Understand how upstream oil and gas business models best fit with emerging energy transition opportunities and gain context on the best avenues for energy transition participation for an upstream oil and gas operator.

Research written by:

Carson Kearl, Associate, 403.213.3814

Morgan Kwan, P.Eng, Director, 403.535.4909

Ian Niebor, P.Eng., CFA, Manager Director, 403.294.6494

This eBook is based off the report published by the Enverus Energy Transition Research team, Ways to Play | Energy Transition Opportunities for Upstream Participants, published on Sept. 6, 2023. Enverus Intelligence Research clients can view the full report here .

Enverus Intelligence Research, Inc., a subsidiary of Enverus, provides the Enverus Intelligence® | Research (EIR) products. See additional disclosures.

The energy transition is happening. While it may be viewed as a major headwind by some traditional upstream oil and gas operators, Enverus Intelligence Research (EIR) sees opportunity in the numerous business models that are emerging around transition technologies and the policies implemented to support them.

With the flurry of buzzwords and headline technologies, it is easy to be overwhelmed with what exactly the energy transition entails and how much effort, if any, should be invested toward it. EIR’s holistic approach to analyzing the energy transition space helps facilitate developing a strategy that goes beyond targeting net-zero emissions, to create a strategy that is accretive to your business.

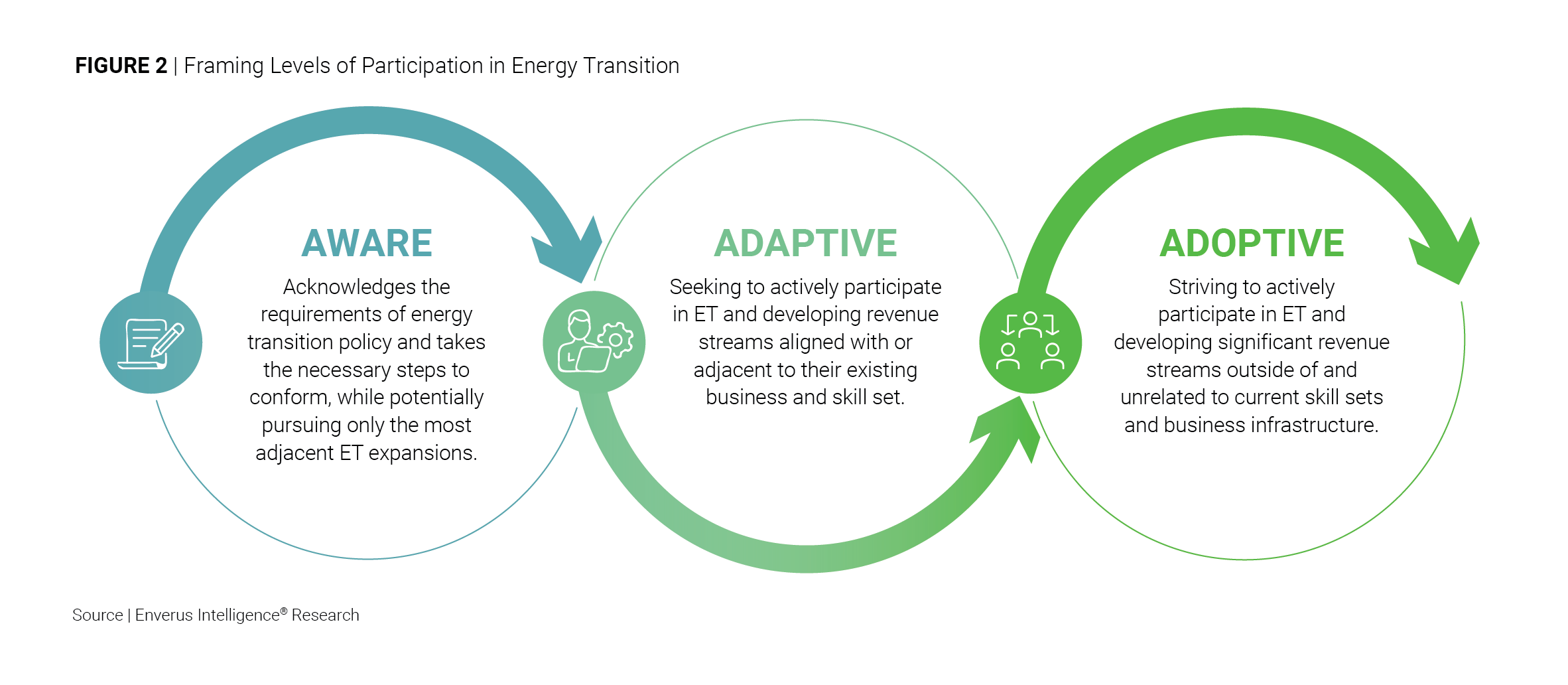

The rise of investor preference toward operators who are participating in the transition presents a unique set of opportunities to diversify revenue streams and gain favor in the public eye. This guide is a framework for operators to create a strategy that suits a scale and scope unique to them.

