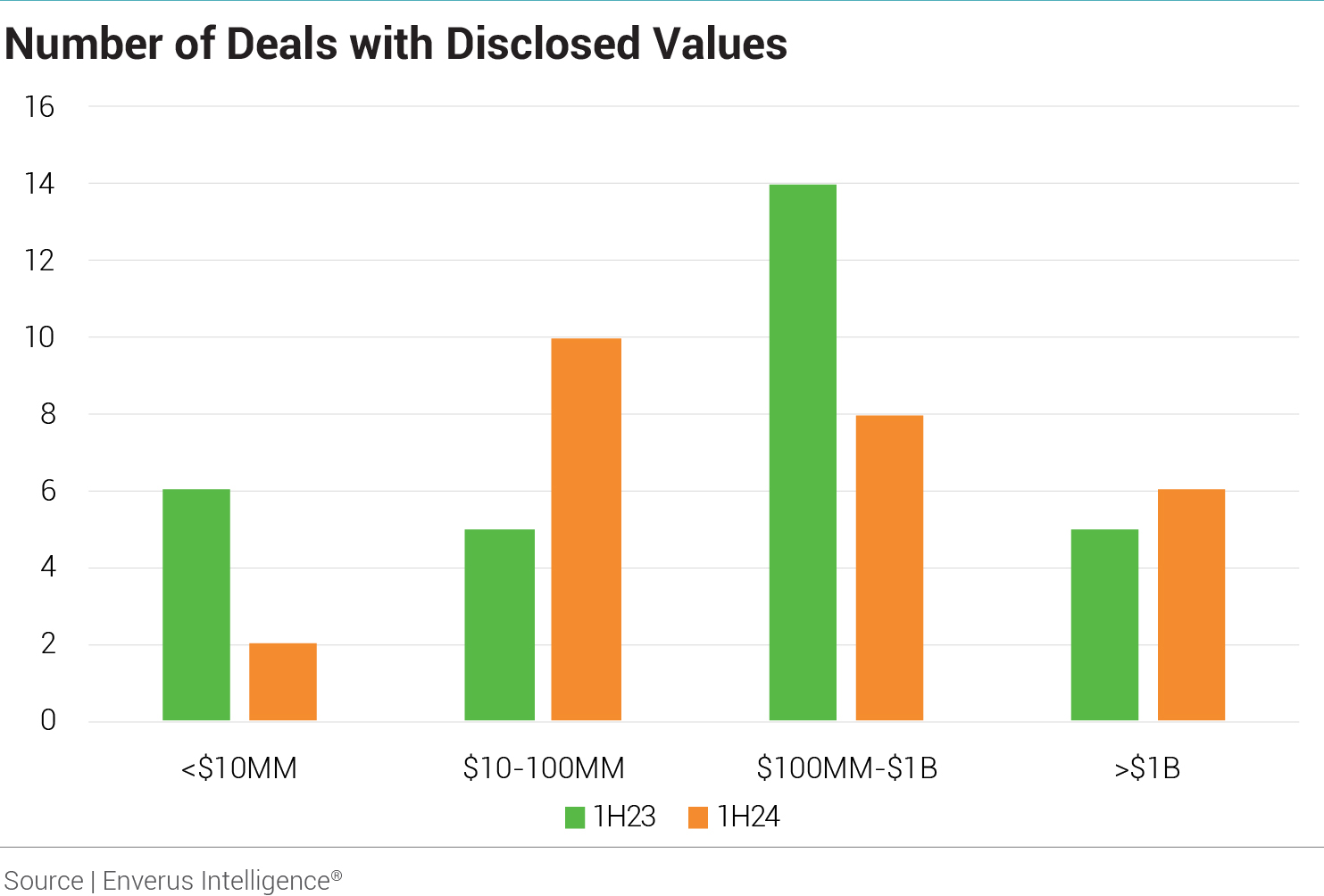

There were 115 U.S. transactions related to renewable energy generation, energy storage, renewable fuels, geothermal, hydrogen and nuclear assets announced in 1H24, according to Enverus Energy Transition M&A data. Only 26 of those had disclosed values, totaling $30.8 billion. Comparatively, 116 transactions were announced in 1H23, of which 30 had disclosed values combining to only $16.4 billion.

