[contextly_auto_sidebar]

CRUDE OIL

- US crude oil inventories posted an increase of 1.6 MMBbl last week, according to the weekly EIA report. Gasoline inventories decreased 1.4 MMBbl, while distillate inventories also decreased, shedding 1.9 MMBbl/d. Total petroleum inventories posted a build of 2.4 MMBbl. US crude oil production was flat versus the week before, per EIA, while crude oil imports were up 0.57 MMBbl/d, to an average of 7.7 MMBbl/d.

- Prices finally got some bullish news early last week after taking a pounding with the announcement of an additional 10% in tariffs on $300 billion of Chinese goods, when the Trump administration announced delaying imposing the 10% tariff on certain items until December rather than September. Cellphones, laptops, and other consumer products showed an easing of the escalating trade tensions that have developed between the world’s largest economies. The market was also reassured that Saudi Arabia will do whatever it takes to support prices and is in discussion with other members to achieve this outcome. The OPEC report released on Friday confirmed that the Kingdom has reduced production 134 MBbl/d from June to July. The market is expecting the Saudis to limit exports to under 7 MMBbl/d during August and September, in an attempt to drain crude inventories. This should offer support for prices prior to the IPO of Saudi Aramco.

- The inventory release on Wednesday had a negative impact on prices, but several markets took it on the chin during the day as the 10-year and 2-year US bonds became inverted for a while (the 2-year had a higher interest rate than the 10-year). Many economists suggested this action in the debt market portends a recession in the US is coming. While history shows that a recession may occur, the timing could be between four and 22 months. Regardless, talk of a recession hit equity markets hard and lent no support for WTI.

- The crude trade has become intrinsically linked to the global economy, and concerns about global demand currently directs the trade. The Saudis will support restricting the supply side of inventories; but for prices to catch a bid, progress will have to occur in the tariff dispute between China and the US. The aforementioned OPEC report stated that the demand for OPEC crude will be lower next year than this year, and 1.3 MMBbl/d lower than 2018. Short of reaching a “deal,” the market will need to see a “truce” of some sort between the parties, thereby reducing the escalation of tariffs.

- The CFTC report released last week (dated August 16) provides a slight bullish bet, as the Managed Money long sector added 13,033 contracts and the short positions covered (reduced) 18,707 contracts. The gains by the long sector are surprising considering the collapse in price the week prior. It also indicates the level of support the market has if prices return to the $50 area again.

- Market internals shifted with the gains early in the week, to a neutral to slightly negative bias. Volume gained week over week, while open interest decreased (not surprising with expiration of September contract coming).

- Evidence is mounting that without a large reduction in output from OPEC or some level of conflict occurring with Iran, price rallies (up to $61 to $64) will be sold until the tariff issues between the US and China come to some sort of pause or solution. The market remains in a range of $50 to $61. Expect this type of environment to continue until further evidence of solutions occur. That said, due to the precarious nature of the tariff struggle, there remains the possibility of China ignoring the bans on buying Iranian crude (in place of US crude) as a retaliatory posture, likely pressuring prices below $50. This event could flood the global crude market going into an already over-supplied 2020.

NATURAL GAS

- Natural gas dry production showed a slight decrease of 0.05 Bcf/d, while Canadian imports decreased 0.32 Bcf/d.

- Res/Com demand decreased 0.02 Bcf/d, while power demand fell by 0.91 Bcf/d. Industrial demand was up slightly on the week, gaining 0.02 Bcf/d. LNG exports gained 0.06 Bcf/d on the week, while Mexican exports increased 0.01 Bcf/d. These events left the totals for the week showing the market decreasing 0.37 Bcf/d in total supply while total demand decreased by 0.86 Bcf/d.

- The storage report last week showed the injections for the previous week at 49 Bcf. Total inventories are now 357 Bcf higher than last year and remain 111 Bcf below the five-year average. Current weather forecasts, in the coming two weeks, are indicating above average temperatures on the East coast and Gulf region and Western US, with more moderating temperatures forecasted in the Central US. This represents a slightly moderating shift from the previous forecast.

