[contextly_auto_sidebar]

CRUDE OIL

- Front-month WTI futures ended last week on a low note, with the May contract settling on Thursday at $22.76/bbl compared to last Monday’s open of $26.09/bbl. This weekend’s historic OPEC+ agreement to take 9.7 MMbbl/d off the market starting May 1 was largely in line with market expectations, prompting a fairly muted price response this morning. Although any cuts to production are certainly better than none, the magnitude of global inventory builds projected for April and May is still likely to result in significant curtailments in US and Canadian production as refiners scale back throughput.

- The Energy Information Administration last Wednesday reported a 15.2 MMbbl increase in nationwide crude oil inventories for the week that ended April 3. A drop in refinery crude intake from 14.9 MMbbl/d to 13.6 MMbbl/d was the principal driver of the build, assisted by a 0.3 MMbbl/d week-on-week decrease in crude exports. Despite the sharply lower crude runs, total US gasoline inventories increased by a whopping 10.5 MMbbl as demand for the product cratered to 29-year lows. Middle distillate inventories fared better, posting a small 0.5 MMbbl build. Total petroleum stocks nevertheless increased by an astonishing 33 MMbbl, with sizable builds reported for fuel oil (1.6 MMbbl), ethanol (1.4 MMbbl), and “other oils” (3.5 MMbbl).

- The Commodity Futures Trading Commission reported an increase in managed-money long positions in NYMEX light sweet crude futures. For the week that ended April 7, managed money positions increased by 5,194 contracts to reach 271,865. Meanwhile, managed-money short positions decreased by 8,927 contracts to reach 91,542. Despite the increase in net long positions, the ratio of longs to shorts remains low at 3:1.

NATURAL GAS

- US Lower 48 dry natural gas production decreased 0.70 Bcf/d last week, based on modeled flow data analyzed by Enverus, mainly due to a 0.54 Bcf/d decrease in the South Central region, while net imports from Canada decreased 0.08 Bcf/d. Res/Com and industrial demand saw decreases of 3.06 Bcf/d and 0.23 Bcf/d, respectively, while power demand saw a gain of 1.00 Bcf/d. LNG export demand decreased 1.07 Bcf/d as flows decreased to Sabine Pass, while Mexican exports fell 0.51 Bcf/d. Weekly average totals show the market dropping 0.78 Bcf/d in total supply while total demand fell by 3.98 Bcf/d.

- The EIA storage report for the week that ended April 3 showed the first injection of the year, adding 38 Bcf to inventories. Total inventories now sit at 2.024 Tcf, which is 876 Bcf higher than at this time last year and 324 Bcf above the five-year average for this time of year. With the decrease in demand outpacing the decrease in supply, expect the EIA to report a stronger injection this week. The ICE Financial Weekly Index report currently predicts an injection of 49 Bcf for the week that ended April 10.

- Current weather forecasts for the six- to 10-day period from the National Oceanic and Atmospheric Administration’s Climate Prediction Center show normal to below-normal temperatures from the Rockies through the Northeast, while above-average temps are seen along the Gulf Coast states as well as the Pacific Northwest. In the eight- to 14-day period, the above-average temperatures extend into the Southwest and the Rockies.

- The withdrawal season ended with the EIA storage report for the week that ended March 27, and inventories sat at 1.986 Tcf, well above inventory levels a year earlier. Currently the market is in shoulder season, and demand is already at a low point for the year. COVID-19 has also caused some demand loss in the market during this already-low demand period. With the demand rebound from COVID-19 not expected until the back half of the year, storage will likely get a significant prop up in the next couple of months. These early season injections, plus the above-average inventories at the end of withdrawal season, are expected to leave storage above average at the end of injection season.

- However, associated gas production is expected to decline throughout the summer as the global crude market copes with severe oversupply. So even with above-average gas inventories at the end of injection season, prices will need an uptick in the back half of the year to fulfill winter heating demand as the market recovers from COVID-19, and production will need to grow in dry gas areas to offset the expected loss in associated gas.

