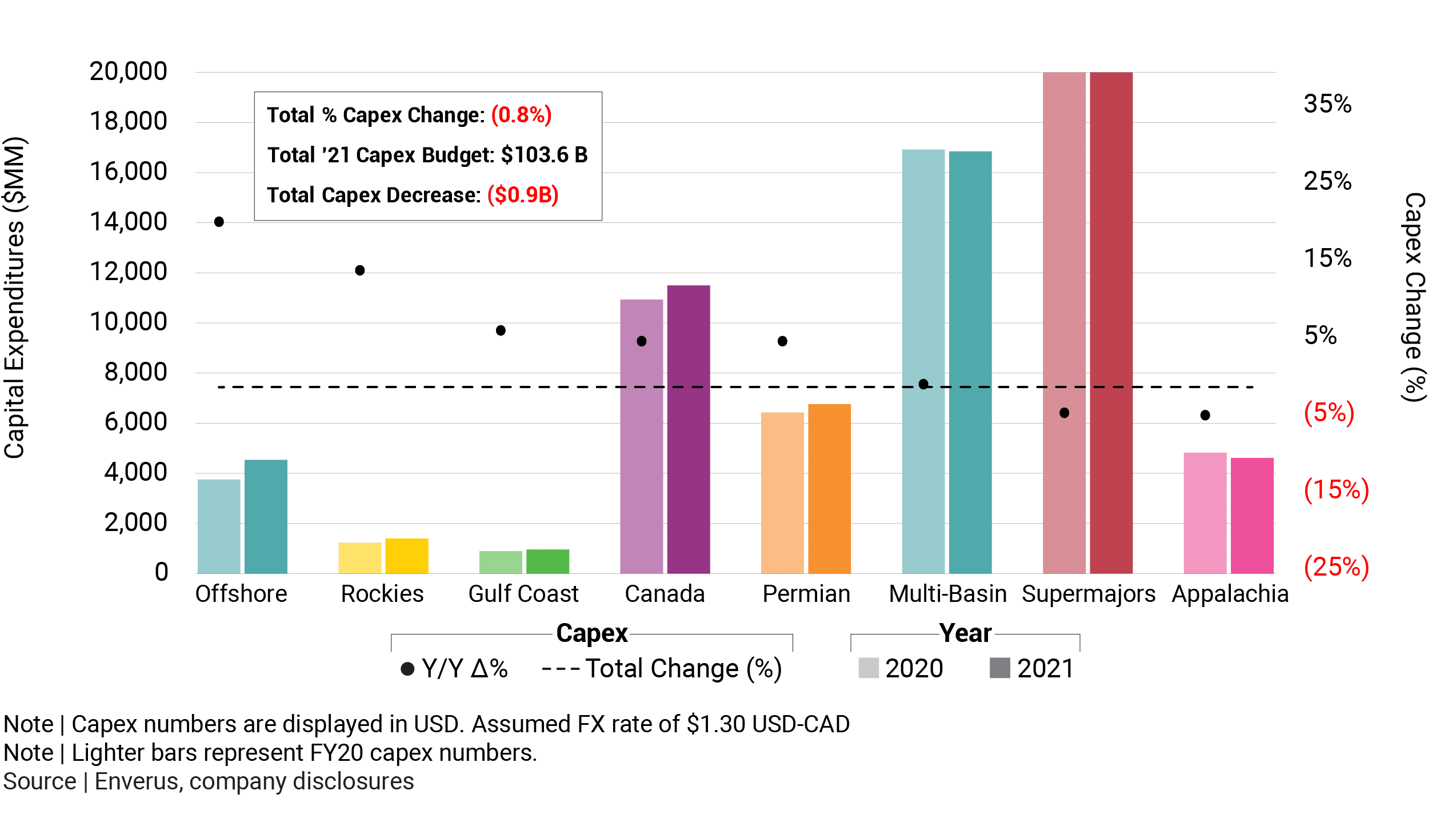

With 1Q21 earnings well underway, it is clear that E&P companies are generating more profits (as measured by free cash flow) than they have in a long time. Cumulative cash flow generated for independent E&P companies in Q1 increased tenfold from the previous year, based on the sample set we have now. Capital discipline reflected in 2021 budgets (Figure 1) and improving commodity prices helped to pivot the industry from growth to cash generation. The question in most investors’ minds is will this be sustained into the future or will the industry shift back to growth and put pressure on commodity pricing with an influx of supply?

Some factors to consider that might lead to an increased capital spending in 2022 will help put the question into perspective. First, although we are seeing capital discipline in 2021 budgets, these budgets on average are weighted to the second half of 2021. Is this weighting a protection against potential cost inflation as activity returns in 2021 or a ramping of activity into the end of the year? If the latter, do 2022 budgets reflect this increased 2H21 cadence and potential production growth? Second, hedging programs initiated in the 2020 price downturn are negatively impacting some operator’s ability to increase capital in 2021. As these hedges roll off, will budgets increase? Third, there is always the prisoner’s dilemma that exists watching other operators grow production and EBITDA. Is there a domino that falls to bring the industry back to a growth mindset in 2022 as strip price hovers around $60/bbl WTI or do cash flow and shareholder returns prevail?

Although there are numerous factors pushing towards higher capital budgets in 2022, we have seen some management incentive programs shift focus away from growth and focus more on cash generation, shareholder return and ESG metrics. Does this become industry standard and will this motivate management teams to remain capital disciplined and to focus on sustaining high levels of cash flow over growth? Only time will tell.

FIGURE 1 | 2020 Versus 2021 E&P Capital Spending by Region