Source: Figure 2 from here: https://intelligence.enverus.com/research/93907

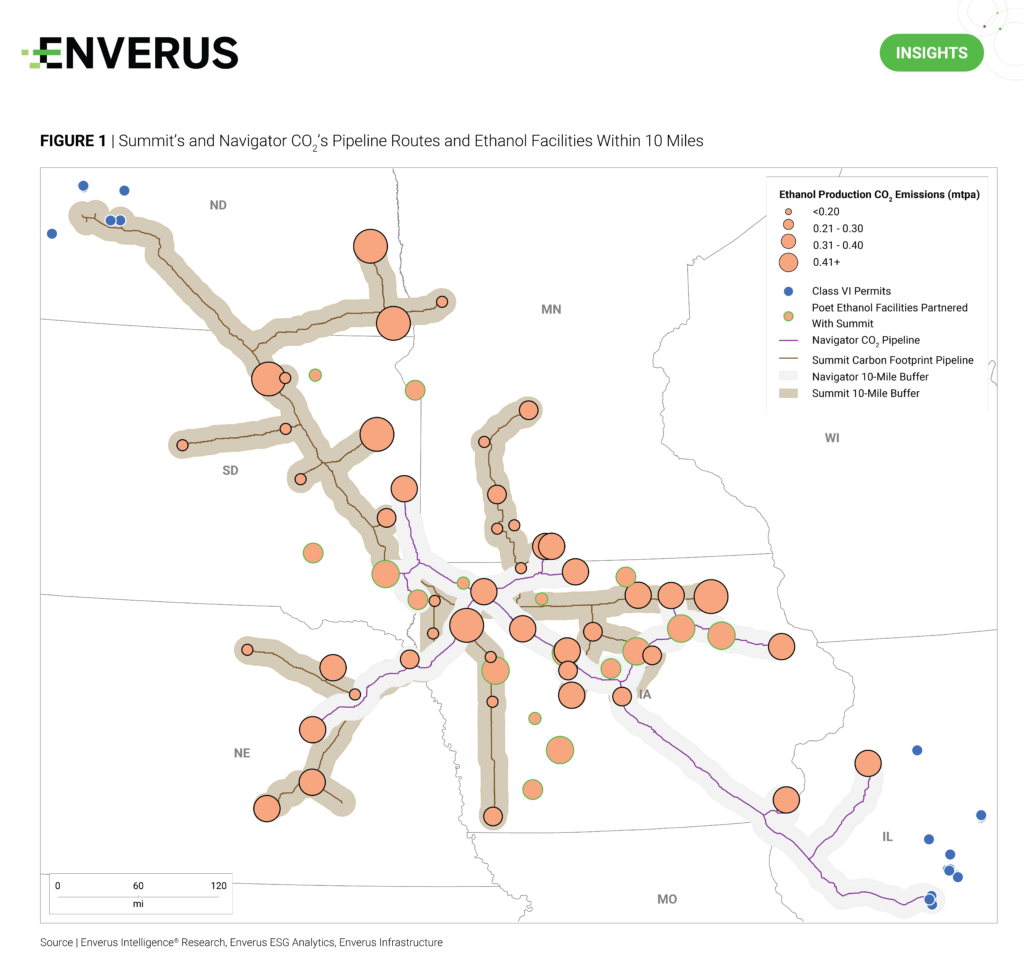

There has been a battle for CO2 in the Midwest with two major CO2 pipeline projects, Navigator Heartland Greenway and Summit Carbon Solutions, looking to capitalize on the 45Q PTC by targeting the low capture cost CO2 emissions from the fermentation process of ethanol. With the cancellation of Navigator’s project in October 2022, Summit Carbon Solutions has been presented a unique opportunity to capitalize on the ethanol facilities that are now stranded from sequestration locations. In a recent report published by Enverus Intelligence Research, this opportunity was quantified by exploring which facilities along Navigator’s proposed pipeline also fall within Summit’s planned route. Based on this analysis, Summit could increase the number of partnered ethanol facilities by 33% and increase captured CO2 by 40%. Adding on facilities from the recently announced Poet partnership brings emissions available to Summit’s project to 18.5 mtpa. However, Summit will still have to overcome the same regulatory hurdles that caused Navigator’s cancellation, and as a result have pushed their planned in-service date to 2026. For more information, please refer to our CO2 Transportation Failure | Adversity and Opportunity for Midwest CCUS report.

Highlights From Energy Transition Research

U.S. Emissions Stocktake | Methane Mitigation Drives Decline – This report serves as U.S. emissions stocktake for the oil and gas sector, evaluating industry progress based on the latest EPA-reported data. We analyze trends in the upstream and gathering sectors from 2020 to 2022, highlighting where operator efforts are paying off and which sources are harder to mitigate. Our analysis also compares the top-producing operators and identifies the main reasons behind the most notable step changes in emission intensity.

Geothermal Anywhere | Prioritizing Non-Conventional Project Locations – New drilling technologies are enabling geothermal projects to be sited outside of traditional areas in the Western U.S., expanding the market for this renewable energy source. This report provides an overview of key drivers of project economics and identifies which locations might be optimal for future expansion.

Hydrogen Fundamentals | Hype Meets Reality – Mounting hype for hydrogen technology has yet to translate to meaningful commercial liftoff. In this report, we apply a robust investment framework to identify defensible business models and projects across the hydrogen production space.

Featured Content