NATURAL GAS LIQUIDS

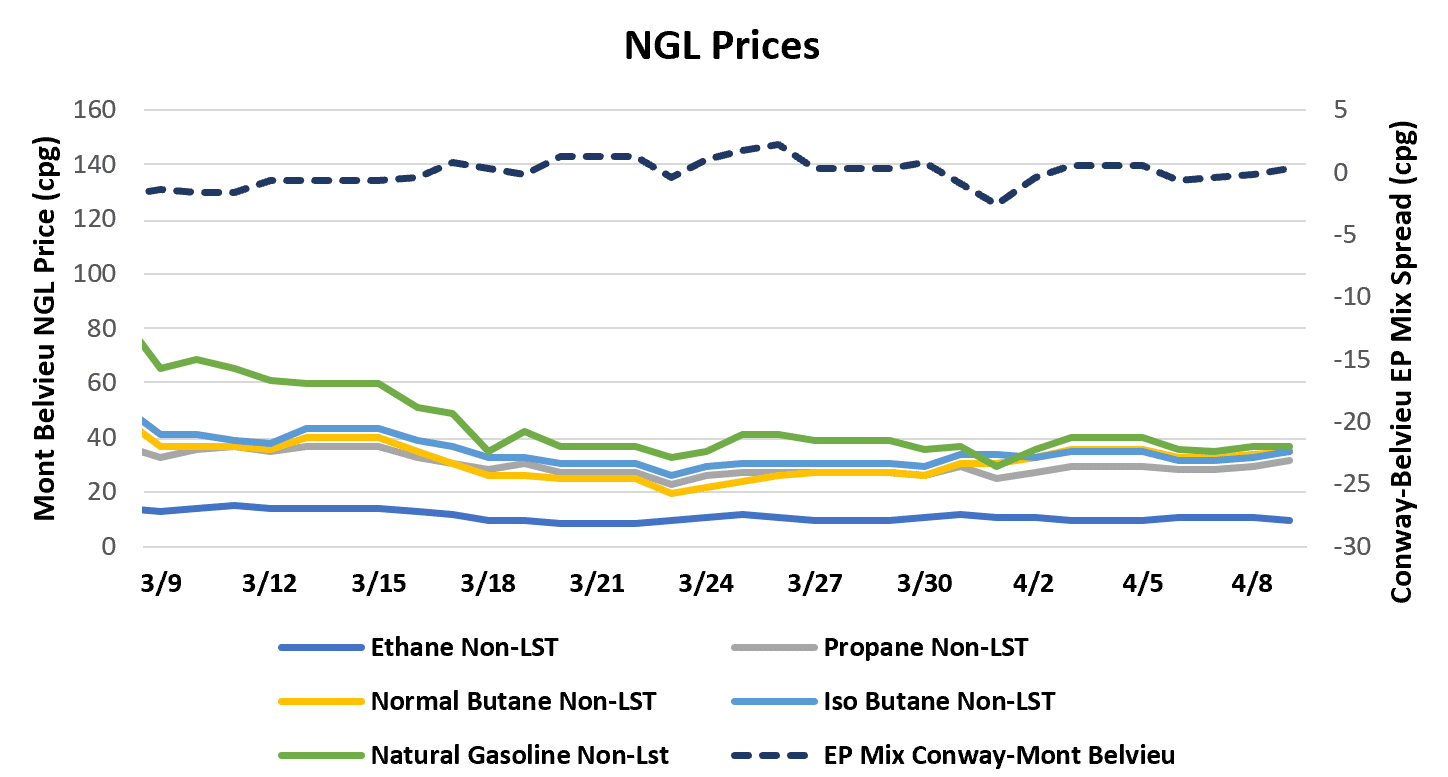

- Ethane and isobutane declined slightly last week, falling $0.004/gallon to $0.103 and $0.001/gallon to $0.328, respectively. Propane saw a gain of $0.025/gallon to $0.297, while normal butane gained $0.025/gallon to $0.337 and natural gasoline jumped $0.006/gallon to $0.363.

- The EIA reported a 168,000 bbl draw on propane/propylene stocks for week that ended April 3. Stocks now stand at 64.50 MMbbl, which is 10.14 MMbbl higher than the same week in 2019 and 13.83 MMbbl higher than the five-year average for this time of year. The five-year average for next week’s report shows a build of 1.32 MMbbl, while the same week last year saw a build of 2.38 MMbbl.

SHIPPING

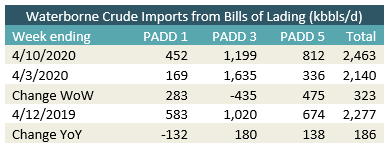

- US waterborne imports of crude oil rose for the week that ended April 10, according to Enverus’ analysis of manifests from US Customs and Border Patrol. As of today, aggregated data from customs manifests suggested that overall waterborne imports increased by 323,000 bbl/d from the prior week. PADD 1 imports rose by 283,000 bbl/d and PADD 5 imports rose by 475,000 bbl/d. PADD 3 imports fell by 435,000 bbl/d.

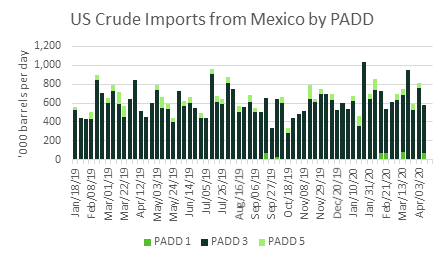

- Crude imports from Mexico declined this week, with 71,000 bbl/d imported to PADD 1 and 511,000 bbl/d imported to PADD 3. The majority of the imports were Maya. However, some Talam was received by the Houston Fuel Oil Terminal, and some Isthmus was received by PBF Paulsboro in PADD 1 and PBF Chalmette in PADD 3.