winter season in propane/propylene stocks for week that ended Feb. 7, showing inventories decreasing 6.17 MMbbl. Stocks now stand at 77.27 MMbbl, which is 19.11 MMbbl higher than the same week in 2019 and 17.93 MMbbl higher than the five-year average. The five-year average draw for next week’s report would be 3.45 MMbbl, while the same week last year saw a draw of 3.57 MMbbl.

SHIPPING

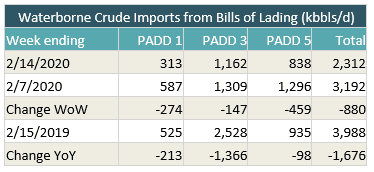

- US waterborne imports of crude oil fell last week according to Enverus’ analysis of manifests from US Customs and Border Patrol. As of this morning, aggregated data from customs manifests suggested that overall waterborne imports fell by more than 800,000 bbl/d from the prior week with decreases in PADDs 1, 3 and 5. PADD 5 accounted for more than half of the overall decrease with a drop of 459,000 bbl/d while PADD 1 fell by 274,000 bbl/d and PADD 3 fell by 147,000 bbl/d.

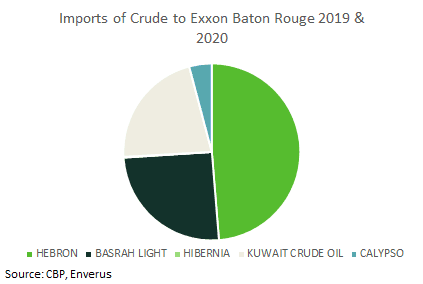

- Last week’s fire at ExxonMobil’s Baton Rouge refinery forced the shutdown of three crude distillation units, according to Reuters. The refinery is relatively independent of waterborne imports, averaging only 22,500 bbl/d of imports in 2019. Much of these imports were crudes from the Canadian Atlantic Coast, while the refinery also took some Trinidadian, Kuwaiti and Iraqi crudes.