[contextly_auto_sidebar]

CRUDE OIL

- US crude oil inventories decreased by 4.9 MMbbl the week that ended Nov. 29, according to last week’s report from the US Energy Information Administration. Gasoline inventories increased by 3.4 MMbbl and distillate inventories by 3.1 MMbbl, and total petroleum stocks were down by 4.9 MMbbl, excluding the Strategic Petroleum Reserve. US crude oil production was flat on the week, while imports were down 0.2 MMbbl/d to 6.0 MMbbl/d.

- WTI started the week firm but quiet until the inventory report was released, after which prices climbed back to the high end of the recent range. Further price support came from Chinese PMI data showing a modest expansion of manufacturing activity in November, although there are still lingering concerns about trade discussions with the US.

- On Friday, the market learned the results of the OPEC+ meeting, including the announcement that the group would cut production by an additional 500,000 bbl/d until March. At first the news was met with some skepticism, as it simply brought the group’s production target in line with recent levels. Then Saudi Arabia’s Energy Minister, Prince Abdulaziz bin Salman, announced that the Saudis would continue the voluntary cut of 400,000 bbl/d, bringing the total supply cut implemented by OPEC+ to 2.1 MMbbl/d. It should be noted that the prince warned that the voluntary cuts were conditional on other OPEC countries meeting their own production targets in full.

- The Commodity Futures Trading Commission reported on Monday and Friday for trading over the previous two weeks. While the Monday report, dated Nov. 26, showed a decline of 39,587 contracts by the Managed Money short sector, this position was reversed by an increase of 27,200 contracts in the Friday report, dated Dec. 3. Net transactions fell by 12,387 contracts. The Managed Money long positions ended up relatively flat by gaining 31,530 contracts in the report dated Nov. 26 only to liquidate 30,798 contracts on the report dated Dec. 3.

- Market internals developed a distinctly bullish bias going into this week as the rally on Friday was accompanied with higher volume and gaining open interest. The high end of the recent range was expanded Friday from $58.68 to $59.85. The bullishness at the close of Friday is likely to spur more buying, bringing potential into play next week for a test of the July high of $60.94 or even the September highs in the $62.59-$63.38 range. Should the market take a more constructive view by consolidating the news and gains of last week, any retracement down to $55-$56 will find buyers.

NATURAL GAS

- US Lower 48 dry natural gas production decreased 0.53 Bcf/d last week, based on modeled flow data analyzed by Enverus, with the declines coming primarily from the Rockies. Canadian imports increased by 0.56 Bcf/d.

- Demand increased across all sectors, led by Res/Com with a 4.81 Bcf/d rise. Power demand increased by 2.24 Bcf/d and industrial demand by 0.40 Bcf/d. LNG exports were flat on the week, while Mexican exports increased by 0.08 Bcf/d. Overall, these events resulted in the market gaining 0.03 Bcf/d in total supply while total demand increased by 7.74 Bcf/d.

- The EIA storage report released last week showed a higher-than-expected withdrawal of 19 Bcf, bringing total inventories 591 Bcf higher than at this time last year and 9 Bcf below the five-year average for this time of year.

- Current weather forecasts from the National Oceanic and Atmospheric Administration show above-average temperatures for the week ahead throughout the Northeast, South-Central and Southeast US, with normal temperatures only in the upper Midwest and below-average temperatures only in the northern Rockies. The eight- to 14-day forecast has above-average temperatures throughout the central US including the Midwest and Eastern regions.

