IMO 2020 rules restricting sulfur content in marine fuels will force refiners to find new sources of crude

With the International Maritime Organization’s (IMO) restrictions on marine fuels with sulfur content greater than 0.5% coming into effect in January, refiners around the world should be well on their way toward adjusting their operations to mitigate the impact on their business. For some, the transition away from high-sulfur fuel oil to low- and ultra-low-sulfur blends will be less difficult than for others. For example, many refineries along the U.S. Gulf Coast should be well positioned for the change given the relatively high complexity of refinery configurations in the region and growing access to supplies of sweet crude. Other refiners, such as those in the Pacific Northwest (PNW), face steeper challenges.

PNW Refiners Face ANS Crude Conundrum as IMO 2020 Takes Hold

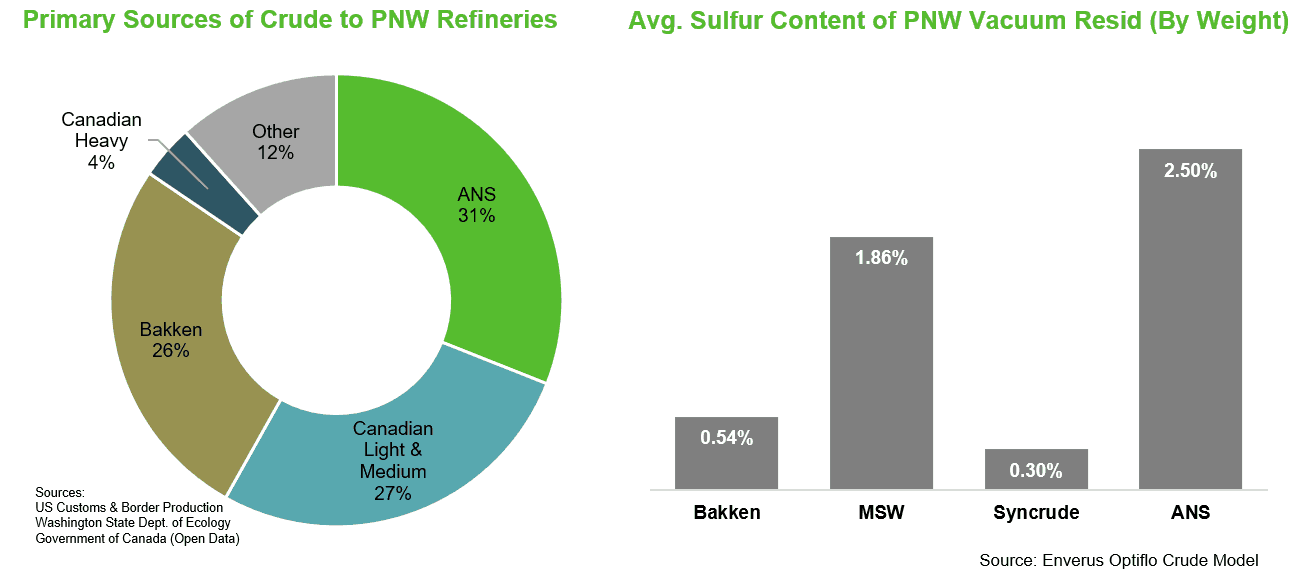

In its heyday, crude from the Alaskan North Slope (ANS) made up over half of PNW refiners’ crude slate. However, this dominant share of the market was substantially reduced over the past 10 years as deliveries of Bakken crude by rail from North Dakota became commonplace. Despite its diminished status though, ANS still makes up close to one-third of the PNW’s crude slate today.