Both half-year periods had a similar number of deals valued above $1 billion: five in 1H23 worth $11.7 billion combined and six in 1H24 worth $28.0 billion combined. The disparity in combined values largely resulted from BlackRock’s January acquisition agreement for Global Infrastructure Partners, valued at nearly $12.6 billion—3.7x the size of 1H23’s largest deal.

Top deals both half-years were for utilities or large infrastructure investors.

The world’s largest independent infrastructure manager with around $115 billion in assets under management, GIP is active in the midstream, digital, transport and water and waste sectors, in addition to renewables. Its global renewables portfolio is expansive, however, with over 19 GW of operational capacity, royalty interests in another 20 GW, and 173 GW under construction or development in 2022.

GIP was also involved in 1H24’s second-largest deal with Canada Pension Plan Investment Board to acquire Midwestern U.S. utility Allete Inc. for $6.2 billion. Allete’s largest subsidiary, Minnesota Power—with 870 MW of owned and contracted wind capacity—has delivered around 50% renewable energy to its retail customers since 2020. It launched a request for proposals for another 400 MW in February.

The largest deal of 1H24 purely for renewable generation capacity was Stonepeak’s $3 billion acquisition of a 50% stake in Dominion Energy’s Coastal Virginia offshore wind project. The 2.6 GW project began offshore construction earlier this year with completion expected in 2H26. Stonepeak also agreed to acquire Ørsted’s equity stake in four onshore wind farms for $300 million, less than a month after announcing the Coastal Virginia deal.

In comparison, 1H23’s largest renewable capacity deal was Brookfield Renewable’s $2.8 billion acquisition of Duke Energy’s commercial renewables business. At the time, the business had 3.4 GWac of wind, solar and battery storage capacity across the U.S., 2.5 GW under construction and 6.1 GW in development.

Duke wasn’t the only major U.S. utility to divest unregulated renewables businesses in 1H23, with American Electric Power agreeing to shed its unregulated business in February 2023 for $1.5 billion—the period’s fifth-largest deal. Both companies are still growing their regulated renewables portfolios, however. AEP also took the third spot in 1H23 with its $2.2 billion acquisition of two wind farms and one solar farm with combined capacity of 999 MW from Invenergy, one of the parties in the consortium that purchased AEP’s unregulated business. The largest deal of any asset type for 1H23 was Vistra’s $3.43 billion acquisition of nuclear peer Energy Harbor Corp.

Solar deals most prevalent, driven by 32.7 GW of projects connected since YE22.