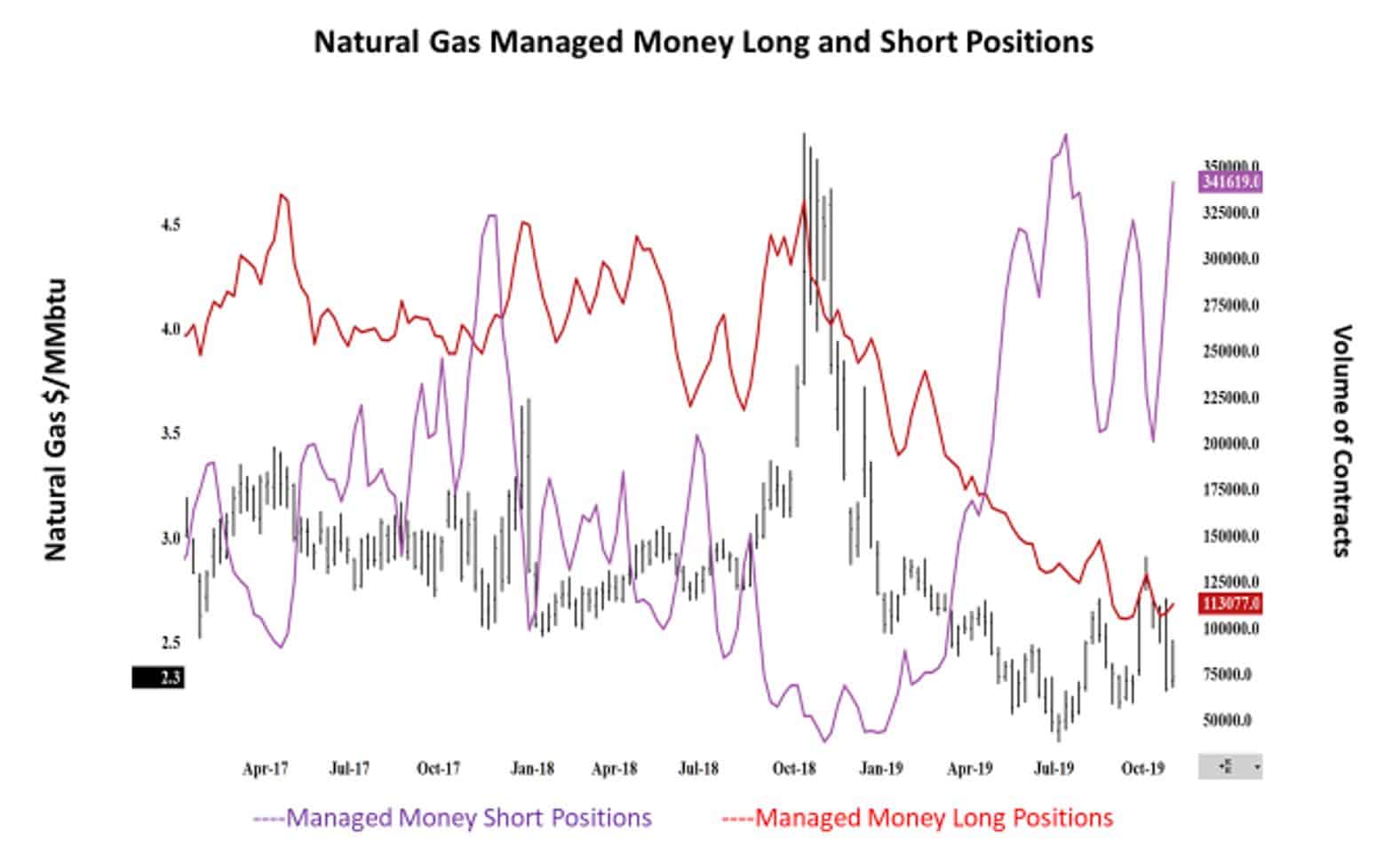

- The CFTC released reports on Monday for positions on Nov. 26 and Friday for positions as of Dec. 3, showing little change in the Managed Money long sector but a significant increase in the short sector. Managed Money short positions increased by 48,373 the week that ended Nov. 26 and then by an additional 49,874 contracts the week that ended Dec. 3. The chart below displays the extensive short position in the current market.

- While this extensive short position screams for a short covering rally that would send prices significantly higher, fundamentals (i.e. weather forecasts) continue to support additional declines.