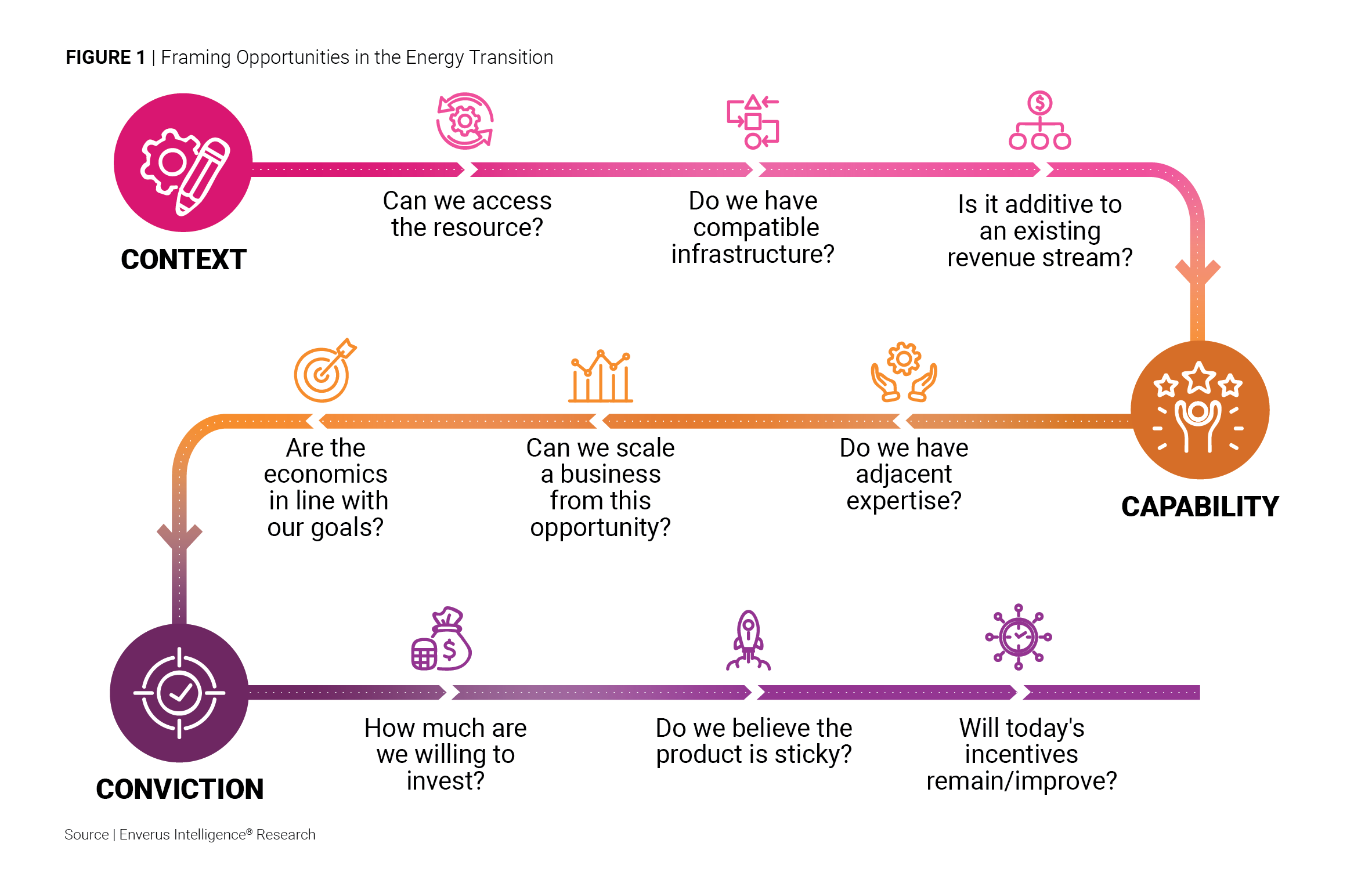

Absolute conviction in the energy transition in general must be a baseline but ultimately EIR categorizes conviction in the energy transition into three buckets:

All these considerations combined help determine which energy transition technologies make sense for an effective strategy. While most upstream operators are increasingly exploring the transition, many remain hesitant to deploy capital. Any decision, including inaction, must be well informed and deliberate in response to growing stakeholder demands. Participation in the energy transition extends beyond social license and is ultimately driven by financial returns. The transition offers both financial challenges, like rising compliance costs, and opportunities, including incentives and new business ventures, making it more than just a social responsibility.

