[contextly_auto_sidebar]

CRUDE OIL

- Front-month WTI futures settled at $18.27/bbl on Friday, an 18-year low. Since then, WTI has fallen to $10.85/bbl as futures converge with spot prices close to expiry. The unprecedented contraction in global oil demand threatens to fill all available storage capacity in the US, and shut-ins are already beginning to materialize. Last week the North Dakota Industrial Commission reported that 4,600 wells in the state have stopped producing since the beginning of March, equating to roughly 260,000 bbl/d of production. Further shut-ins are expected, and not just in North Dakota. Prices for some grades have hit single digits in the field, and postings for Utica condensate are now in negative territory.

- The Energy Information Administration reported another very large inventory build last week, and still more builds are expected. According to the EIA, total US commercial crude oil stocks increased by 19.2 MMbbl the week that ended April 10, with Cushing accounting for 5.8 MMbbl of the build and PADD 3 making up another 10.3 MMbbl. Total gasoline stocks were up 4.9 MMbbl, of which blending components made up 3.9 MMbbl. Distillate inventories bulged 6.3 MMbbl as demand dropped by over 1 MMbbl/d week-on-week. Overall, total US commercial petroleum stocks were up 27.2 MMbbl/d compared to the prior reported week.

- The Commodity Futures Trading Commission reported a 15,032-contract increase in net length in light sweet crude futures by money managers. Total managed-money long positions in WTI futures stood at 295,870 contracts, up 24,005 week-on-week, while short positions were reported at 100,515 contracts, a weekly increase of 8,973.

NATURAL GAS

- US Lower 48 dry natural gas production decreased 0.15 Bcf/d last week, based on modeled flow data analyzed by Enverus, while net imports from Canada increased 0.68 Bcf/d on decreased exports in the Midwest. Res/Com and industrial demand saw increases of 5.33 Bcf/d and 0.68 Bcf/d, respectively, while power demand saw a drop of 1.65 Bcf/d. LNG export demand increased 0.24 Bcf/d, while exports to Mexico fell 0.04 Bcf/d. Weekly average totals show the market gaining 0.53 Bcf/d in total supply while total demand increased by 4.68 Bcf/d.

- The EIA storage report for the week that ended April 10 showed an injection of 73 Bcf. Total inventories now sit at 2.097 Tcf, which is 876 Bcf higher than at this time last year and 370 Bcf above the five-year average for this time of year. With the increase in demand outpacing the increase in supply, expect the EIA to report a weaker injection this week. The ICE Financial Weekly Index report currently predicts an injection of 45 Bcf for the week that ended April 17.

- It’s no secret that over the past month the market has seen some trying times, and those challenges are likely to continue over the coming months. Due to revised spending plans from oil and gas companies, rigs have been falling off the map, dropping from 794 rigs on March 18 to 498 rigs on April 18. Every basin in the country has seen rigs lay down; however, the gas-heavy Appalachian Basin has held the strongest, falling just 12.8% over the last month while other basins averaged about a 45% drop. The basin has seen some declines in production based on pipeline nominations, but these declines have been consistent since the production peak in late 2019. We continue to monitor pipeline nominations closely for evidence of shut-ins or additional declines in reaction to the COVID-19 pandemic.

NATURAL GAS LIQUIDS

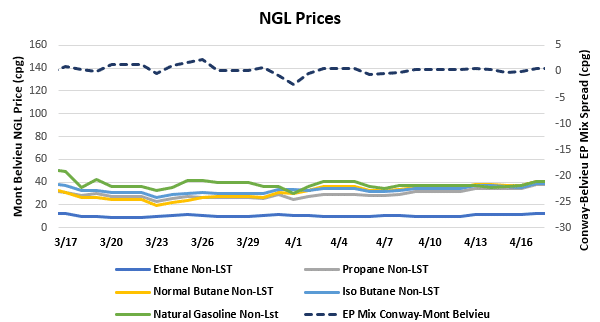

- Purity product pricing was up across the board last week. Ethane saw a gain of $0.014/gallon to $0.117, propane increased $0.055/gallon to $0.352, normal butane jumped $0.045/gallon to $0.381, isobutane gained $0.041/gallon to $0.368, and natural gasoline increased $0.009/gallon to $0.372.

- While NGL prices remain low, gains were seen over the last week. Propane and butane saw prices climb last week as international demand saw an uptick for both products. Natural gasoline did gain slightly week-over-week, but it is still in a battle due to the lack of demand for the product. Natural gasoline demand has fallen as COVID-19 has spread across the world. The lack of gasoline consumption due to travel shutdowns has put severe downward pressure on C5. Additionally, C5 is used as a diluent in heavier Canadian crude production. Similar to the US, Canadian production is expected to decline in the current market environment, meaning less demand for natural gasoline as a diluent.

SHIPPING

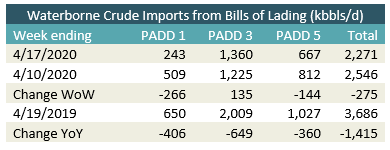

- US waterborne imports of crude oil fell last week, according to Enverus’ analysis of manifests from US Customs and Border Patrol. As of today, aggregated data from customs manifests suggests that overall waterborne imports fell by 275,000 bbl/d from the prior week. PADD 1 imports decreased by 266,000 bbl/d and PADD 5 imports decreased by 144,000 bbl/d. PADD 3 imports rose by 135,000 bbl/d.

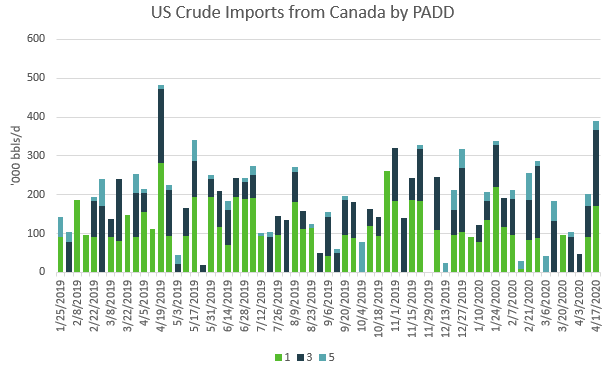

- Imports from Canada rose this week with 172,000 bbl/d imported to PADD 1, 194,000 bbl/d imported to PADD 3 and 24,000 bbl/d imported to PADD 5. This represented the highest Canadian imports since the week of April 19, 2019. Among these imports, Hebron and Hibernia were received by Phillips 66 Bayway in PADD 1 and Valero St. Charles, Valero Tule Lake and Phillips 66 Alliance in PADD 3. Synthetic crude was fed to Shell Martinez in PADD 5.