We all understand the motivations that drive folks who hunt for treasures. Whether it’s buying extra Powerball tickets, trying to pick the next crypto or biotech winner in the stock market, or even using a metal detector at the beach to find a lost Rolex, we understand.

It’s the allure of making a risk pay off in a big way.

The careers of many oil and gas geoscientists have been made on the foundation of the inherent risk in conventional resource exploration.

Work up a hunch in an area no one’s worked before. Try to confirm it by pulling a bunch of logs and mapping out reservoir thickness and trap structure. Assess that source, reservoir, seal and trap conditions are satisfied, and then lease the acreage. Confirm it with seismic if need be. Sell it to management or your investment group and then line up a rig.

Get your morning reports on drilling rates, samples and tops, and as you get close to your target pay zone, start looking for reports of oil and gas shows.

Finally, when the well reaches total depth, head out to the location and watch in anxious anticipation as the logging company shows the down log and you get your first look at the log response of the thing you’ve been chasing for months — or maybe even years.

Experience elation. You’ve found producible hydrocarbons that will make money greater — maybe much greater — than your workup, lease and drilling costs.

Or, experience dejection. You, your company or your investment groups risked a bunch of money and came up with nada.

In a weird way, the process was the perfect expression of the digital age — ones and zeroes — before the digital revolution even occurred.

The experience of exploring for oil and gas was both brutal and immensely satisfying. Brutal in the sense that there were no shades of gray. You either made tons money or you lost a lot of money.

But we kept doing it because we were totally captivated and enthralled by the idea of thinking in four dimensions and putting our minds deep in the earth to ferret out where Mother Nature had hidden and locked up hydrocarbons.

And the fundamental assumption that kept prospect generators engaged in the world’s greatest treasure hunt was that our societies always needed more oil and gas.

Fast forward to 2021. Unconventional reservoir development has become firmly entrenched as the dominant method of producing oil and gas in the U.S. Instead of discrete traps of various sizes ranging up to hundreds or even a few thousand acres requiring careful research to identify, unconventional plays like the Eagle Ford in South Texas are prospective over nearly 4 million acres.

And unlike conventional exploration, there are many shades of gray in these plays, ranging from wells with modest returns on investments to money-making superstar wells.

By now, we’re probably all familiar with the current mantra imposed on the industry by the investment community — deliver free cash flow, reduce your debt and live within your means.

So, my question is this: How can that possibly be inspirational for the exploration-minded geoscientists in the upstream workforce that have traditionally been guided to find more?

Maybe they can find inspiration in developing really detailed reservoir models that guide development plans. Perhaps this kind of incremental advancement of reservoir petrophysics and facies developments synchs up with the younger generation’s reported aversion to risk.

Or maybe the fact that they are getting great paychecks to support their future plans is enough.

But from my limited perspective, I always wanted to be inspired to do great things, to work against long odds and succeed. And it’s hard to see how management and C-suites can be truly inspirational for their workforce if they’re messaging management rather than risk taking.

Maybe we can close the circle by inspiring this upstream geoscience workforce to come full circle to identify the best places to store, rather than extract, the fluids and gases that we recognize as harmful to our planet’s climate.

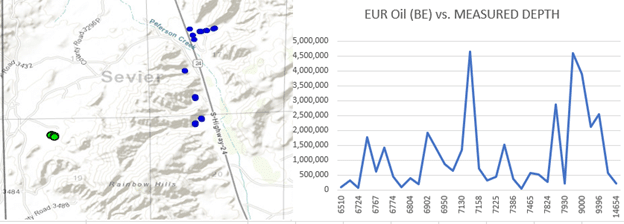

Perhaps creation of true free cash flow will allow some companies to start adding incremental risk to their strategy portfolios by stepping back into conventional exploration to find exceptional fields like Utah’s Covenant Field — nearly 38 million barrels estimated ultimate recovery (EUR) with a median measured depth of 7,150 feet, most of it produced from just over 700 acres.

However accomplished, it’s essential for company leadership to clearly define inspirational goals to keep their workforce engaged, because without an engaged workforce a company can only look forward to long term decline.