- Market internals developed a slightly bearish bias as prices failed on the rally early last week, only to decline and break lower on significantly higher volume and higher open interest. Prices confirmed the intermediate high end of the range last week when they failed at a test of $2.51. Prices are now testing support and have opened the trade this week with a gap from last Friday. Further declines will take prices to the area of support between $2.187 and $2.159 and down to $2.12, and potential exists for an eventual break down to the August lows of $2.029.

NATURAL GAS LIQUIDS

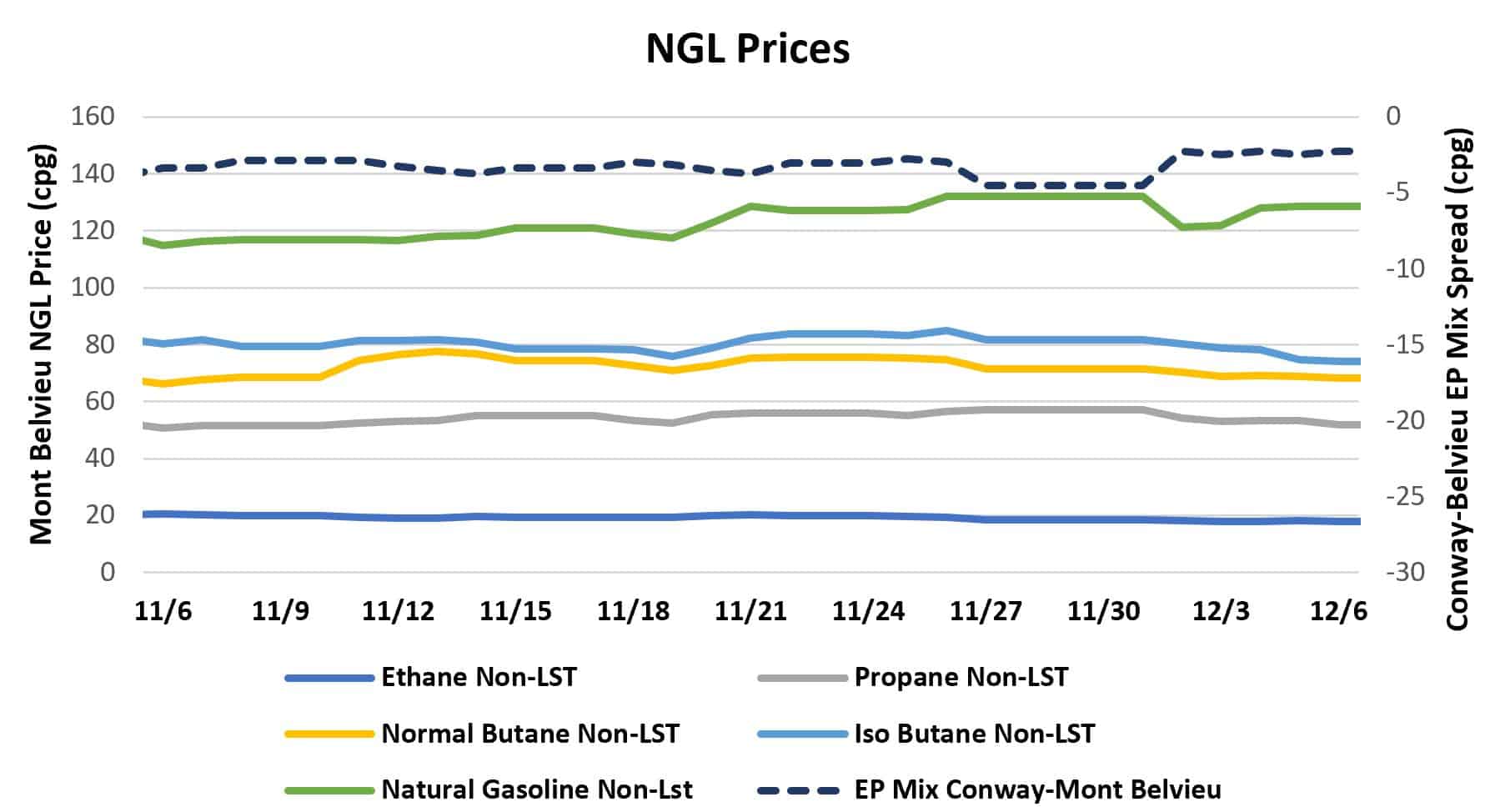

- NGL prices were down across the board last week. Ethane fell by $0.009 on the week to $0.180/gallon, propane fell $0.035 to $0.532/gallon, normal butane fell $0.039 to $0.695/gallon, isobutane fell $0.055 to $0.773/gallon, and natural gasoline fell $0.056 to $1.257/gallon.

- The EIA last week reported a 1.745 MMbbl draw in propane/propylene stocks. Propane/propylene inventories now stand at 91.8 MMbbl, which is 11.98 MMbbl higher than it was the same week in 2018 and 17.31 MMbbl higher than the same week in 2017.