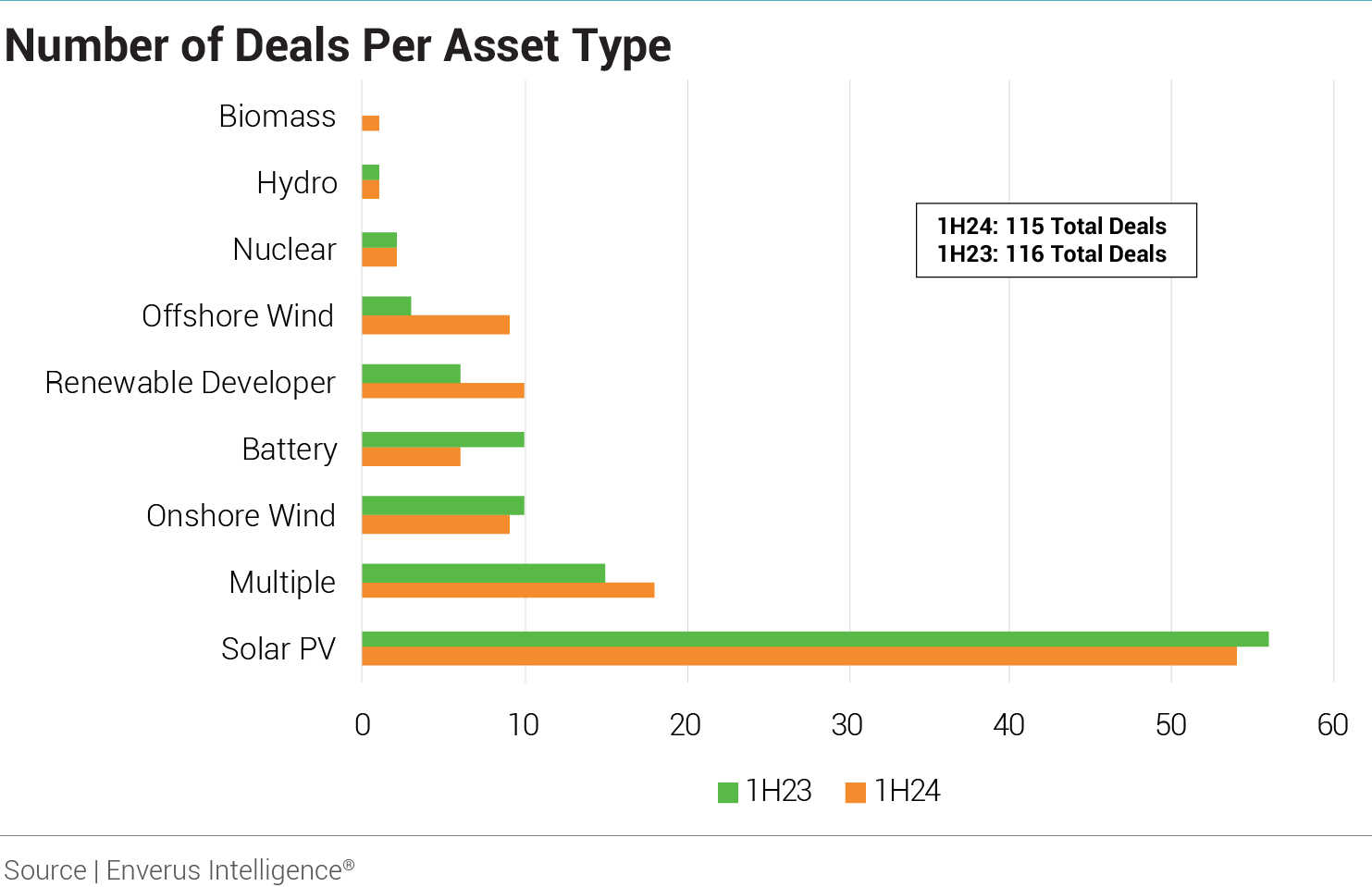

On an asset-type basis, both half-years saw similar activity levels. Transactions for solar assets were the most prevalent, with 54 deals announced in 1H24 compared to 56 in 1H23. Helping drive this M&A activity, solar has seen far more growth than other asset types in recent years, with 32.7 GW from 883 projects coming online since Jan. 1, 2023, according to Enverus Foundations P&R data. There were 15 deals in 1H24 consisting of multiple asset types, compared to 18 in 1H23. Activity for onshore wind, batteries and corporate-level acquisitions of renewable developers was also consistent YOY.

The largest difference was seen in offshore wind, with nine deals announced in 1H24 compared to only three in 1H23. This is likely due, at least in part, to significant issues in the nascent sector since 2H23 forcing several major developers to adjust their plans, if not exit offshore wind entirely.

Find more great content on the renewable energy sector, carbon management and environmental investments in the latest issue of Energy Transition Pulse.

About Enverus Intelligence Publications

Enverus Intelligence Publications presents the news as it happens with impactful, concise articles, cutting through the clutter to deliver timely perspectives and insights on various topics from writers who provide deep context to the energy sector.