- The moderation associated with the longer-term forecasts may pressure prices early this week. A lack of late-summer demand will exert more pressure on prices, as the ending inventories for storage may end well over 3.6 TCF.

- The CFTC report released last week (dated August 16) provides added emphasis of what the speculative trade is expecting for prices. The Managed Money short position increased their exposure by adding 10,502 contracts, while the Managed Money long positions decreased positions by 4,045 contracts.

- Market internals continue a bearish bias on the week as volume was slightly lower than the previous week, while total open interest also declined week over week, (according to preliminary data from the CME).

- The fundamentals may allow for some weakening of prices this week as the market heads into a historically bearish time of the year (either side of the Labor Day weekend). Nothing fundamentally has changed in the past week, and an additional test of the August lows at $2.029 should be expected, perhaps with the September contract, or with the October contract as it takes over as prompt month. Should prices for either contract break below $2.02, additional declines will push prices lower to support dating back to May ’16 between $1.952 and $1.909. Any rally will run into selling at the highs from last week at $2.267, up to the July expiration high of $2.324.

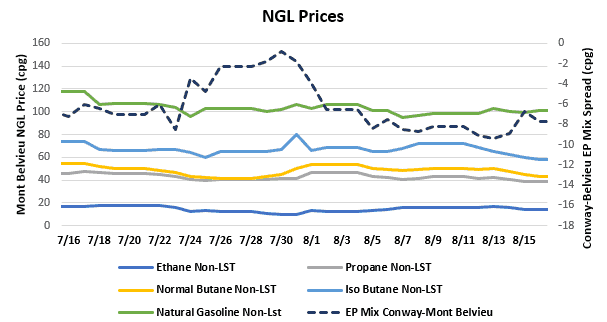

NATURAL GAS LIQUIDS

- Ethane was up $0.002 to $0.152 on the week, while propane was down $0.018 to $0.403, normal butane was down $0.025 to $0.468, isobutane was down $0.057 to $0.628, and natural gasoline was up $0.019 to $1.00.

- US propane stocks increased ~3.21 MMBbl for the week ending August 9. Stocks now sit at 86.51 MMBbl, roughly 16.73 MMBbl and 17.27 MMBbl higher than the same week in 2018 and 2017, respectively.

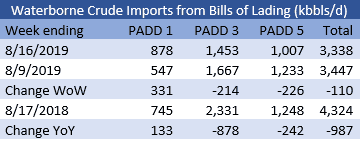

SHIPPING

- US waterborne imports of crude oil fell for the week ending August 16, according to Drillinginfo’s analysis of manifests from US Customs & Border Patrol. As of August 19, aggregated data from customs manifests suggests that overall waterborne imports fell by 110 MBbl/d from the previous week. PADD 1 imports rose by 331 MBbl/d, while PADD 3 imports fell by 214 MBbl/d and PADD 5 imports were down by more than 225 MBbl/d.

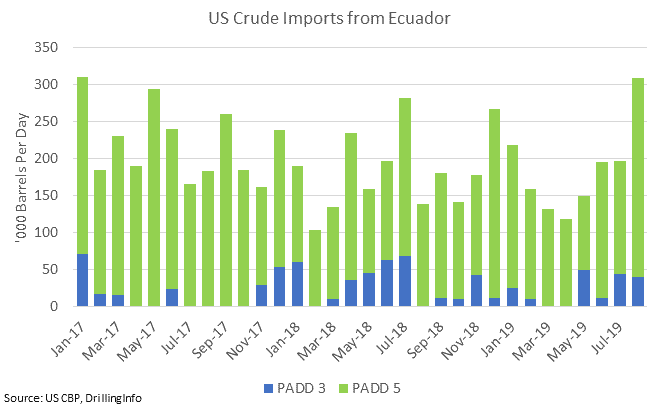

- US imports of crude from Ecuador have been elevated in August and are on pace to see the highest level since January 2017. PADD 5 is the biggest consumer of Ecuadorian crude, with Oriente being the dominant grade. The biggest difference has been imports to Valero’s Benicia refinery. That refinery has taken two cargoes of more than 300 MBbl this month, roughly double the usual imports for the refinery, which has received Ecuadorian crude each month in 2019 with the exception of March and June.