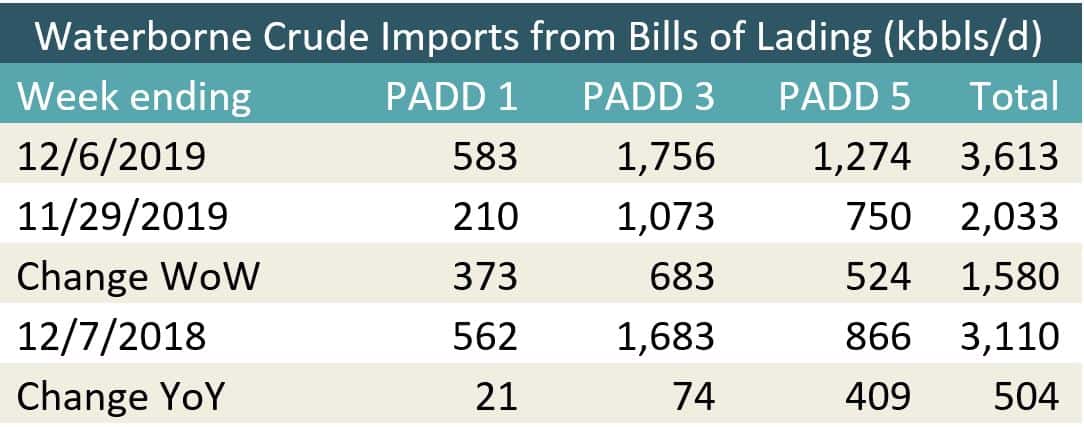

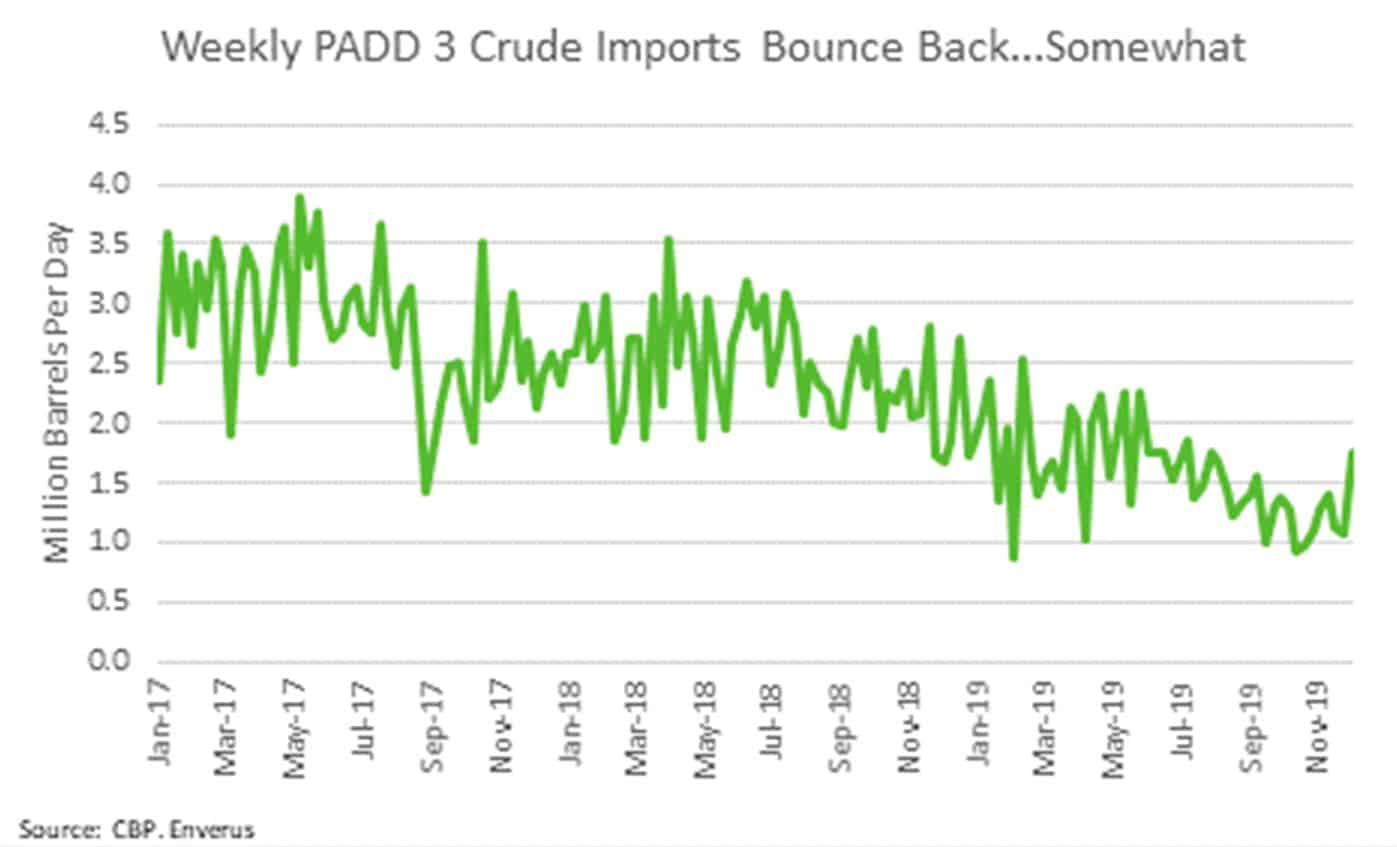

SHIPPING

- US waterborne crude imports rose last week, according to Enverus’ analysis of manifests from US Customs and Border Patrol. As of today, aggregated data from customs manifests suggested that overall waterborne imports increased by more than 1.5 MMbbl/d from the prior week. The large increase was driven by higher imports across all PADDs. PADD 1 increased by nearly 375,000 bbl/d, PADD 3 increased by more than 680,000 bbl/d, and PADD 5 increased by nearly 525,000 bbl/d. At nearly 1.76 MMbbl/d, PADD 3 imports are at their highest level since the week of July 12.

- Driving the increase were higher imports from Iraq and Colombia. Imports from Iraq were over 500,000 bbl/d, their highest level since the week of Oct. 11, with the majority of these barrels going to PADD 5. More than 200,000 bbl/d of Iraqi crude wound up in PADD 3, something that hadn’t happened for the previous two weeks. ExxonMobil took nearly 500,000 bbl of Basrah Heavy to Baytown, while Chevron imported nearly 1 MMbbl to Pascagoula. Imports from Colombia hit their highest level since mid-September after no imports from Colombia were recorded the previous week.