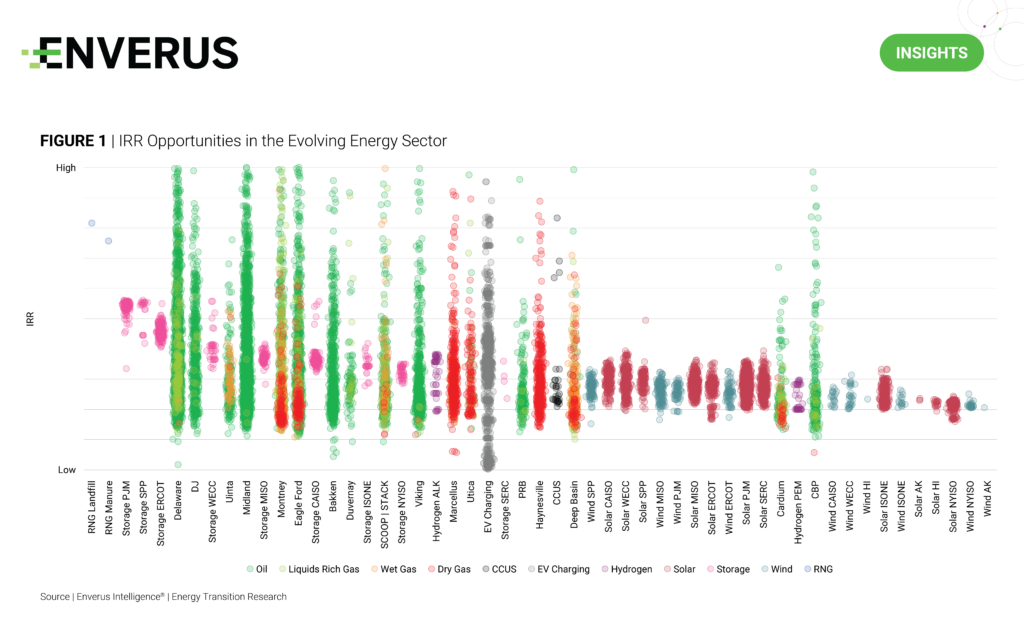

The attractiveness of internal rates of return (IRR) across various energy transition technologies is noteworthy, sometimes surpassing established oil and gas business models. The arrival of these new opportunities often requires strategic partnerships but continues to prove to be economic (sometimes wildly) on a broad scale.

Traditionally, oil and gas wells have demonstrated wider distributions and higher average IRRs, owing to both prevailing sentiments surrounding the energy mix and the inherent geological risk factors involved. This remains the case for most scenarios, but solar and wind projects follow a much different approach. In this case, power purchase agreements are used for different market structures, arranging delivery at a specific rate of return. The further improvement of that structure sees IRR values for solar and wind generation to increase in the long term.

The emergence of new battery storage projects presents an enticing opportunity for significant returns, contingent on optimal storage market conditions. The team at Enverus Intelligence© | Research (EIR) can see a consistent 60%-80% IRR rate for some of the major ISOs across the United States implementing battery storage. The ability to store excess energy and release it during peak demand times not only enhances grid stability but also creates additional revenue streams.

As the energy industry continues to evolve, stakeholders will be rewarded for a watchful eye on emerging opportunities across various sectors.

Highlights from Energy Transition Research

- Emissions – U.S. versus Western Canada – In this report, EIR compares Scope 1 upstream and midstream GHG emissions in Western Canada and the U.S., focusing on key differences in absolute emissions and intensities across major areas of interest.

- Going green with Hydrogen – IRA economics and technology benchmarking – This report explores green hydrogen production technology and incentives available in the U.S. and models the resulting project-level economics.

Energy is changing. Connect weekly with the ideas that are leading the way.

About Enverus Intelligence®| Research

Enverus Intelligence Research, Inc. is a subsidiary of Enverus and publishes energy-sector research that focuses on the oil and natural gas industries and broader energy topics including publicly traded and privately held oil, gas, midstream and other energy industry companies, basin studies (including characteristics, activity, infrastructure, etc.), commodity pricing forecasts, global macroeconomics and geopolitical matters. Click here to learn more.