[contextly_auto_sidebar]

CRUDE OIL

- US crude oil inventories posted a decrease of 2.7 MMBbl last week, according to the weekly EIA report. Gasoline and distillate inventories increased 0.3 MMBbl and 2.6 MMBbl, respectively. Total petroleum inventories posted a build of 4.0 MMBbl. US crude oil production was flat versus the week prior, per EIA, while crude oil imports were up 0.49 MMBbl/d, to an average of 7.2 MMBbl/d.

- The US–China trade war and the continuous developments, both bearish and bullish, have been the main drivers for prices as of late. The dip below $55/Bbl from the previous week recovered early last week due to slight softening of the trade war. The optimism regarding a possible thaw of US–China tensions came after US President Donald Trump remarked that he would be talking with Chinese President Xi Jinping to discuss trade issues, and was furthered bolstered by the US stating it would extend a reprieve that permits China’s Huawei Technologies to buy components from US companies. The hopes that major economies around the globe will take measures to battle the economic slowdown also gave some support to prices.

- However, the support to prices from the easing US–China trade tensions was short-lived, as the sentiment reversed quickly on Friday following an announcement by China and Twitter statements from President Trump that caused a nearly 2% slump in prices. China’s commerce ministry on Friday said it would impose retaliatory tariffs on $75 billion worth of imports from the US, including a levy on crude. The announcement by China was followed by a series of Twitter posts by Donald Trump, where he said he would be imposing higher tariff rates on some Chinese imports. Trump said that the $300 billion worth of imports from China that were set to be taxed at 10% on September 1 will now be taxed at a 15% rate starting October 1, and the $250 billion worth of Chinese imports currently taxed at 25% will be taxed at 30%. The announcements by China and Trump once again increased concerns about the global economy and demand growth.

- As the market was digesting the news from Friday, US–China trade tensions took the forefront once again today, but this time supporting prices, as hopes on easing US–China tensions once again surfaced following statements by both governments. Trump on Monday said he believed China was seeking a trade deal after saying Beijing contacted US officials, while China’s top negotiator, Vice Premier Liu He, said that Beijing hopes to resolve the trade war through “calm” negotiations without escalating the tensions any further.

- The CFTC report released last week (dated August 20) showed the Managed Money long sector reduced contracts by 8,044 and the short positions covered (reduced) 18,087 contracts. The reduction by the long sector could be attributable to the worries about the trade war and gloomy economic outlook.

- Prices have been trading in the tight range of $54/Bbl to $56/Bbl the past couple of weeks, pressured by concerns about an economic slowdown and demand growth while getting some support from the rising tensions in the Middle East. The attacks on the Saudi Arabian oilfield by a Houthi group and the ongoing OPEC cuts have provided little support to prices, which shows that without a larger reduction in output from OPEC or some level of conflict occurring with Iran, price rallies (up to $61 to $64) will be sold until the tariff issues between the US and China come to some sort of solution. Further expectations and hopes on easing US–China trade issues could provide short-term support. However, due to the precarious nature of the tariff struggle, there remains the possibility of China ignoring the bans on buying Iranian crude (in place of US crude) as a retaliatory posture, likely pressuring prices below $50. This event could flood the global crude market going into an already oversupplied 2020.

NATURAL GAS

- Natural gas dry production saw an increase of 0.53 Bcf/d. Most of this gain came from the Mountain region, with gains in Colorado (+0.27 Bcf/d) and Wyoming (+0.16 Bcf/d). Canadian imports also increased on the week, gaining 0.43 Bcf/d. Total supply change for the week showed supply gaining 0.95 Bcf/d.

- Domestic natural gas demand was relatively flat on the week, gaining just 0.19 Bcf/d. This gain was led by industrial demand, which increased 0.12 Bcf/d. Res/Com showed an increase of 0.07 Bcf/d, while Power demand was flat week over week. LNG exports saw an increase of 1.26 Bcf/d, as Sabine Pass maintenance has concluded. Mexican exports also increased, gaining 0.16 Bcf/d. Total demand change for the week showed demand gaining 1.65 Bcf/d, largely due to LNG exports.

- The storage report last week showed the injections for the previous week at 59 Bcf. Total inventories are now 369 Bcf higher than last year and remain 103 Bcf below the five-year average. With the gain in demand outpacing the gain in supply last week, expect the EIA to report a weaker injection this week.