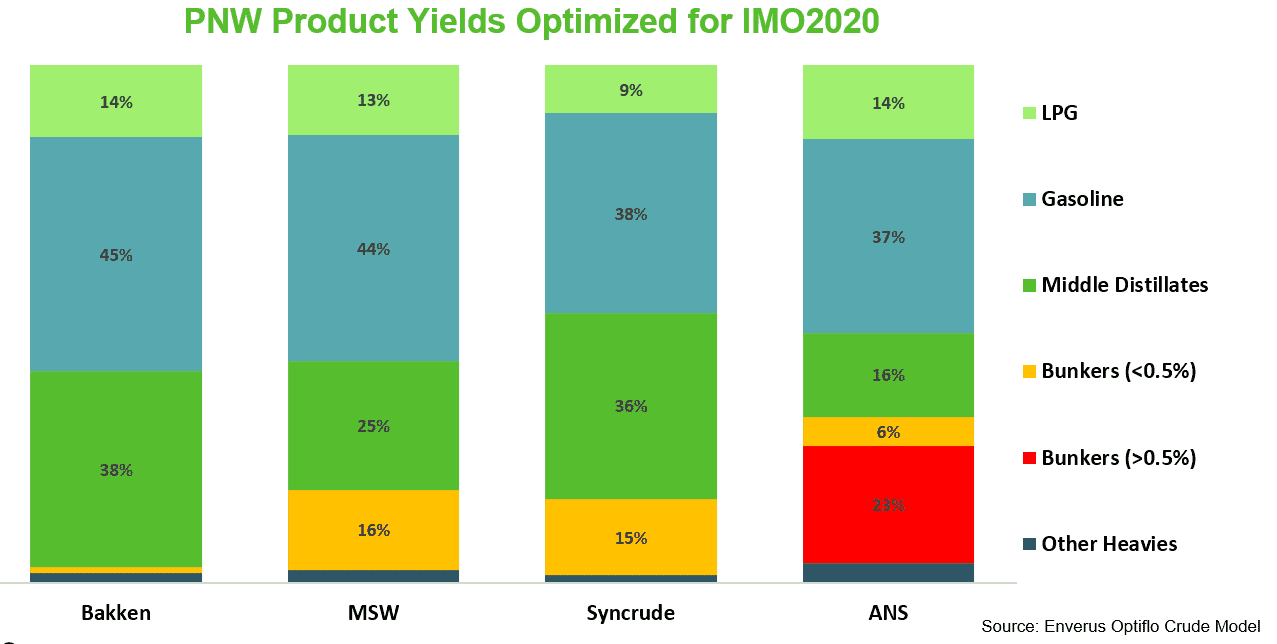

This is going to be a problem in a post-IMO 2020 world because ANS makes a very high-sulfur vacuum resid (see chart below), and in large quantities. Indeed, roughly 20% of the ANS atmospheric distillation column goes to producing heavy residual fractions. Compare that to 6.9% for Bakken and less than 1% for most Canadian synthetics. This wasn’t a problem when the sulfur specification for marine bunkers was 3.5%, but it will be a problem in a post-IMO 2020 world when that threshold is reduced to 0.5% for many vessels still not fitted with scrubbers.

In the chart below, you can see that this high-sulfur vacuum resid contributes significantly to the production of bunker fuels that will not meet the IMO 2020 specification. In contrast, refiners that run a diet of mostly Bakken, Canadian syncrude, or even a conventional Canadian sweet like Mixed Sweet Blend (assuming you could get it to the PNW) would have no trouble hitting the IMO 2020 spec. Of course, what we are presenting here is a simplification as refiners seldom run just one grade of crude. The point we are trying to make is that PNW refiners have a clear incentive to substitute some amount of ANS in their slates for something that will help them reduce their production of high-sulfur marine fuels. The challenge is going to be in the logistics.

PNW Crude-by-Rail Options Limited by Government Restrictions

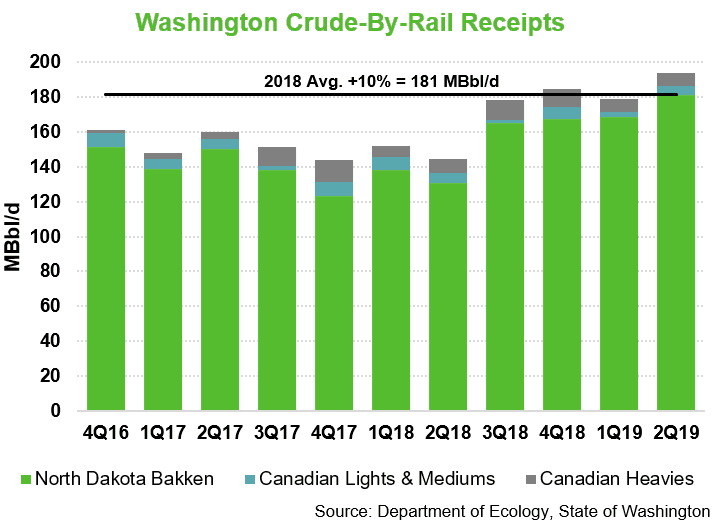

Given the lack of local crude production and tight availability of sweet crude grades in the Pacific Basin, bringing in more light sweet Bakken crude by rail to substitute for ANS seems like the logical solution. Unfortunately for PNW refiners, legislation ratified by the state of Washington in July complicates matters significantly.

The stated intent of Washington’s crude by rail law was to improve public safety by restricting inbound volumes of crude grades the state government deemed to be dangerously volatile. A common measure of volatility for petroleum liquids is Reid Vapor Pressure (RVP), and the new crude by rail law put the RVP cap at 9 psi. Federal transportation guidelines are not that stringent, and the state’s safety concerns are disputed by industry groups as well as the states of North Dakota and Montana.