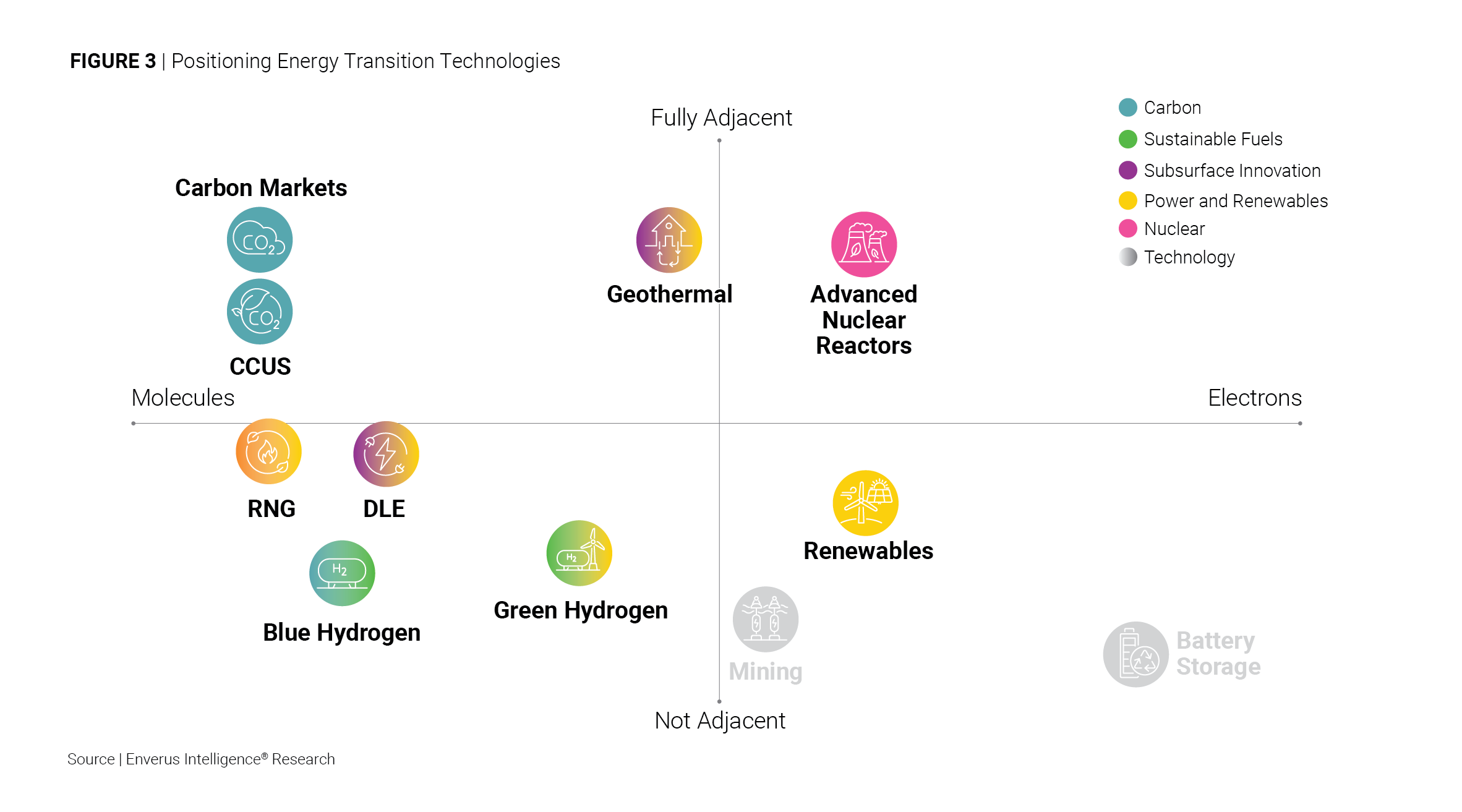

While the term energy transition is a broad, sweeping term thrown about to capture any movement away from hydrocarbons, the Energy Transition Research (ETR) team focuses on the technologies that are attracting capital flows and investor interest, and are set to make a meaningful impact on the primary energy mix. To simplify the array of technologies, we organize them into either technologies that impact the hydrocarbon molecule or are part of the electrification movement.

For each technology we specify how closely it fits within an operator’s current business (Figure 3). Fully adjacent technologies bolster revenue from existing sources or leverage credit schemes like those contained in the U.S. Inflation Reduction Act (IRA). Partially adjacent technologies create a new revenue stream founded on existing infrastructure and skill sets such as producing a new product or CCUS. Given the application of some technologies, we recognize that they are non-adjacent to existing hydrocarbon business models. Non-adjacent technologies are mostly power-focused and either involve generation projects or mass consumption of electricity to produce a resource.

ETR evaluates many of the technologies that are part of the energy transition, focusing on those that attract the most investor interest and capital flow. Below are details on the various technologies and how an upstream operator can incorporate them in their transition strategy.

NOTE: In the text below, upstream in the context of the oil and gas industry refers to exploration and production activities.

RNG, also known as biomethane or upgraded biogas, is derived from organic materials such as agricultural residues, wastewater sludge, municipal solid waste or livestock manure. RNG can serve as a direct substitute for conventional natural gas because it’s chemically similar, being primarily methane.

