The pace of electric vehicle (EV) adoption is hastening around the world, with China set to surpass 30% of new sales in 2023. The U.S. Environmental Protection Agency (EPA) announced its plan to significantly increase regulation on tailpipe emissions, so much so that it would require between 54%-60% of new vehicles sold in the U.S. to be electric by 2030 and 64%-67% by 2032.

This new regulation shifts away from MPG standards and targets total greenhouse gas emissions. Exceeding President Joe Biden’s goal of 50% adoption by 2030, it is slightly more aggressive than Enverus Intelligence Research’s (EIR) view on U.S. EV adoption prior to the regulation change. According to our analysis, the adoption curve required by the EPA would displace approximately 0.8 MMbbl/d of U.S. oil demand in 2030 and 1.1 MMbbl/d by 2032, which is 50 Mbbl/d and 80 Mbbl/d higher than our estimates, respectively.

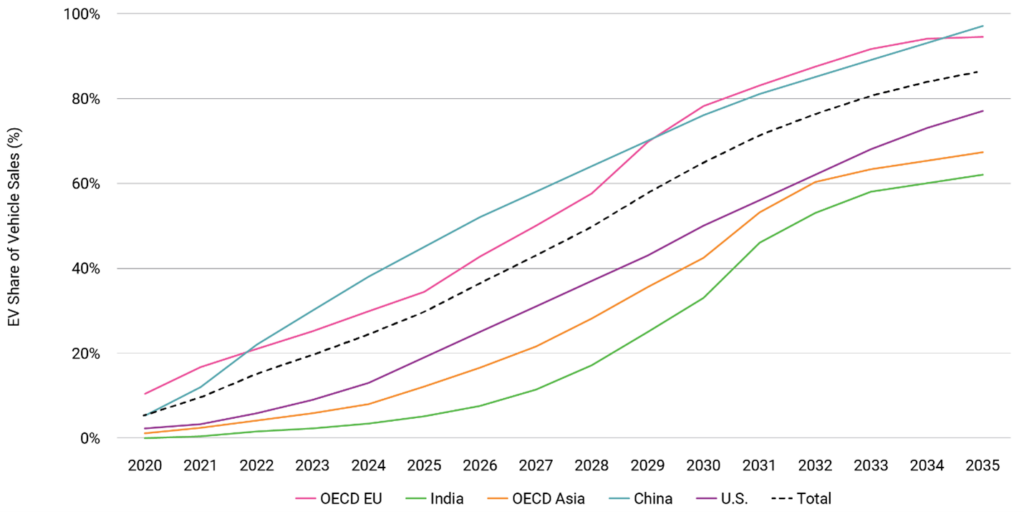

FIGURE 1 | EV Adoption by Forecast Region

Figure 1 describes our view for EV adoption across five key regions that represent more than 80% of global gasoline demand today. Critical to meeting that level of demand, the supply of copper and lithium needs to grow significantly over the next decade. Key areas of investment to support the transition of the personal transportation industry include onshore battery manufacturing (including component production), charging infrastructure and securing critical mineral supply chains.

Highlights from Energy Transition Research

1. CCUS play fundamentals: Separating the winners from the losers

The Inflation Reduction Act supercharged activity along the CCUS value chain and accelerated the race to secure partnerships with emitters and landowners for CO2 storage. However, as we approach in-service dates slated for mid-decade, expectations will be tested as projects move from ideation to implementation. Amid all the hype, how can we separate the winners from the losers?

2. Electric vehicles: A call on capital

EV adoption is one of the most visible shifts associated with the energy transition, but detractors argue battery technology and supply chains cannot support a high rate of adoption. This report examines demand for key minerals and areas, particularly in mineral recycling and battery technology, where innovation is most impactful.

3. Renewables performance drivers: Design choices that matter

This report analyzes the impact of wind and solar project design decisions made by developers and quantifies the choices that result in the strongest asset performance.

Energy is changing. Connect weekly with the ideas that are leading the way.

About Enverus Intelligence®| Research

Enverus Intelligence Research, Inc. is a subsidiary of Enverus and publishes energy-sector research that focuses on the oil and natural gas industries and broader energy topics including publicly traded and privately held oil, gas, midstream and other energy industry companies, basin studies (including characteristics, activity, infrastructure, etc.), commodity pricing forecasts, global macroeconomics and geopolitical matters. Enverus Intelligence Research, Inc. is registered with the U.S. Securities and Exchange Commission as a foreign investment adviser. Click here to learn more.