Countries around the world are increasingly embracing clean hydrogen as a central pillar of their energy transition strategies, with announced global production expected to increase 42-fold by 2030. Green hydrogen has especially gained widespread attention because of its decarbonization potential, role in energy storage and versatility as an energy carrier.

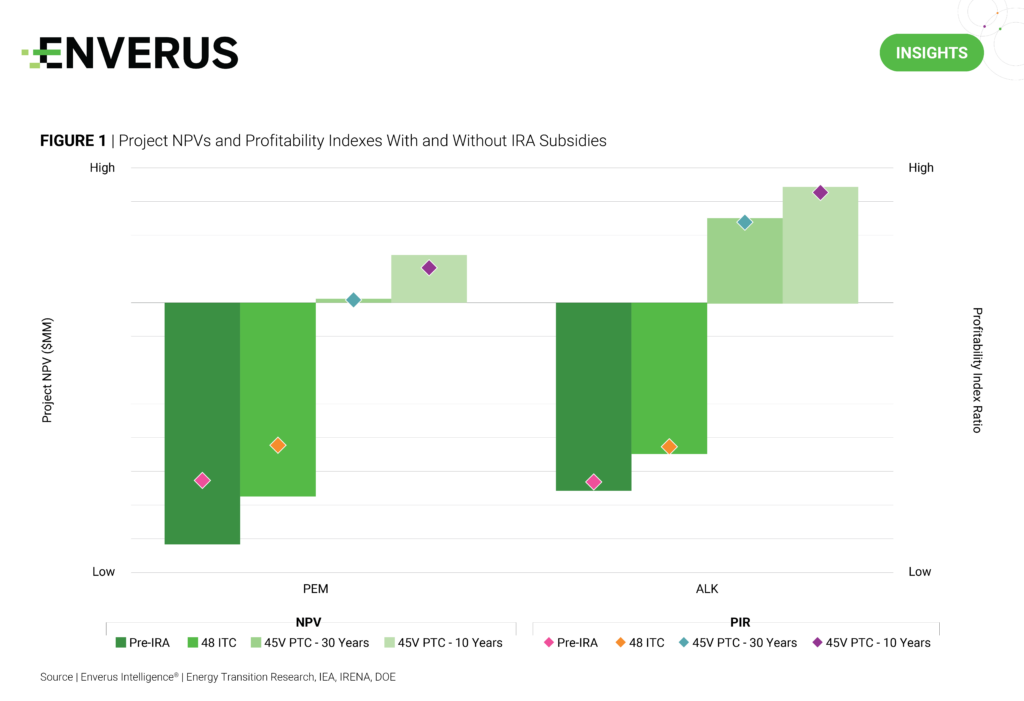

Government incentives like the Inflation Reduction Act (IRA) aim to reduce production costs and support market development by encouraging innovation and driving early supply growth. The Enverus Intelligence® | Research (EIR) team’s modeling suggests that the IRA’s 45V production tax credit (PTC) meaningfully bolsters economics and drives positive returns among green hydrogen generation projects (Figure 1). Capex only represents a small percentage of overall costs, limiting the relative impact of the IRA’s clean energy investment tax credit (48 ITC) compared to the 45V PTC for both alkaline and proton exchange membrane (PEM) electrolyzers.

While the PTC provides support for the first 10 years, EIR notes that net cash flows turn negative for the remainder of the 30-year modeled life after the tax incentives expire. This results in lower NPVs and profitability index ratios for alkaline and PEM projects over a 30-year project life compared to the 10-year scenario. Project operators will likely need to renegotiate power purchase agreements at lower prices, realize extensions to the 45V PTC or secure premiums on the green hydrogen sales price to justify continued production after year 10.

Highlights from Energy Transition Research

- Podcast – Carbon management strategy with CRC President Francisco Leon – In this podcast, we sit down with Francisco Leon, president and CEO of California Resources, to discuss the energy transition landscape in California and learn more about the company’s carbon management strategy.

- Lithium – Alberta competes for the prize – EIR outlines the untapped opportunities in Alberta’s lithium brines, focusing on the potential for direct lithium extraction and prospects in wastewater processing. The report reviews the competitive landscape and offers insights into strategic considerations for operators.

- Canadian emissions webinar slides – A presentation deck showing updated 2023 findings from the Canadian facility-level dataset, looking at Scope 1 upstream and midstream GHG emissions across Alberta, B.C. and Saskatchewan.

Energy is changing. Connect weekly with the ideas that are leading the way.

About Enverus Intelligence®| Research

Enverus Intelligence® | Research, Inc. (EIR) is a subsidiary of Enverus that publishes energy-sector research focused on the oil, natural gas, power and renewable industries. EIR publishes reports including asset and company valuations, resource assessments, technical evaluations, and macro-economic forecasts and helps make intelligent connections for energy industry participants, service companies, and capital providers worldwide. EIR is registered with the U.S. Securities and Exchange Commission as a foreign investment adviser. See additional disclosures here.