RNG presents a promising opportunity for upstream operators to leverage their core competencies in infrastructure development, project management and operations within the context of a sustainable, low-carbon energy solution.

Biogas production

Organic waste is decomposed anaerobically (in the absence of oxygen) in digesters or landfills to produce biogas.

Upgrading

The biogas, a mixture of methane, carbon dioxide and impurities, is processed to remove contaminants and CO2 to create high-quality RNG.

Integration

Once cleaned and upgraded, RNG can be injected into existing natural gas infrastructure or utilized for various applications, from electricity generation to transportation fuel.

Carbon markets, also known as cap-and-trade systems or emissions trading systems, are market-based approaches used to control GHG emissions by providing economic incentives for businesses to reduce their carbon footprint.

Participation in carbon markets provides an economic incentive for upstream operators to innovate and reduce their emissions, potentially turning a regulatory challenge into a business opportunity.

Cap

Governments or regulatory bodies set a maximum limit or cap on the total amount of GHGs that can be emitted by certain sectors of the economy. This cap is usually reduced over time, aiming to decrease overall emissions.

Allocation

Once the cap is set, emission allowances (often equivalent to one ton of carbon dioxide) are either given away to emitters or auctioned off.

Trading

Companies that emit less than their allocated amount can sell or trade their extra allowances on the carbon market. Conversely, companies that exceed their limits can buy additional allowances from those with excess.

Banking and borrowing

In some systems, companies can bank unused allowances for future use or borrow against future reductions.

Offsets

In addition to trading allowances, some systems allow for carbon offset credits. These are credits earned from projects that reduce, avoid or sequester emissions outside of capped sectors, like afforestation or renewable energy projects.

