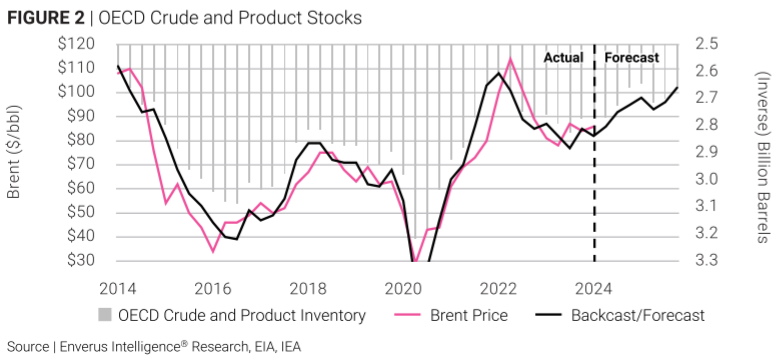

Crude and product stocks are currently at levels that suggest Brent should be ~$85/bbl. We believe there is no geopolitical premium embedded in the price of oil. Historical data shows prices are justified at current stock levels.

Looking forward, Enverus Intelligence® Research (EIR) remains bullish on Brent crude prices.

EIR expects Brent prices to continue to push higher and reach an average of $95/bbl by the fourth quarter of 2024. This move up in price is driven by crude and product draws in the second half of the year – assuming OPEC holds its production at current levels.

Brent crude oil prices reached a high of $91 a barrel recently due to strong demand growth and improved momentum in the economy, as indicated by marked improvement in both consumer and industrial sentiment indexes.

That said, there is upside risk to oil prices.

Bullish statements about refilling the U.S. Strategic Petroleum Reserve and additional Russian production cuts are currently unaccounted for in EIR expectations for global oil balances.

However if these two variables play up to their potential, higher prices (possibly $100 bbl and above) will ensue, as it would drastically tighten global oil balances. Currently, EIR’s Brent forecast is ~$10 a barrel higher than the current strip.

Specifically, Russia agreed to slash its production this past March by another 471,000 barrels per day (bpd) during the second quarter to meet the production cuts agreed on with other OPEC+ countries so that the reduction in output would be even.

Saudi Arabia, as the de facto leader of OPEC+, plays a critical role in shaping these global oil strategies. Here’s what you need to know about their position in the market.

Next the U.S. Secretary of Energy recently stated the SPR would be refilled or exceed pre-Biden sales levels by the end of the year. A return to pre-Biden sales levels would require a build of around 200 MMbbl. This could mean crude purchases this year of 500 -1500 Mbbl/d depending on the start date.

(Posted: 03/18/2024)

EIR has doubts about the aggressive pace stated by the Secretary of Energy, while Russia has a checkered history of adhering to stated cuts.

Over the longer term, EIR believes oil prices in general will rise because expected global supply additions, appear unable to keep up with demand growth. OPEC will be the marginal producer in this scenario and have market control. “OPEC manages Brent prices to stay in the group’s comfort zone of $85 to $105 per barrel,” said Al Salazar, head of Macro Oil and Gas Research at EIR.

As for natural gas, Henry Hub prices should slowly recover this summer and average $2/MMBtu, which is roughly 30 cents/MMBtu under the current strip and down for our prior estimate of $2.25.

Prices are anticipated to average $4.50/MMBtu by late 2025 and will touch $5 during winter months, which is close to the current strip. Such price levels are what is needed to motivate Haynesville production to grow at a pace sufficient to serve the historic LNG build-out, Salazar said.

Creating market strategies without the right tools or intelligence is like playing darts blindfolded – you’ll hit something, but it’s probably not the bullseye! When you need macro analysis to effectively forecast markets there’s no time for frustrating lags or bad intel. Empower your team with actionable insights using T&R Data Loaders for Refinitiv or Bloomberg data! Visualize proprietary data in real time and seamlessly integrate market data into your analysis with our Data Loaders solution. Designed to streamline data management within Enverus Trading and Risk Solutions, our flexible loaders support efficient data integration from Refinitiv and Bloomberg. No more waiting in queues for data onboarding – with the Enverus Self-Service Workflows application, you control the pace.

Ready to jumpstart your trade strategy for 2024? Fill out the form now.

Authors

Al Salazar

Senior Vice President, Enverus Intelligence® | Research (EIR)

Al Salazar is a seasoned member of the Enverus Intelligence team, bringing more than 23 years of experience in the energy industry with a focus on fundamental analysis of oil, natural gas and power.

Throughout his career, Al has held key positions at EnCana/Cenovus and Suncor, where he honed his skills in forecasting, hedging, and corporate strategy.

Al’s 15-year tenure at EnCana/Cenovus was particularly impactful, where he contributed significantly to the company’s success. Al earned his bachelor’s degree in applied energy economics from the University of Calgary in 2000, followed by an MBA with honors from Syracuse University in 2007. Al’s academic background, coupled with his extensive professional experience, has equipped him with a deep understanding of the energy industry’s complexities and the necessary skills to navigate them effectively.

Chris Griggs

Product marketing manager for Enverus Intelligence® | Research (EIR) and Trading & Risk. Chris Griggs leads the development and communication of the value these products provide various industries, including oilfield services, investment funds, wealth management departments, banks, E&P oil and gas departments, and midstream operators. Chris helps provide customers across the energy ecosystem with the intelligent connections and actionable insights that allow them to uncover new opportunities and thrive.

About Enverus Intelligence Research

Enverus Intelligence ® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations and macro-economic forecasts; and helps make intelligent connections for energy industry participants, service companies and capital providers worldwide. Enverus is the most trusted, generative AI and energy-dedicated SaaS company, offering real-time access to analytics, insights and benchmark cost and revenue data sourced from our partnerships to 98% of U.S. energy producers, and more than 35,000 suppliers. Learn more at Enverus.com.