About Enverus Intelligence Publications

Enverus Intelligence Publications presents the news as it happens with impactful, concise articles, cutting through the clutter to deliver timely perspectives and insights on various topics from writers who provide deep context to the energy sector.

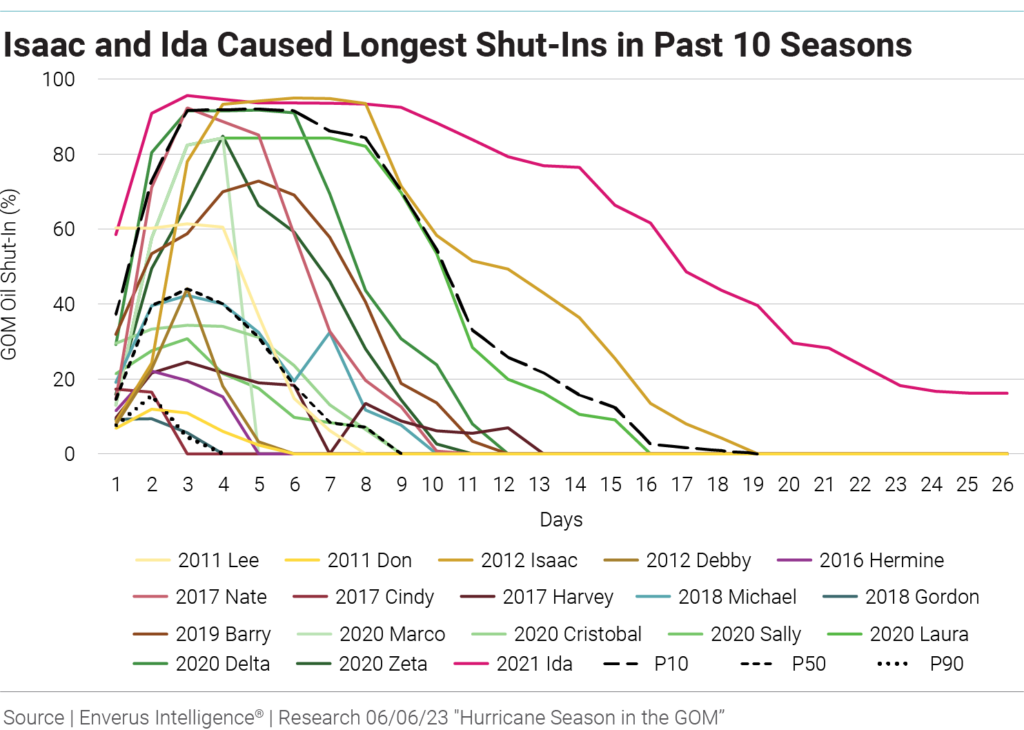

The summer heat has arrived early for much of the Southern U.S., bringing with it the threat of hurricanes in the Gulf of Mexico. While the storms bring the threat of a catastrophic loss of output from the nation’s refining and exporting industries, history reminds us that the worst-case scenario is rarely the reality. An analysis from Enverus Intelligence® | Research, available to EIR subscribers, shows that in the 50% probability scenario, a hurricane would affect about 40% of total GOM production and require seven days to recover.

Hurricanes are more likely when summer warmth rules the ocean waters. The official season in the Atlantic Basin runs from June 1 to Nov. 30, peaking on Sept. 10, although storms sometimes occur outside these dates. Most activity occurs between mid-August and mid-October.

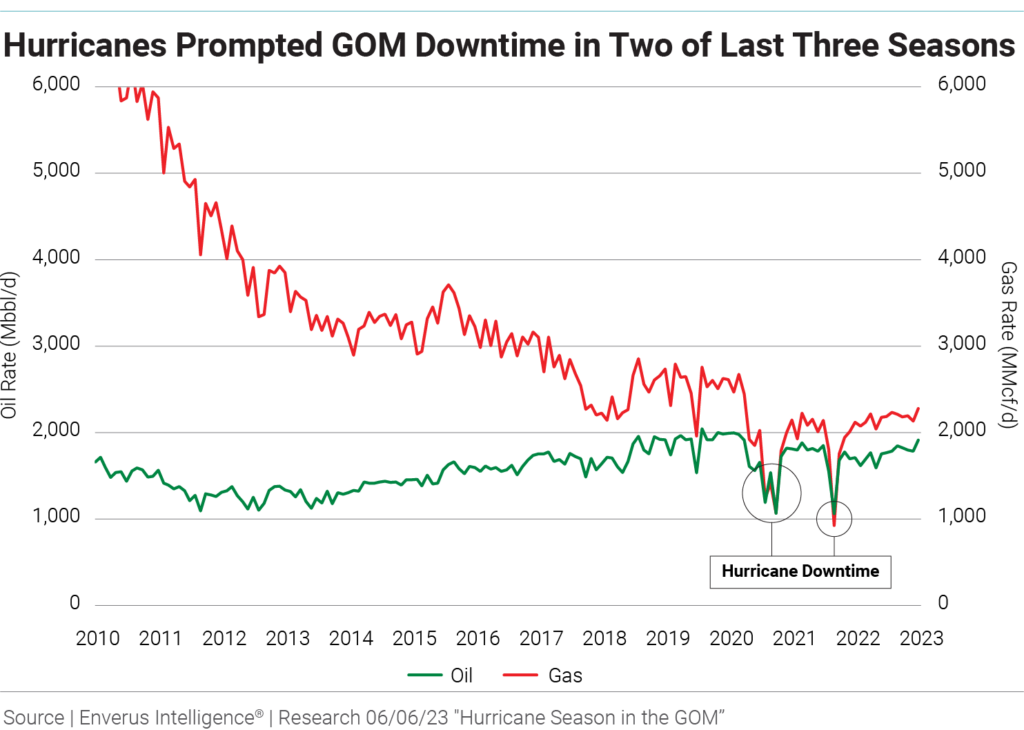

Colorado State University forecasts 13 named storms this year including two major hurricanes, which implies a near-average Atlantic hurricane season. EIR estimates that a near-average season causes the equivalent of 3% downtime to the GOM during Q3.

Of course, any Gulf denizen who has ever obsessively followed TV weathercasters as they track a storm and shift the “cone of uncertainty” knows to stay on guard. Anyone in Houston who’s endured Hurricane Harvey or Hurricane Ike knows you only need one hurricane to rip everything asunder. EIR’s P10 case estimates a 90% shut-in and 16 days to recover.

However, barring a direct hit of energy infrastructure, hurricane disruptions don’t lead to durable changes to oil and gas prices. In the past, the U.S. Strategic Petroleum Reserve has responded to GOM shut-ins with releases to offset supply losses. This year, draws on the SPR to combat high gasoline prices have reduced the government’s ability to respond.

Natural gas prices have been more sensitive to hurricanes as there is the no U.S. natural gas equivalent to the SPR. If one wants to look ahead, about 15 Bcf/d of sanctioned LNG offtake capacity will come online around the U.S. Gulf Coast by the end of the decade. If a hurricane would impact LNG export facilities in the future, EIR estimates a serious bullish impact on global gas prices, but a bearish effect on the Henry Hub.

What is the impact of Atlantic hurricanes on U.S. GOM’s oil and gas production? How do we estimate potential for production shut-ins, oil-price upside and loss of assets? Click for more (available to EIR subscribers)!