Right or wrong, the law is in effect, but rail offloading facilities that were either constructed or permitted before Jan. 1, 2019 have been allowed to continue receiving greater than 9 psi RVP crude. There is just one catch: each of the grandfathered rail offloading facilities is limited to receiving no more than its 2018 average volume plus 10% (or roughly 181 MBbl/d for the state of Washington as a whole).

Unfortunately for refiners, the letter of the law does not differentiate between grades of crude oil or their respective RVPs when assessed against that volume limit. Once a facility exceeds its 2018 average plus 10% gross volume limit (regardless of RVP), the facility has two years to phase out all receipts of crude oil with an RVP greater than 9 psi. Due to this stipulation, the Washington crude-by-rail law effectively puts a cap on all crude by rail (even low-RVP grades from Canada) unless the refineries attached to the grandfathered rail offloading facilities are willing to forgo high-RVP Bakken once the two-year clock runs out. This is not a desirable position for any refiner to be in as it constrains their options and reduces operational flexibility.

If Not Rail, Then What are the Alternatives for Shipping Crude to PNW Refiners?

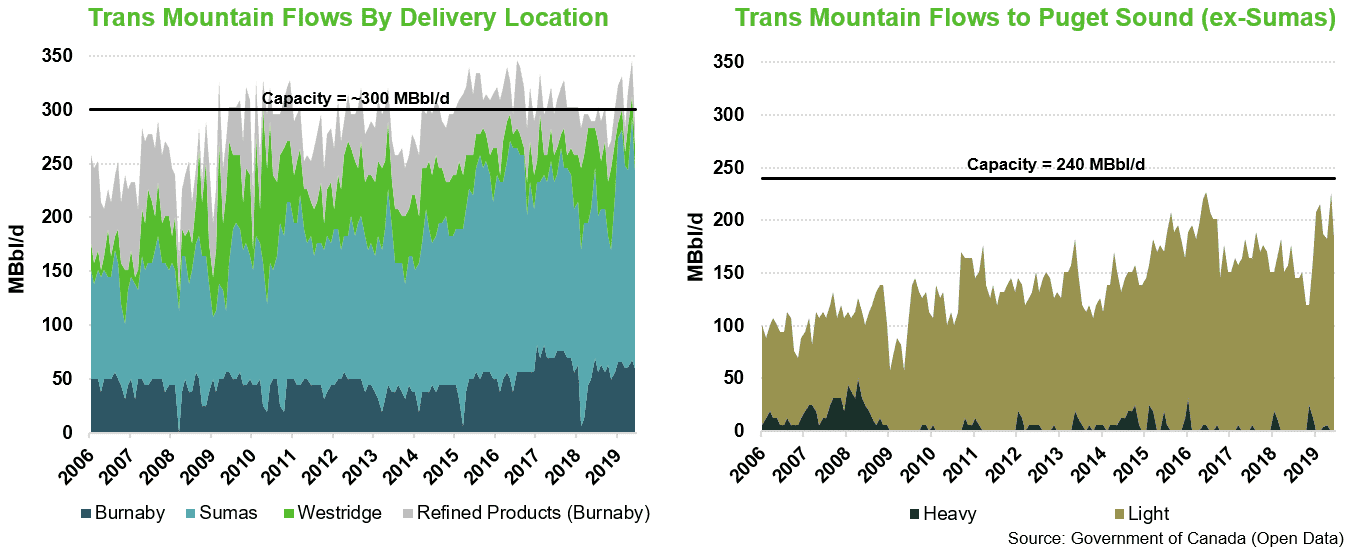

With rail options limited just as the new IMO rules come into effect, the only other ways to deliver Canadian light sweet grades in the PNW market is by barge or via the Puget Sound pipeline (240 MBbl/d), which receives crude from the Trans Mountain system (300 MBbl/d). Unfortunately for refiners looking for incremental supplies from Canada, Trans Mountain is already operating at capacity, and this has kept the Puget Sound pipeline operating below nameplate. In other words, the PNW is already receiving as much Canadian crude as it can get.

This situation will change when Trans Mountain’s capacity is expanded to 890 MBbl/d in 2022. Not only will this allow for more capacity to be utilized on the Puget Sound pipeline, but the expansion at the Westridge marine terminal also would provide more capacity for waterborne movements down the West Coast. In the meantime, PNW refiners appear to be over a barrel and will likely need to source incremental sweet barrels from farther afield (such as West Africa) as they substitute out ANS. This will come at a high cost given current freight rates. Although PNW refiners may see their margins squeezed due to IMO 2020 and the higher cost of crude supply that will result from the need to find alternatives to ANS, these costs will ultimately trickle down to consumers of motor fuels.