Lenders have and continue to price credit risk within the E&P industry by assessing the proportion of a borrower’s cash flow and collateral to its net debt. However, in recent years many lending institutions began adopting policies to incorporate environmental, social and governance (ESG) factors into their investment decisions to assess risks unquantified by traditional metrics. Until very recently it’s been difficult to observe the impact of ESG scores or rankings on the market prices of securities, but our analysis below suggests this may no longer be true.

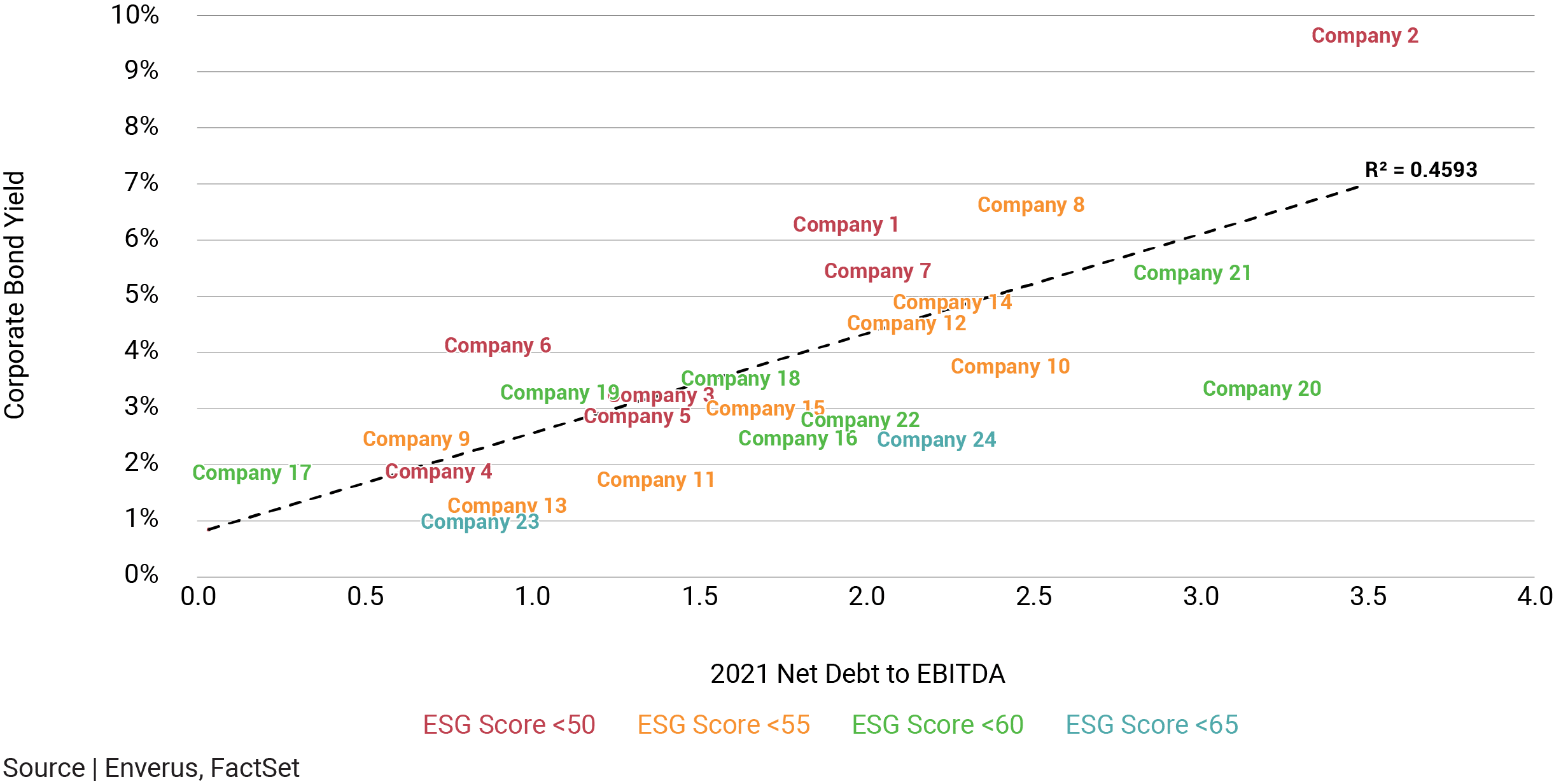

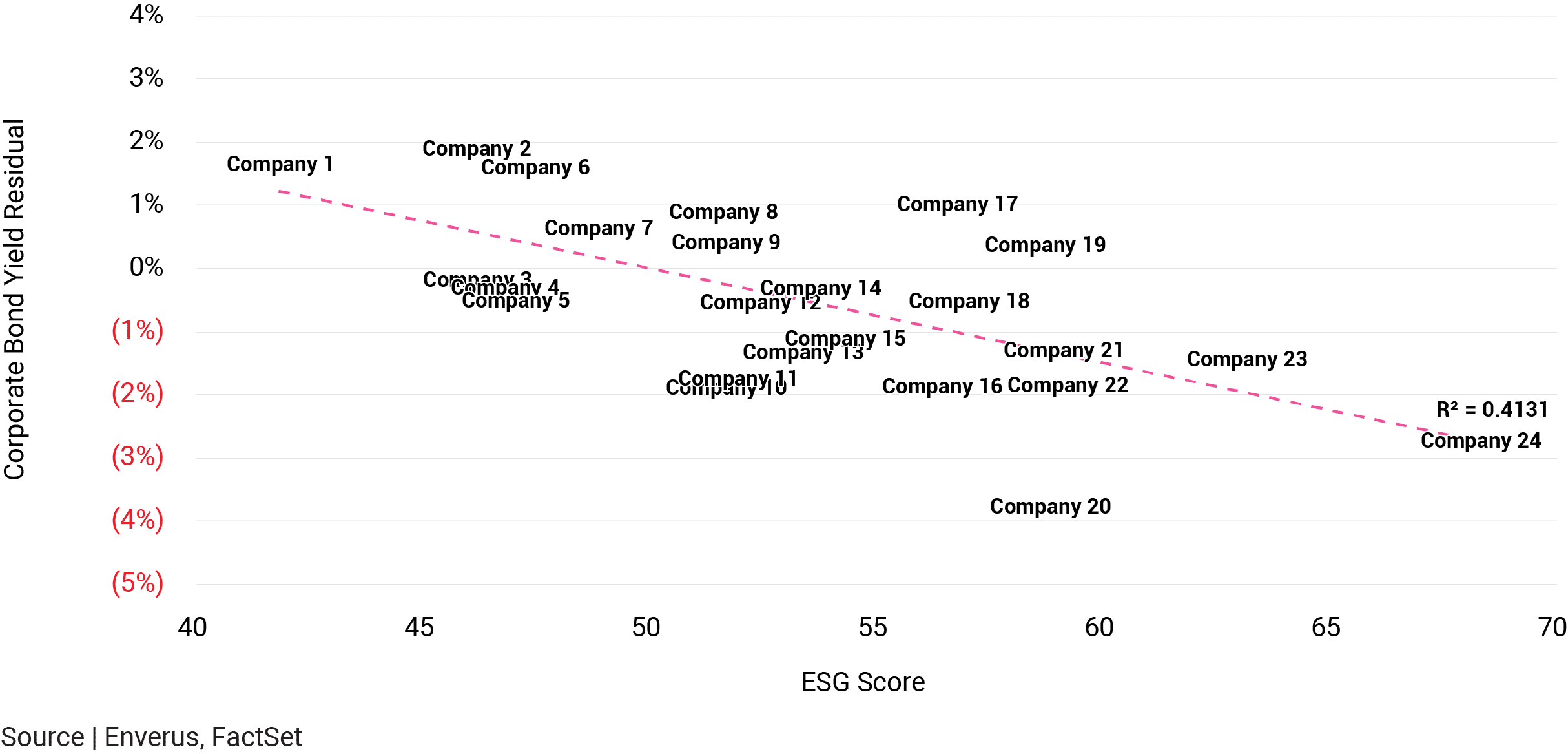

To identify if there is a relationship between recent E&P bond yields and our proprietary ESG scores, we created two figures. Figure 1 compares E&P bond yields to our estimates of 2021 net debt to EBITDA (earnings before interest, taxes, depreciation and amortization). We expect and observe a positive correlation with bond yields and net debt to EBITDA, which means the more capital a company borrows the higher the interest it must pay on incremental debt, all else equal. Figure 2 plots the residuals of this function against our ESG scores, where a higher ESG score suggests the borrower carries less ESG related investment risk. The observed negative correlation between the residuals and ESG score implies market participants are now rewarding strong ESG performers with a lower cost of debt capital after normalizing for leverage.

Some may argue that correlation does not imply causation. Based on the level of interest and uptake in ESG related information from our clients, we believe it’s becoming an increasingly important part of the investment process and will likely continue to impact investor behavior in the future.

Need To Know | Bond yields are a good proxy for how expensive it is for a company to access debt capital. The ratio of net debt to EBITDA measures how much debt a company carries relative to how much cash flow it generates.

FIGURE 1 | E&P Bond Yields Versus Net Debt to EBITDA

FIGURE 2 | E&P Bond Yield Residual Versus Enverus ESG Score

Click below to learn about our Enverus ESG™ Analytics solution.