[contextly_auto_sidebar]

CRUDE OIL

- US crude oil inventories decreased by 5.5 MMbbl according to last week’s report from the US Energy Information Administration. Gasoline inventories increased 2.0 MMbbl while distillate inventories decreased 0.2 MMbbl. Total petroleum inventories posted a substantial decrease of 10.2 MMbbl. US crude oil production increased 100,000 bbl/d on the week, while crude oil imports were up 0.23 MMbbl/d to 6.8 MMbbl/d.

- Optimism is driving the WTI market, as participants believe that the Phase 1 tariff deal between the US and China and the additional production cuts promised by OPEC+ in 2020 will offset the potential surplus predicted by the International Energy Agency and other sources that forecast global inventory builds during 2020. This optimism was confirmed on Friday with the bullish declines in crude oil inventories and total petroleum inventories in the EIA’s Weekly Petroleum Report, which was released on a holiday-related delayed schedule.

- The Commodity Futures Trading Commission report was not released Friday due to the holiday; it will come out today instead. Due to the strength in prices at the beginning of last week, coupled with slight increases in daily open interest, expect the speculative trade to increase positions in the report dated Dec. 24.

- Market internals last week continued the bullish bias with the market gaining price each day of the week. Due to the holiday, total volume was lower on the gains and the total open interest declined slightly week over week.

- The WTI market continues to maintain the breakout that occurred two weeks ago. The bullish bias combined with the daily incremental gains suggests that the market wants to challenge September’s highs between $62.59 and $63.38. Any correction to the momentum will test $60, and further declines should test the low end of the recent range at $58.

NATURAL GAS

- US Lower 48 dry natural gas production increased 0.87 Bcf/d last week, based on modeled flow data analyzed by Enverus, while Canadian imports decreased by 0.86 Bcf/d. Res/Com demand fell 10.87 Bcf/d, while power and industrial demand decreased 3.15 Bcf/d and 1.67 Bcf/d, respectively. Rounding out the demand picture, LNG exports gained 0.18 Bcf/d, while Mexican exports decreased 0.65 Bcf/d. Overall, these events resulted in the market dropping 0.39 Bcf/d in total supply while total demand fell by a substantial 16.67 Bcf/d.

- The EIA storage report last week showed a withdrawal of 161 Bcf, the highest so far of this season. Total inventories are now 518 Bcf higher than at this time last year and 69 Bcf below the five-year average for this time of year.

- Current weather forecasts from the National Oceanic and Atmospheric Administration show normal temperatures in the coming week from the Mississippi River through the East with some above-average temperatures along the East Coast, while the Western US shows below-average temperatures. The eight- to 14-day forecast expands the below-normal temperatures from the West to the upper Midwest, the Northeast and New England with above-average temperatures only along the Gulf Coast.

- Judging from the price action early last week and through the January contract expiration last Friday, the delayed CFTC report being published today, for positions on Dec. 24, will likely show that the short sector rolled positions forward and may show that it covered some positions. That trend reversed with the bearish expiration of the January contract, as open interest gained on the weak expiration, with the shorts likely adding to positions.

- The market internals continue a bearish bias, especially with the expiration of January on its lows for the month as prompt. These events occurred on holiday-related lower volume and a slight decline in total open interest.

- Prices traded in a narrow weekly range again last week, just $0.159, and broke down slightly below the previous January prompt low from earlier in the month. Friday’s intra-day low of $2.138 ahead of expiration will provide buying opportunities for the new February contract this week. With the bearish forecasts moderating and providing some slight support for prices, rallies may run into selling at the highs of the last two weeks, between $2.297 and $2.377.

NATURAL GAS LIQUIDS

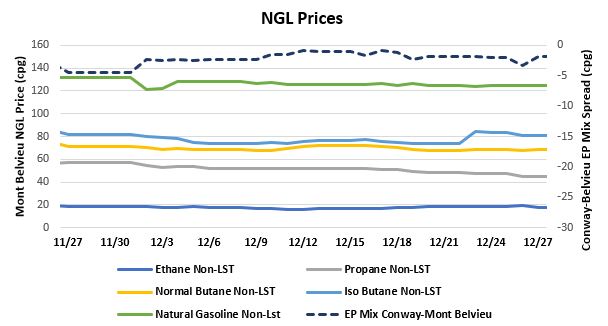

- Ethane gained 5.4% to average $0.184/gallon last week, while isobutane gained 10.0% to average $0.825/gallon. The gain in isobutane was largely attributable to international pricing strength, as well as gains in crude. Propane saw a 7.8% drop to average $0.464/gallon, normal butane fell 2.4% to average $0.685/gallon and natural gasoline fell 1.0% to average $1.245/gallon.

- The EIA reported a 2.56 MMbbl drop in propane/propylene stocks for the week that ended Dec. 20. Stocks now stand at 88.40 MMbbl, which is 16.18 MMbbl higher than the same week in 2018 and 19.76 MMbbl higher than the same week in 2017.

SHIPPING

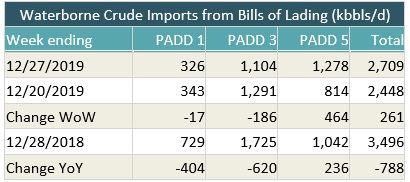

- US waterborne imports of crude oil rose last week, according to Enverus’ analysis of manifests from US Customs and Border Patrol. As of today, aggregated data from customs manifests suggests that overall waterborne imports increased by more than 250,000 bbl/d from the prior week. The increase was driven by higher imports into PADD 5, which rose by 464,000 bbl/d. PADD 1 imports fell by 17,000 bbl/d and PADD 3 imports fell by 186,000 bbl/d.

- US waterborne crude imports have averaged 2.592 MMbbl/d so far in December. That’s the lowest level since at least 2017 and likely far beyond that. The biggest decline year over year has been from Venezuela, which has fallen to zero as a result of sanctions. The second biggest decline was from Saudi Arabia. US imports from the kingdom have dropped by nearly 500,000 bbl/d from this time last year.