A set of technologies and processes that CO2 emissions at their source, then either utilize them in various applications or store them underground to prevent them from entering the atmosphere. CCUS plays a vital role inaddressing climate change, especially in sectors where decarbonization is challenging.

Capture

This is the process of capturing CO2 emissions directly from industrial processes or directly from the atmosphere. Various technologies can be used, including post-combustion capture, pre-combustion capture, oxyfuel combustion and direct air capture.

Utilization

Captured CO2 can be used in various applications. Examples include:

Storage

If not utilized, the captured CO2 can be transported and stored underground in geological formations, such as depleted oil and gas reservoirs or deep saline aquifers.

DLE is a term used to describe a range of technologies designed to extract lithium directly from brine sources more rapidly and efficiently than traditional evaporation pond methods.

Given that upstream typically refers to the exploration and production phase in the oil and gas industry, the term can be analogously applied to lithium exploration and brine production.

Blue hydrogen refers to hydrogen produced from natural gas through a process called steam methane reforming, where the carbon dioxide (CO2) byproduct is captured and stored using CCS technology. This process reduces the carbon emissions typically associated with traditional hydrogen production methods, making the hydrogen “blue.”

Steam methane reforming

Natural gas (primarily methane, CH4) is reacted with steam to produce hydrogen and CO2. The primary reaction is: CH4+ H2O = CO + 3H2.

Carbon capture and storage

The CO2 produced from steam methane reforming is captured and then transported and stored underground in geological formations to prevent its release into the atmosphere.

Green hydrogen is produced using renewable energy sources, primarily through the electrolysis of water. Electrolysis splits water (H2O) into hydrogen (H2) and oxygen (O2) using electricity. When the electricity used for this process comes from renewable sources such as wind, solar or hydro, the resulting hydrogen is termed “green” since the production process is carbon-free.

Electrolysis

Water is passed through electrolyzer that applies an electric current to split water molecules into hydrogen and oxygen.

Renewable energy integration

For hydrogen to be considered green, the electricity used in electrolysis should come from renewable sources. This ensures that the entire hydrogen production process is carbon neutral.

Advanced reactors, often referred to as small modular reactors (SMRs), present a compact alternative to traditional nuclear reactors. Their design allows for off-site manufacturing and subsequent on-site assembly, minimizing on-location construction. Their reduced reactor core size, combined with cutting-edge design elements, offers heightened containment capabilities and an elevated safety profile.

Modularity

SMRs are designed to be modular, meaning they can be manufactured in a factory and transported to their intended location. This approach aims to reduce construction times and costs.

Scalability

Their modularity also means multiple advanced reactors can be deployed together to achieve the desired capacity, offering flexibility and scalability in power generation.

Safety features

Advanced reactors often incorporate passive safety features that rely on natural forces like gravity and natural circulation, reducing the need for external power or active cooling systems.

Geothermal energy harnesses the Earth’s natural heat stored beneath the surface, utilizing it for electricity generation or direct heating. This renewable energy source is consistent as it does not rely on intermittent factors like sun or wind.

Heat extraction

Geothermal systems extract heat from the Earth through deep wells that tap into hot water and steam reservoirs.

Electricity generation

In geothermal power plants, the heat from the Earth’s core is used to heat water or another working fluid to produce steam. This steam drives a turbine connected to a generator, producing electricity.

Direct use applications

Geothermal heat can also be used directly for heating buildings, growing plants in greenhouses, drying crops, heating water at fish farms and several industrial processes such as pasteurizing milk.

Renewable energy generation, specifically solar and wind, has witnessed rapid growth due to increasing demand for sustainable energy, technological advancements and decreasing costs. While solar captures energy from the sun through photovoltaic cells or concentrating solar power systems, wind energy taps into the kinetic energy from wind to turn turbines and generate electricity.

Solar energy

Wind energy

Wind turbines transform the kinetic energy from the wind into mechanical energy. This mechanical energy is then converted into electrical energy through a generator.

Discover

About Enverus

Resources

Follow Us

© Copyright 2024 All data and information are provided “as is”.