- The CFTC report released last week (dated August 20) showed the Managed Money short positions decrease their exposure by dropping 34,116 contracts, while the Managed Money long positions also decreased by 4,250 contracts.

- Cameron LNG and Freeport LNG announced the starts of train 1 at each facility last week. Cameron’s train 1 has capacity of 0.70 Bcf/d, while Freeport’s train 1 has capacity of 0.72 Bcf/d. Based on Enverus flow data since August 16, Cameron has averaged ~0.27 Bcf/d of exports, and Freeport has averaged ~0.09 Bcf/d. Elba Island has also requested in-service approval from FERC for the start-up of their first train.

- Current weather forecasts show the coming week to be cooler, before rebounding to the warmer side of normal to start September. Forecasts also show that September is expected to be on the warm side. However, above-normal temperatures heading into the last two months of summer will not likely produce large rallies, as temperatures are typically starting to decline from peak summer levels.

- As the September contract heads into expiration, history tells us to expect a rally. Although a historically bearish time of year, a rally upon expiration is a common theme. This morning and at the time of this writing, the September contract is up ~$0.073, to $2.225/MMBtu.

NATURAL GAS LIQUIDS

- This morning, Enterprise announced a binding open season on the ATEX ethane pipeline. The pipeline, which runs from the Marcellus/Utica to Mont Belvieu, could be expanded by up to 50 MBbl/d. This expansion will allow Enterprise to deliver Northeast ethane to their pet-chem facilities in Mont Belvieu. The expansion of the pipeline would hit the market by 2022.

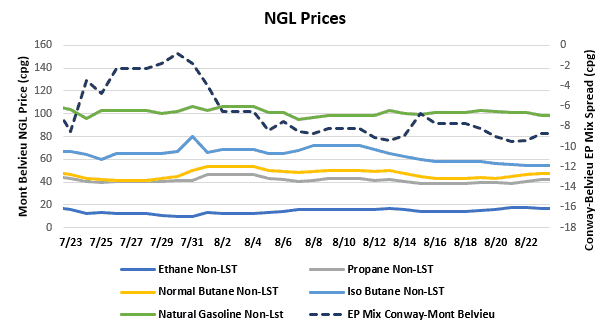

- Ethane was up $0.016 to $0.167, propane was down $0.001 to $0.402, normal butane was down $0.016 to $0.452, isobutane was down $0.070 to $0.558, and natural gasoline was up $0.007 to $1.010.

- US propane stocks increased ~3.99 MMBbl for the week ending August 16. Stocks now sit at 90.50 MMBbl, roughly 21.66 MMBbl and 18.32 MMBbl higher than the same week in 2018 and 2017, respectively.

SHIPPING

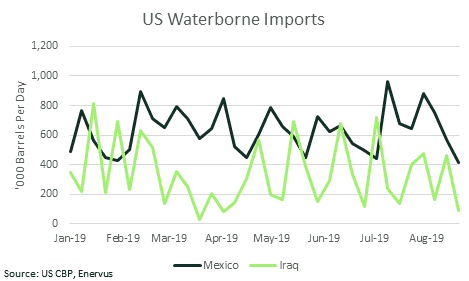

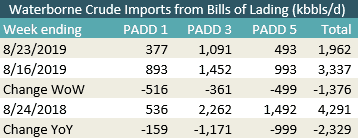

- US waterborne imports of crude oil fell for the week ending August 23 according to Enverus’ analysis of manifests from US Customs & Border Patrol. As of August 26, aggregated data from customs manifests suggested that overall waterborne imports fell by nearly 1.4 MMBbl/d from the previous week. PADD 1 imports fell by 516 MBbl/d, while PADD 3 imports fell by 361 MBbl/d and PADD 5 imports were down by nearly 500 MBbl/d. This is the lowest overall level of waterborne imports since at least 2017, and the lowest level of imports to PADD 3 since April.

- Driving the decline were lower imports from Iraq, which were at slightly more than 85 MBbl/d, the lowest since April and down by more than 250 MBbl/d from this year’s weekly average. Imports from Mexico were also down significantly, more than 225 MBbl/d lower than the average weekly imports for the year.