[contextly_auto_sidebar]

CRUDE OIL

- US crude oil inventories decreased by 1.1 MMbbl the week that ended Dec. 13, according to last week’s report from the US Energy Information Administration. Gasoline inventories increased 2.5 MMbbl while distillate inventories increased 1.5 MMbbl. Total petroleum inventories posted a decrease of 0.9 MMbbl. US crude oil production was flat on the week, while imports were down 0.31 MMbbl/d to 6.6 MMbbl/d.

- The tariff deal between the US and China provided a tail wind to the market. WTI prices were firm last week, rising above $60/bbl and maintaining those gains through the expiration of the January contract. Prices softened slightly when the February contract took over as prompt but closed the week over $60/bbl. The fundamental implications of last week are showing strength, with doubts about the deal diminishing and additional support from the expectation reduced OPEC+ production during the first quarter of 2020.

- The Commodity Futures Trading Commission report released Friday and dated Dec. 17 showed a slight decline of 5,811 contracts by the Managed Money short position, but the Managed Money long position increased by 38,501 contracts. It has now become evident that the speculative trade expects the initial tariff agreement between the US and China to facilitate further gains.

- Market internals last week continued the bullish bias, with a slight neutral, with the market staying above $60/bbl but on lower volume and declining open interest. With the holiday trade lighter this week, prices may become more volatile, but the bullish trend remains in place, especially with the expiration of the January contract above $60/bbl.

- The WTI market maintained the breakout of the previous range with the close of the January contract and the close on Friday. The momentum may take prices higher to test $60.94/bbl, the high from last July. Breaks above that level will set up a test of the September highs between $62.59 and $63.38/bbl. Should the market choose to digest the recent gains and develop a consolidating pattern, expect a retracement down to the $58/bbl area.

NATURAL GAS

- US Lower 48 dry natural gas production decreased 0.9 Bcf/d last week, based on modeled flow data analyzed by Enverus, with declines of 0.45 Bcf/d in the South-Central region, 0.20 Bcf/d in the Mountain region and 0.28 Bcf/d in the East region. Canadian imports increased by 0.61 Bcf/d.

- Demand in the Res/Com market sector increased by 7.23 Bcf/d on colder weather, while industrial demand increased 0.63 Bcf/d and power demand inched up 0.03 Bcf/d. LNG and Mexican exports had little movement, decreasing by 0.05 Bcf/d and 0.14 Bcf/d, respectively.

- Overall, these events resulted in the market losing 0.39 Bcf/d in total supply while total demand increased by 7.96 Bcf/d

- The EIA storage report last week showed a withdrawal of 107 Bcf, the first triple-digit draw of the season. Total inventories are now 618 Bcf higher than at this time last year and 9 Bcf below the five-year average for this time of year. Current weather forecasts from the National Oceanic and Atmospheric Administration show above-average temperatures from the Mississippi River east and north in the coming week. The eight- to 14-day forecast has above average temperatures from the Rockies east and in the Pacific Northwest.

- The CFTC report dated Dec. 17 showed the Managed Money short sector slowing positions by adding just 243 contracts, while the Managed Money long sector gained 5,292 contracts. It seems that the speculative short trade expects further price declines. However, there was no major extension downward during the week, likely due to increasing concern about changes in long-term weather forecasts.

- The market internals developed a neutral to bearish bias, with prices staying in a narrow $0.145 range last week on declining volume and declining total open interest. While the CFTC report showed a slight gain in short interest, total open interest declined on Wednesday through Friday as prices firmed and rose into the close. This may be due to some light short covering going into the holiday period, which should show up on the next CFTC report.

- As expected, rallies attempting to hit $2.40 were met last week with selling and could not get above $2.377. Current forecasts remain bullish, and increasingly so after the New Year. With the potential changes in forecasts, the traditional lighter holiday trade and the January contract expiration on Friday, pricing that day could become volatile. The $2.158 low of last week should hold the declines, and prices above $2.38 are likely to force traders to roll short positions into the February contract.

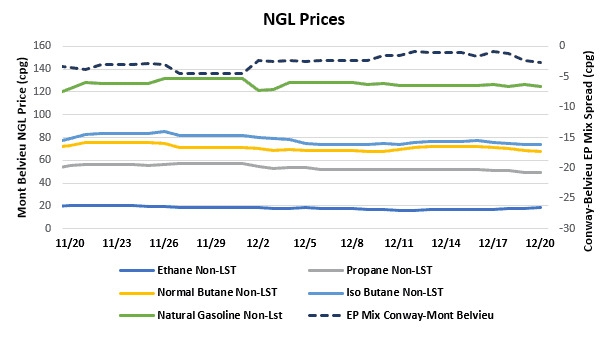

NATURAL GAS LIQUIDS

- Ethane prices gained $0.011 to average $0.175/gallon for the week, while normal butane gained $0.004 to average $0.701/gallon and isobutane gained $0.001 to average $0.750/gallon. Propane saw a drop of $0.014 to average $0.504/gallon and natural gasoline fell $0.006 to average $1.257/gallon.

- The EIA reported a 2.54 MMbbl gain in propane/propylene stocks for week that ended Dec. 13. These inventories now stand at 90.96 MMbbl, which is 17.71 MMbbl higher than the same week in 2018 and 19.62 MMbbl higher than the same week in 2017.

SHIPPING – Shipping content is produced using Enverus’s new import manifest tool. Please contact Bert Gilbert ([email protected]) for more details.

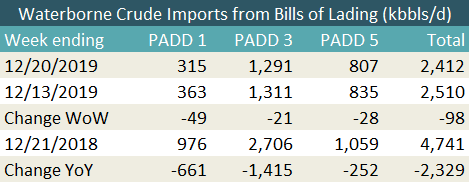

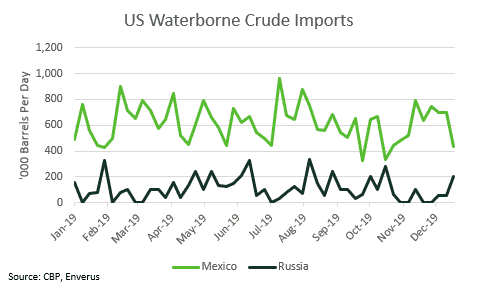

- US waterborne imports of crude oil fell slightly last week, according to Enverus’ analysis of manifests from US Customs and Border Patrol. As of today, aggregated data from customs manifests suggested that overall waterborne imports decreased by nearly 100,000 bbl/d from the prior week. All three PADDs saw lower imports: PADD 1 fell by nearly 49,000 bbl/d, PADD 3 by 21,000 bbl/d, and PADD 5 by 28,000 bbl/d.

- Lower-than-usual imports from Mexico contributed to this week’s decline. At 434,000 bbl/d, waterborne crude imports from Mexico hit their lowest level since late October. Adding some support were imports from Russia, which were also at levels not seen since October. The US imported more than 200,000 bbl/d of Russian crude, with Phillips 66 receiving a cargo of Urals at its Lake Charles, Louisiana, refinery and another of Sokol at its Ferndale refinery in Washington state. Par Pacific also imported a cargo of Sokol to its Kapolei refinery on the Hawaiian island of Oahu.